Lending activities contribute most to profits of Vietnam’s brokerages

This segment was also the only one in the brokerage sector that saw gross profit increase compared to the third quarter of last year.

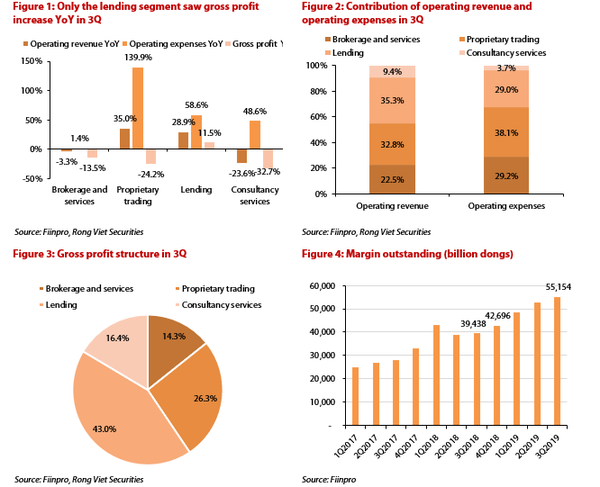

The lending segment contributed the most with VND1.16 trillion (US$49.83 million) or 43% of total gross profit in Vietnam’s brokerage sector in the third quarter this year, according to Viet Dragon Securities Company (VDSC)’s latest report.

This segment was also the only one that saw gross profit increase compared to the third quarter of last year. On the contrary, the brokerage and services segment accounted for the least in total gross profit with VND386.4 billion (US$16.6 million) or 14.3% of the total.

Meanwhile, operating revenues and operating expenses reached VND6.04 trillion (US$259.46 million), up 14.6% year-on-year and VND3.33 trillion (US$143.03 million), up 52.8% year-on-year.

Even though revenues from the main business segments including lending and proprietary trading rose sharply in the July – September period, increasing 35% and 29% year-on-year, respectively, expenses from these two segments also skyrocketed by 59% and 140% year-on-year, respectively.

According to VDSC, the cost increase in the lending segment was because brokerages raised funds for lending activities. Meanwhile, the sharp increase in expenses of proprietary trading was due to the loss from financial assets (FVTPL), which increased by 164.4% year-on-year. The increase in FVTPL accounts for 50% of the increase in FVTPL of the 73 brokerage companies, stated the report.

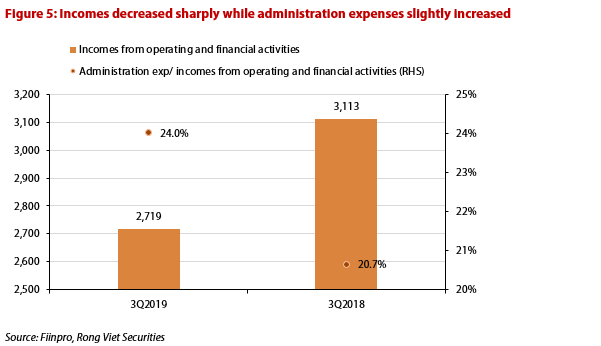

Additionally, revenues from financial activities in the third quarter reached VND34 billion (US$1.46 million), a decrease of 76% year-on-year. However, because financial expenses declined sharply by 81% year-on-year, income from financial actives decreased by 47% year-on-year. Total income from operating and financial activities slid by 13% year-on-year.

While income fell, administration expenses slightly increased by 1.6% year-on-year to VND653 billion (US$28.05 million). The ratio of administration expenses over income from operating and financial activities added 3 basic points to 24%.

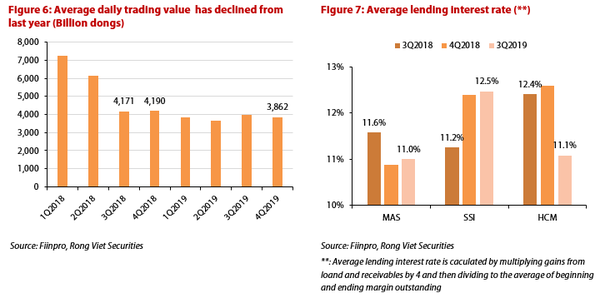

VDSC expected the lending segment will continue to contribute the most to total operating revenue in the fourth quarter because the current margin outstanding are 34% higher than the average of margin outstanding in the same period of last year. However, brokerages are competing for market share, especially foreign ones. Hence, it is expected that the average lending interest rate may decrease compared to the same period last year.

Contrarily, it is assumed that revenue from the brokerage and services and consultancy services segments will not improve much in the October – December period because: (i) the average daily trading value in October was 24% lower than the same period last year, and (ii) there are not many IPO or deals in the remaining months of the year.