European firms remain upbeat on Vietnam’s investment climate

The latest report reflects confidence in Vietnam’s long-term economic trajectory despite short-term caution about market fluctuations.

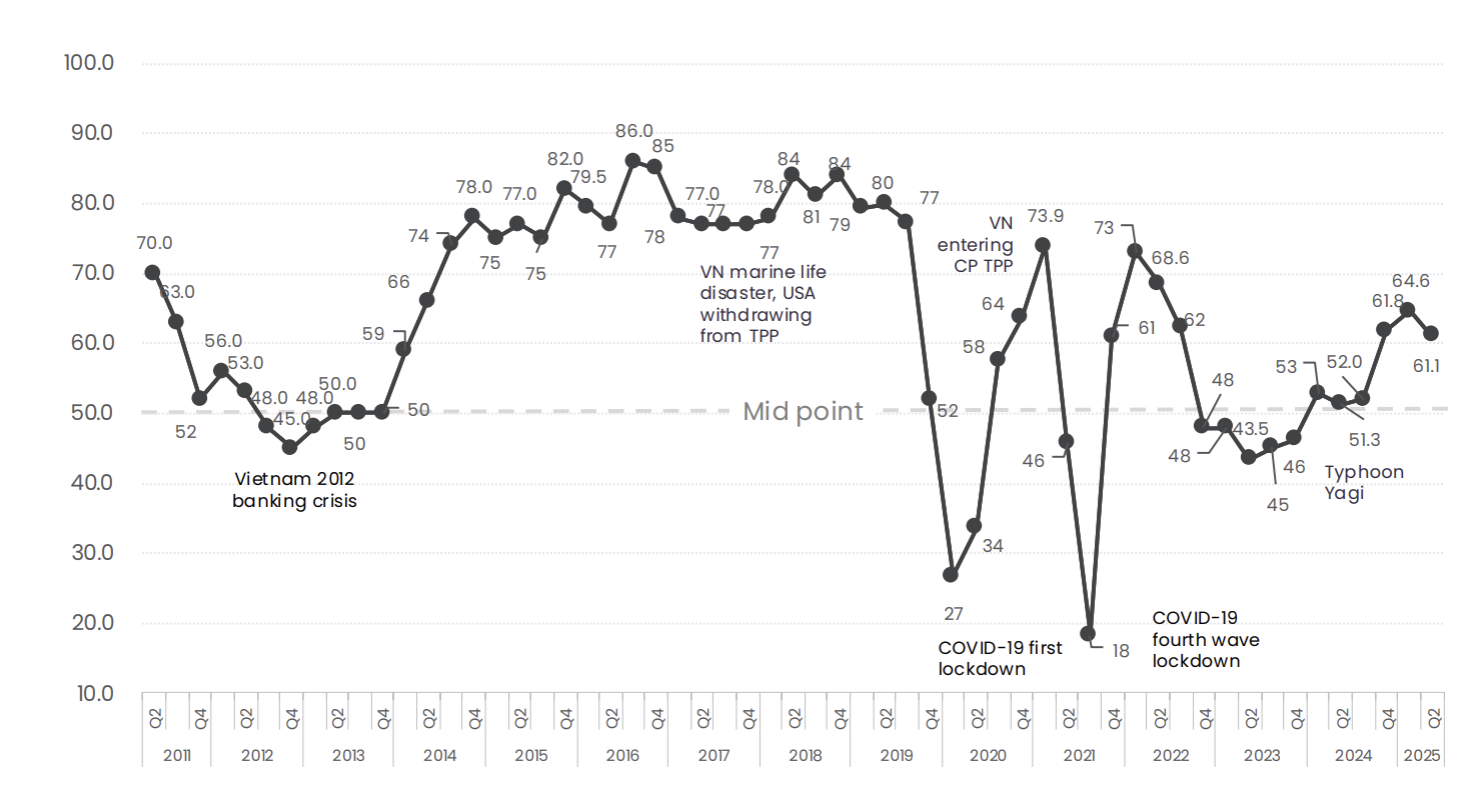

THE HANOI TIMES — European companies in Vietnam continue to express confidence in the country’s investment environment, according to the Q2 2025 Business Confidence Index (BCI) released by the European Chamber of Commerce in Vietnam (EuroCham).

