Foreign investors unable to get Vietnamese stocks despite value at lowest level: Bloomberg

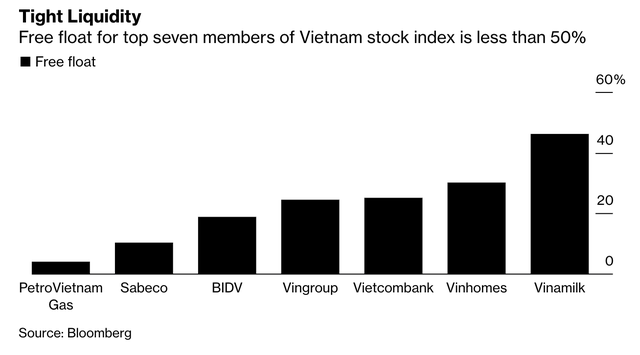

Tight liquidity is considered the main reason for difficulty that any investor who would like to take advantage of the country’s economic growth is facing.

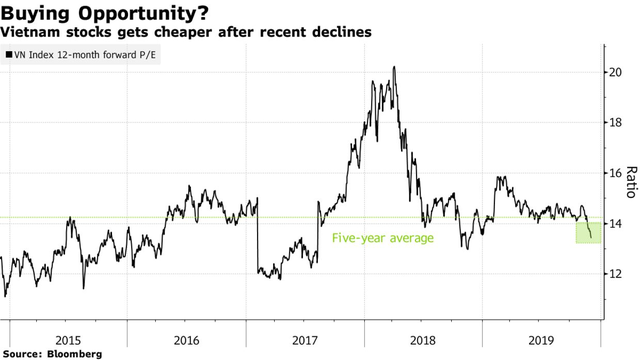

A recent retreat in Vietnamese stocks has brought the market’s valuation back below its five-year average. While that’s the cheapest level in a year, tapping this opportunity is easier said than done, Bloomberg reported.

Bloomberg pointed to tight liquidity as reason for difficulty that any investor who would like to take advantage of the country’s economic growth is facing.

“That is because issues like overseas ownership limits, small free-float levels and strong state control have left few shares for foreigners to trade,” said Bloomberg.

The good news, however, is the country has taken several measures to tackle the problem. It has relaxed foreign-ownership limits for some industries and has been speeding up the process of reducing government stakes in companies. It also started a derivatives market in 2017 and introduced more products this year.

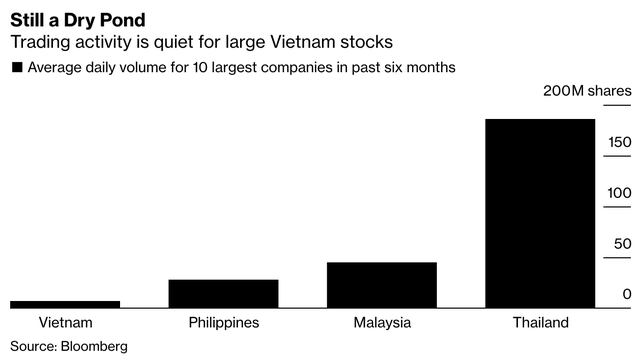

Still, trading volume in Vietnam’s stock market remains tiny compared with other Southeast Asian countries, even for the nation’s large caps.

While foreigners cherish the opportunity to invest in Vietnam shares, that is actually what has made trading worse. The tight liquidity of some top stocks is partly the result of major overseas owners holding their stakes for the long term, said Tim Love, a director for emerging-market equities at GAM Investments. High execution costs and fears of not being able to access that same foreign ownership tranche again discourage trading, he said.

Hopes that privatization will help market liquidity are also dimming. While the Vietnamese government has made a push to accelerate the revamp of rules for state-owned enterprises, the privatization process has been slowing and concern is now rising that it’ll miss a target to divest VND60 trillion (US$2.6 billion) between 2017 and 2020.

Share sales of state-owned enterprises fetched US$147 million in the past 11 months, or 32% of the value last year, data compiled by Bloomberg show. That is because the nation did not have marquee companies offering stakes, according to Vietnam’s Ministry of Finance.

“It will definitely make it easier if the state control gradually recedes,” Felix Lam, a senior manager of Asia Pacific equities at BNP Paribas Asset Management in Hong Kong, was quoted by Bloomberg as saying. He does not hold Vietnam stocks because the volume is too low for his mandate.

For investors to place more bets in Vietnam, they will need to have a better sense of what the nation is doing to boost liquidity, and what other market-related measures it’s looking at, according to Lam. “When you have visibility, you have a much higher chance to be re-rated and enjoy the foreign flows,” he said.

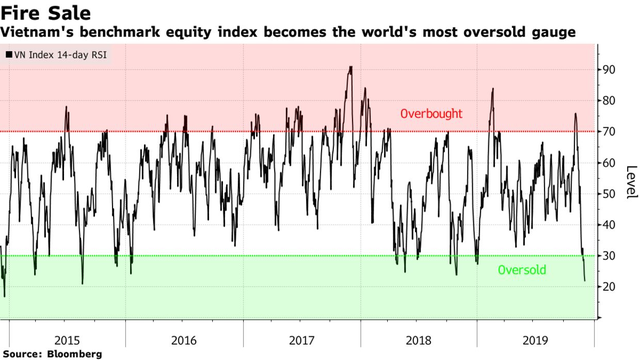

That would be welcome news for a market that’s now the world’s most oversold among major ones.

Overseas traders invested more than US$230 million in Vietnamese shares since January, data compiled by Bloomberg show. While that is better than the withdrawals for countries such as Malaysia and Thailand, the inflows for the nation’s equities are much smaller than in the past two years.

Despite all this, GAM Investments’ emerging-markets team is overweight Vietnamese stocks. It is sticking to shares that are relatively more liquid, holding them for a longer time -- especially those that have positive free cash flow, Love said.

“Liquidity issues do not imply the opportunity is not real,” he said. “The market has been de-rating recently, which is a wonderful opportunity to go the other way and buy. In our view, it is now correctly priced and under-appreciated.”