Vietnam's industrial production hits 13-month high

Business conditions strengthened to the greatest extent in just over a year.

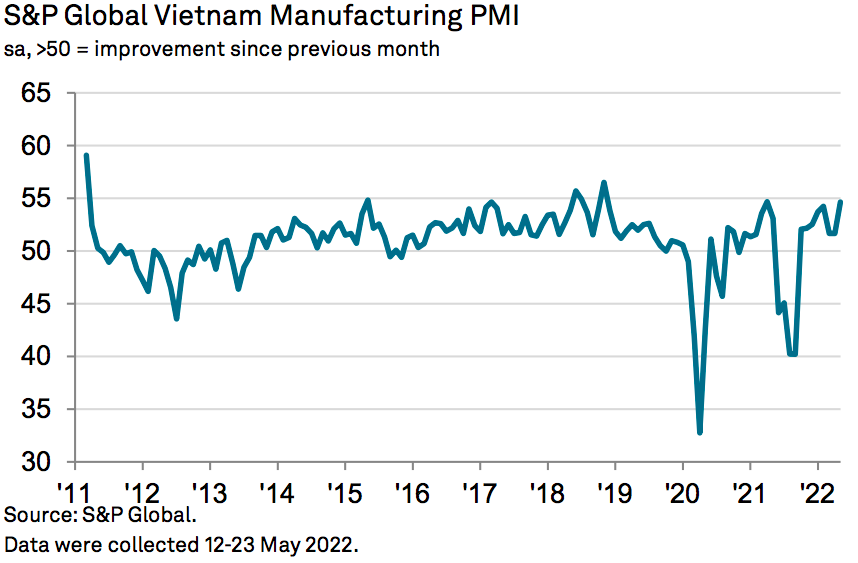

The Vietnam Manufacturing Purchasing Managers' Index (PMI) rose to 54.7 in May from 51.7 in April, signaling a marked monthly improvement in the health of the private sector midway through the second quarter.

A reading below the 50 neutral marks indicates no change from the previous month, while a reading below 50 indicates contractions, and above 50 points means an expansion, according to S&P Global.

“Vietnamese manufacturers are increasingly able to operate normally as pandemic disruption fades, with May seeing sharp accelerations in the growth of output and new orders, in turn boosting employment and purchasing. There is also growing confidence that firms won't have to contend with Covid-19 issues going forward,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

"That said, the lockdowns in China did impact the sector in two principal ways - limiting export demand and causing further delivery delays. Firms will therefore hope that business in China can also return to normality soon, providing a further boost to the recovery in Vietnam," he said.

The sustained growth of new orders meant that firms continued to re-build their staffing levels midway through the second quarter. Employment was up for the second month running and at a solid pace that was the fastest since April 2021.

Purchasing activity was also ramped up in response to new order growth, with the rate of expansion quickening to a three-month high. Despite a sharp rise in input buying, stocks of purchases continued to fall as inputs were used in the production process. Pre-production inventories were down for the second month running, albeit marginally.

Stocks of finished goods were also lower, falling for the third successive month on the back of the use of inventories to help meet order requirements. The depletion was the joint sharpest in ten months.

Rates of inflation remained elevated despite showing some signs of easing during May. Both input costs and output prices rose at the slowest rates in three months, but in each case, inflation was still well above the series trend. Rises in costs for oil and gas were highlighted by respondents, with increased shipping charges also adding to inflationary pressures. In turn, firms passed higher prices on to their customers.

Aside from restricting the growth of exports, the other main impact of the pandemic lockdowns in China on the Vietnamese manufacturing sector was the delay in receiving inputs. Suppliers' delivery times lengthened sharply, and to a greater extent than in April.

The report indicated that problems in supply chains were also caused by international shipping issues. The confidence in the fact that there will be a lack of disruption from the Covid-19 pandemic over the coming year supported optimism in the outlook for production, with sentiment rising for the second month running to the highest since January.