As many as 72% of surveyed business leaders said they would recommend Vietnam as an investment destination, a consistent trend across recent BCI reports. “That level of consistency speaks volumes,” noted EuroCham Chairman Bruno Jaspaert.

However, this quarter's BCI score of 61.1 reflects a slight dip in optimism amid international market volatility and delays in domestic reform. Nevertheless, the long-term outlook remains positive.

The Q2 2025 Business Confidence Index (BCI)

This steady confidence contrasts with the growing turbulence in global markets. While international trade tensions escalate and supply chains remain under pressure, European firms in Vietnam continue to demonstrate remarkable resilience.

A key concern is the unresolved US tariffs, as the third round of trade talks between Vietnam and the US in June ended without concluding, leaving cross-border companies in limbo.

Only 15% of respondents cited negative financial impacts, such as order cancellations, penalties, or price renegotiations, while 70% said they had experienced no significant disruption. Remarkably, 5% even reported net gains, highlighting Vietnam’s relative stability amid global volatility.

Certificate of Origin crucial in trade diplomacy

One tool helping firms maintain resilience is the Certificate of Origin (C/O): a strategic asset for preferential trade access, credibility, traceability, and compliance in modern trade.

About 56% of BCI respondents reported submitting C/O documents on a monthly basis, especially among larger enterprises.

EuroCham Chairman Jaspaert said that, as geopolitical shifts continue to reshape global supply chains, a clear origin offers an even greater competitive advantage.

“This push toward digitalization is not just about reducing paperwork; it is about positioning Vietnam as a trusted, future-ready trade partner; by securing its supply chain and increasing truly ‘Made in Vietnam’ goods, it gains a powerful edge in global trade,” he said.

Since May 5, the Ministry of Industry and Trade (MOIT) has issued C/Os for a fully digital system nationwide, welcomed by businesses and expected to reduce paperwork, improve turnaround, and integrate more with digital customs and electronic signatures.

The launch ceremony of the EuroCham Vietnam 2025 Whitebook in Hanoi. Photos: EuroCham Vietnam

Reforms boost confidence among EU businesses in Vietnam

The proportion of European businesses confident in Vietnam’s economic stability for Q3 2025 fell to 50% in the Q2 BCI, down eight points, but Thue Quist Thomasen of Decision Lab said this is not a sign of growing pessimism.

He explained that rather than signalling declining optimism, the shift reflects caution amid global uncertainty and volatility. Only 11% of respondents anticipated a negative outlook, suggesting that businesses are pausing to observe developments.

The survey showed that 39% of companies had a neutral short-term outlook, while 43% rated their business outlook as 'good' or 'excellent.'

Despite ongoing challenges to the business environment, Vietnam’s fundamentals, including macroeconomic stability, a young and dynamic workforce, and an expanding network of free trade agreements (FTAs), continue to bolster long-term investor confidence, Thomasen added.

EuroCham data revealed EVFTA benefits vary by business size, with larger firms gaining more in EU-to-Vietnam exports, while SMEs play a more active role in two-way trade, especially Vietnam-to-EU exports.

A notable shift is evident in how businesses perceive EVFTA tariff benefits, with those citing tariff preferences rising from 29% in Q2 2024 to 61% in Q2 2025, reflecting the phased tariff reduction’s effectiveness and growing reliance on preferential terms.

The EVFTA is a prime example of what strong reforms and business engagement can achieve, but realizing its full potential requires Vietnam to push for regulatory precision, consistent enforcement, and a sustainable, reliable investment environment.

EuroCham Chairman Bruno Jaspaert said: “With clearer rules and stronger reform commitments, Vietnam is on the cusp of becoming a magnet for high-quality investment and sustainable development.”