Covid-19 boosts cashless payments in Vietnam

Transaction values via smartphones increased by 177% in the first half of 2020.

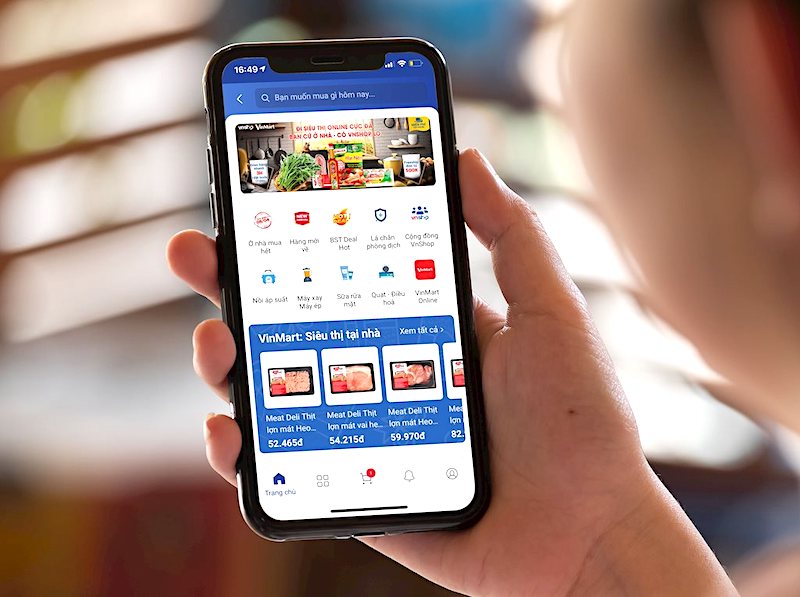

Concerns over Covid-19 and mobility restrictions have prompted the use of cashless payments in Vietnam, according to local insiders and providers.

| Vietnamese users are familiar with cashless payments thanks to Covid-19. |

Statistics from Shopee, the leading e-commerce platform in terms of visitors in Vietnam, showed that the number of users of AirPay e-wallet, which is associated to it, has increased compared to normal in this period of mobility restriction.

The number of cashless transactions jumped more than five times in the first half of 2020 against the same period last year, while the total value of non-cash transactions soared six times in the same period, according to the latest report by Visa.

For GrabMart service, the number of cashless transactions in August soared 128% compared to the previous month.

Vietnam has about 15 million people using internet banking and mobile banking services per month. The country records about 30 million cashless transactions per day, according to the State Bank of Vietnam (SBV).

The speedy development of cashless payment is thanks to the synchronization of e-banking, credit card, e-wallet, making cashless payment the optimal solution for local people to pay for essential services such as electricity, water, tuition, hospital fees, shopping and travel.

Improving methods of cashless payments

According to the SBV, in the first six months of 2020, the inter-banking e-payment system safely processed transactions worth about VND12,900 trillion (US$554.8 billion), up 36% in value compared to the same period in 2019.

Between January and June, the number of transactions via smartphones reached more than 472 million, with a value of about VND4,900 trillion (US$210.7 billion), up 177% over the same period of 2019.

Local banks continue to develop card payment services. By the end of June, 106 million cards had been issued, an increase of about 14.5% over the same period in 2019.

Over 171 million transactions were settled through bank cards with a value of about VND399 trillion (US$17.2 billion), up 20.9% and 9.1% over the same period of 2019, respectively.

Banks have integrated more features into their cards to pay for goods and services, and focused on improving the quality of card services and the safety of card payment.

As of the end of June, the country had more than 19,570 ATMs and 266,310 point-of-sale (POS), up 4.4% and 2.5% over the same period in 2019, respectively.