Enhanced local trade finance in Vietnam: A potential US$55 billion annual trade boost

International trade is an important driver of productivity, jobs, and development – but to be effective, adequate trade finance is essential.

Improving access to affordable trade finance in Vietnam could increase imports and exports by up to six and nine percent, respectively, representing an annual increase in merchandise trade of US$55 billion, according to a new report by the International Finance Corporation (IFC) and the World Trade Organization (WTO) released today [February 22].

| Overview of the event. Photo: IFC |

The study – Trade Finance in the Mekong Region – the second in a series of regional trade finance surveys after West Africa, analyzes the trade finance ecosystem in Vietnam, Cambodia, and Laos, and provides insights into how international trade can be increased with better support from financial institutions. According to the report, increasing coverage is more important than reducing the cost of trade finance.

As detailed in the report, local trade finance in Vietnam is scarce, costly, and segmented, offering just traditional services.

“Prices can be as high as 5% of the value of the transaction for letters of credit and 12-14% for import/export finance in the country,” said Marc Auboin, WTO’s Counsellor in Economic Research & Statistics.

This is particularly important as Vietnam has one of the world’s highest levels of trade integration at 185% of trade to GDP in 2022, along with Cambodia at 210% and Laos at 107%, well above the global average of 62%, he noted.

“Cambodia, Laos, and Vietnam form one of the world's most integrated and trade-driven regions,” Auboin continued.

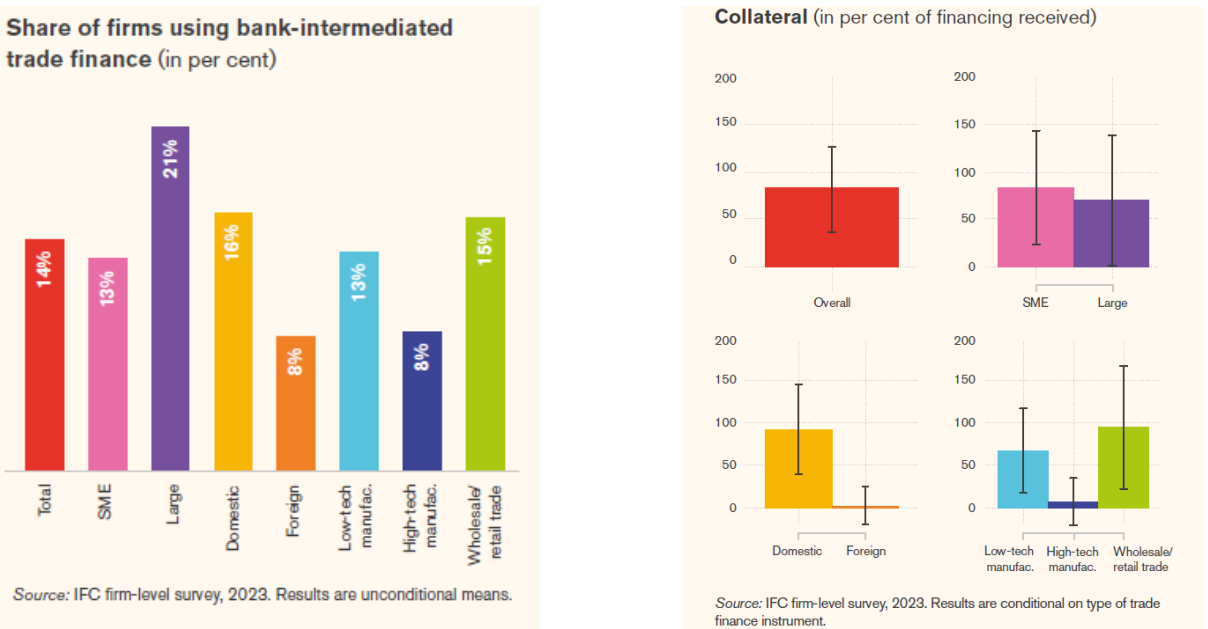

In 2022, domestic banks supported only 21% of the country's total merchandise trade of $731 billion. Notably, banks are more likely to support local enterprises engaged in intra-regional trade than large multinationals involved in global trade. The subsidiaries of multinationals in high-growth, high-value sectors such as electronics and garments rely less on trade finance intermediated by local banks.

"Since local trade finance in Vietnam is currently concentrated in domestic manufacturers, increasing the coverage of local trade finance will not only help improve the competitiveness of Vietnamese importers and exporters but, more importantly, will boost production, deepen global supply chain integration and spread the benefits of trade more evenly among local producers," said Thomas Jacobs, IFC Country Manager for Vietnam, Cambodia and Laos.

| Domestic producers use local banks more intensively for trade finance yet are also considered riskier by banks. |

Explaining the issue, IFC Senior Economist Alexandros Ragoussis cited importers' and exporters’ views that high collateral requirements and onerous application processes are among the main reasons why they did not seek support from local banks.

On the supply side, Vietnamese banks rejected an average of 12% of trade finance requests – mostly from small and medium-sized enterprises – accounting for around $20.3 billion in unmet demand in 2022. Rejections are attributed to a lack of collateral and high credit risk.

In this regard, Tran Long, Deputy CEO of BIDV, shared that only about 25% of SMEs in Vietnam have access to formal credit sources or trade finance tools. Current SBV regulations show that trade finance products, including document discounting and payment support, are being managed similarly to credit lines, which limits banks' ability to provide trade finance tools to enterprises.

“If businesses want to utilize trade finance products, they essentially need to be granted credit limits or working capital by the bank,” he said.

Moreover, lack of transparency in accounting practices, financial reporting, and management capacity makes banks reluctant to provide trade finance products, such as invoice financing, export contracts, and document collection, especially those advanced trade finance methods applied in other countries.

| Customer at a National Citizen Bank's branch in Hanoi. Photo: Pham Hung/The Hanoi Times |

“I expect SMEs to enhance operational efficiency, comply with regulatory requirements, and improve their management capabilities. On the bank's side, efforts should be made to enhance communication so that enterprises understand the common trade finance products offered in the market,” he said.

On the regulatory side, there are still many legal loopholes that need to be addressed to make it easier for banks to provide trade finance to enterprises and for SMEs to use these tools. Therefore, banks need to diversify trade finance products and not integrate them into the credit mechanism or credit assessment process with enterprises, he continued.

Instead, banks can rely on advanced methods to assess the financial capacity of enterprises, such as cash flow, export invoice financing based on inventory, among others. Furthermore, banks can collaborate with fintech companies and insurance firms to incorporate technology into their operations to reduce transaction processing time. With technology applications, all parties involved can maintain multiple connections between customers, enterprises, customs, shipping companies, or logistics firms, thereby promoting transparency and expanding trade finance, he suggested.

To further promote trade finance, the experts recommend developing instruments like supply chain finance and innovative digital offerings to reduce costs and improve access. This, in turn, would require stronger regulatory frameworks that address collateral requirements, digital transactions, central bank conditions, and accountability frameworks. In addition, it also suggests increasing awareness of how to access trade financing among smaller firms and local suppliers. Trade finance, an umbrella term including various financial instruments, helps to oil the wheels of trade by bridging the gap between exporters’ and importers’ differing expectations about when payment should be made. Trade finance includes loans and working capital facilities that exporters need to process or manufacture products and importers to buy inputs, raw materials, and equipment. Insufficient trade finance increases the risks of the trade transaction (i.e. not receiving payment or delivery) and trade costs (i.e. opportunity costs of using scarce cash resources). |