Vietnam’s power development plan to drive LNG growth

The draft power development plan (PDP) VIII estimates about US$128.3 billion will be needed over the next decade, in order to achieve the natural gas and renewables targets.

The main drive behind stronger gasification in Vietnam will come from the State, as Vietnam’s latest state PDP VIII (2021-2030), published in February 2021, sets higher targets for gas and other renewables in the domestic energy mix for the decade ahead, according to Fitch Solutions.

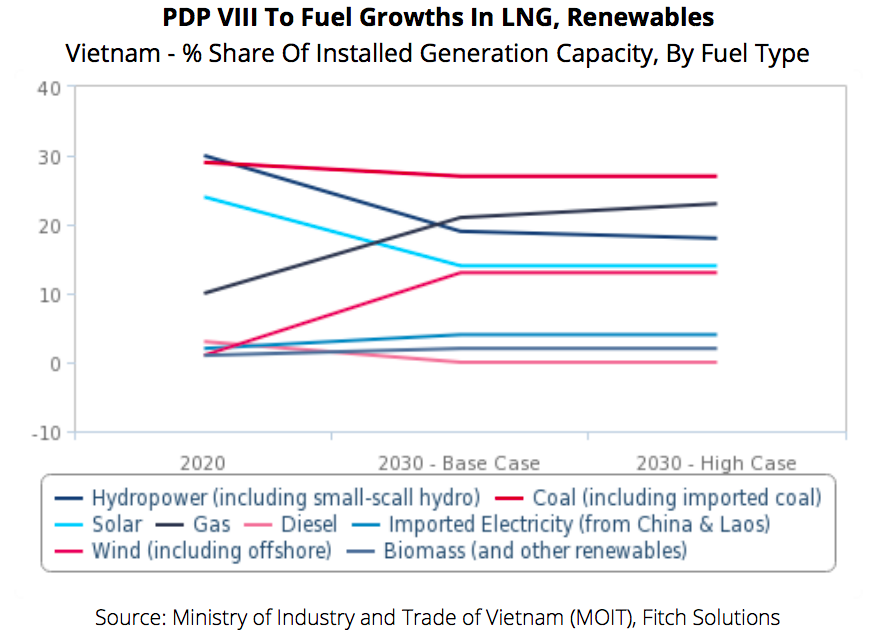

Under the plan, the Vietnamese Government affirms its nascent support for the clean energy transition and outlines the ambition to increase the share of cleaner-burning gas in the national power generation capacity composition to 21% by 2030 from about 10% in 2020.

| The outlook for Vietnam's LNG sector remains promising. Source: PVN |

In order to achieve these targets, Vietnam is aiming to reduce contributions from domestically produced coal and hydropower, which despite the lower cost and stable supply, contribute to air pollution and cause environmental damages.

Given the circumstance, Fitch Solutions expects a promising outlook for Vietnam’s emerging LNG sector. “It is one of several new LNG markets in Asia that are forecast to begin first imports in the coming decade,” noted the agency, adding the country looks towards the fuel to replace declining domestic production and replace polluting, environmentally harming fuels in the energy mix.

Having been historically self-sufficient in natural gas, Vietnam’s need for LNG imports is large and growing, and stems from fast-declining output across mature offshore fields, a slowdown in exploration, and the lack of access to any cross-border pipelines. A number of large-scale developments on the horizon, including Ca Voi Xanh (Blue Whale) and Block B-O, could add significant volumes of new output and in turn, reduce the future need for imports if successfully developed.

“The prospect for LNG imports into Vietnam over a 10-year horizon is strong,” stated Fitch Solution, as LNG imports are forecast to see exponential growth from less than 1bcm to over 4bcm over the next decade, next to a more than doubling of domestic gas demand and growing utilization across power generation and industries.

Strong foreign interests in Vietnam’s LNG sector

According to Fitch Solutions, the rise of new LNG markets such as Vietnam is bullish news for global suppliers, such as the US, Qatar, Australia, and Russia all large exporters which are aiming to expand their respective LNG exports in the coming decade.

In spite of LNG’s growing popularity across global markets, these suppliers remain in need of new LNG sales outlets. Growing concern for long-term demand builds as traditional LNG import powerhouses such as Japan commit to a carbon-free future, and in the process, seek to curb the dependence on LNG. Japan, accounting for almost 30 of global LNG imports, could see total annual LNG imports decline by as much as a third according to industry estimates should current national decarbonization targets, and planned increases in renewables, hydrogen generation targets are achieved in full.

Thus, the emergence of new demand centers like Vietnam (along with few others in Southeast Asia, Africa, and Latin America) is crucial both in terms of maintaining the demand balance in the market, and also ensuring contracting opportunities for global liquefaction project developers, stated Fitch Solutions.

Fitch Solutions expects the level of interest in Vietnam’s LNG sector from foreign parties remains strong. PDP VIII estimates about US$128.3 billion will be needed over the next decade, in order to achieve the natural gas and renewables targets.

The plan estimates 74% or about $96 billion would be needed to go towards the development of power sources such as LNG, solar, and wind to make the targets feasible. About $56 billion worth of LNG-related investments, or 23 different LNG-to-power projects, have been proposed and announced in Vietnam.

The bulk of the current pipeline is backed up by financial, developmental commitments from US-based companies, although only a handful has secured formal approval and even fewer have signed power purchase agreements (PPA) with state-owned Electricity of Vietnam (EVN), the sole permitted buyer of electricity in Vietnam.

Continuing to attract more up-front investments and strategic investors will be crucial in order for Vietnam’s LNG sector to live up to its full potential, stated Fitch Solutions.