Covid-19 highlights Vietnam’s omni channel shopping trend

Local retailers in FMCG should rethink their channel strategy as Covid-19 impacted the way Vietnamese consumers shopping.

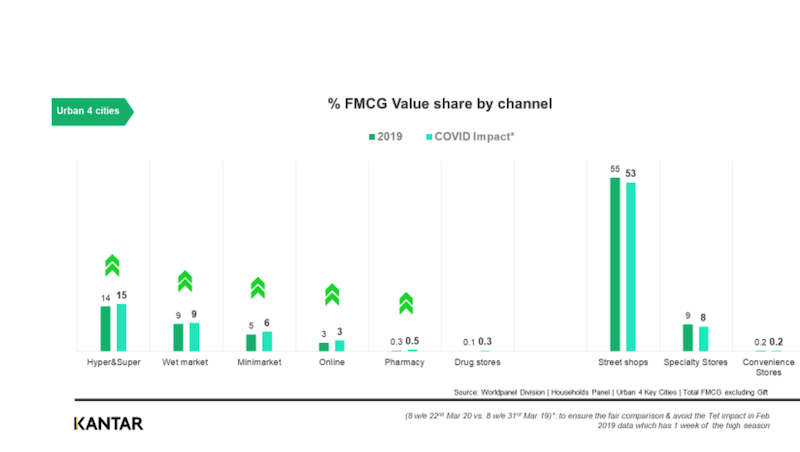

All channels in fast-moving consumer goods (FMCG) have been achieving double-digit growth, which has never seen over the past seven years in Vietnam. It implies that the omni-channel shopping trend in Vietnam is further strengthened during the pandemic, according to a latest Kantar Worldpanel survey, released on May 14.

| Local consumers are shopping at supermarket. Photo: VOV.vn |

The analysis focused on the Covid-impacted period of the first eight weeks ending March 22 (February and March) before the national social distancing order became effective on April 1 as ‘pre-lockdown period’.

With concerns of exposure battling against potential shortages of essential goods at home, Kantar’s research has seen an impact on the way Vietnamese people shop and thus, leading to changes in channel choices. Different channels serve different consumer needs, reflecting different shopping behaviors.

For stock-up purpose, Vietnamese consumers go shopping at hypermarket, supermarket and emerging channels such as online and mini market more frequently while making larger trips in traditional channels like street shops and wet markets, according to the survey.

Through reaching extra transactions, big modern formats including hypermarket, supermarket and even cash & carry and emerging formats outpace traditional trade during this uncertain time. The big retail formats have key advantages of a wide variety of categories, brands and pack sizes including fresh foods – an important commodity for quarantine times that helped them increase revenue growth in the context of Covid-19.

The survey shows that Vietnamese consumers visit hypermarkets and supermarkets more often than ever before, with a purchase on average made every 10 days over the last four weeks ending March 22.

| Source: Kantar |

Kantar’s survey found that Covid-19 pushes Vietnamese people to have new experiences. There is a significant number of consumers who haven’t shopped FMCG products online or at mini markets before, now starting to make their first transactions. Both online shopping and minimart format reached a peak in terms of shopper base versus any historical four-week period.

Though these channels had already shown good progress in Vietnam recent years, it presents a chance for them to further expand if new shoppers enjoyed their experience. “Understanding this and working to remove other existing barriers will be key for the continued development of these emerging channels after the crisis,” the survey wrote.

Kantar witnessed that shopping behaviors are changing with various retailers benefiting from this. Big C, Bach Hoa Xanh and Mega Market are physical retailers managing to achieve an impressive surge during pre-lockdown.

In terms of online shopping, incremental FMCG transactions came from both social commerce and e-commerce. Facebook - the most popular social media platform remains the most chosen platform for online FMCG purchases, followed by Shopee - the pure e-commerce player. Both of them recorded triple-digit growth.

While some of these changes and winners may be short-term, there will be many hoping to extend this opportunity into the long term, pointing to how the FMCG players may behave in the next phases of Covid-19. The implications for FMCG players will be to re-think and develop growth strategies and partnerships with the key retailers in order to win the “new normal”, the survey concluded.