VND remains most stable currency in region: Report

With the internal strength of the currency and the central bank's flexible management, the VND is expected to depreciate by a maximum of 3% in 2022.

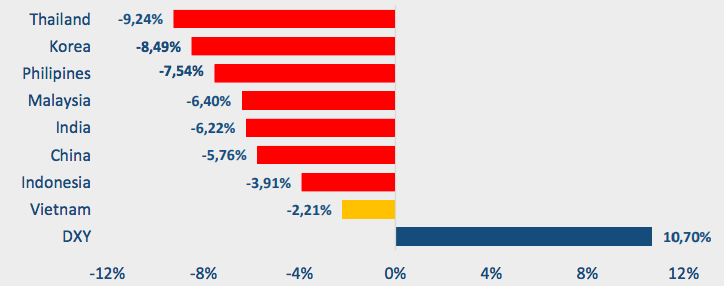

The Vietnamese Dong (VND) has devalued by 2.21% against the US dollar compared to late 2021, but remained the most stable currency in the region, according to the Bao Viet Securities Company (BVSC).

| VND is among the most stable currencies in Asia. File photo. |

In the international market, the US dollar index (DXY), which measures the value of the US dollar against other currencies, rose by 0.76% in July and 10.7% since early 2022.

According to the BVSC, all currencies from emerging economies in Asia have depreciated against the USD, with Thailand’s Bath suffering the largest decline by 9.42% compared to the beginning of the year.

It was followed by South Korea’s Won whose value fell by 8.49%, the Philippine Peso (-7.54%), the Malaysian Ringgit (-6.4%), and the Indian Rupee (-6.22%), or the Chinese Yuan (-5.76%).

| Values of currencies in Asia compared to the USD (late July against late 2021). Source: BVSC |

BVSC report noted following a policy meeting last month, the Federal Reserves (FED) decided to hike benchmark rates by 75 basis points for a second consecutive month. This prompted the USD to rise by 13%, the highest level in the past 20 years before cooling down in late July.

Meanwhile, the State Bank of Vietnam (SBV) increased the USD selling price from VND23,250 in early July to VND23,400, or a rise of VND150, as well as changed the transaction method from 3-month USD forward contracts to spot buying.

BVSC suggested pressure for VND depreciation mainly comes from stronger USD, as Vietnam continues to maintain stable macroeconomic conditions, low inflation, and a positive trade balance.

“With internal strength of the currency along with flexible management of the SBV, the VND would depreciate for a maximum of 3% in 2022,” noted the report.

Meanwhile, banks’ capital mobilization rate for the 12-month period rose by 0.23 percentage points to 5.77 percentage points compared to late 2021.

Vietnam’s credit growth as of July 26 expanded by 9.42%, the highest seven-month growth in the past five years.

The SBV’s decision to keep selling foreign currency in the past months has also led to a 3-month high increase in inter-bank interest rates.

“High probability of FED’s future rate hikes may put pressure on rising inter-banking interest rates,” noted the BVSC, saying the rate may expand by 0.5 percentage points for this year.