Profit of Vietnam banking sector predicted to grow 22.5% in 2020

In 2020, the credit growth is expected to be in range of 13 – 13.5%, down from 13.7% last year.

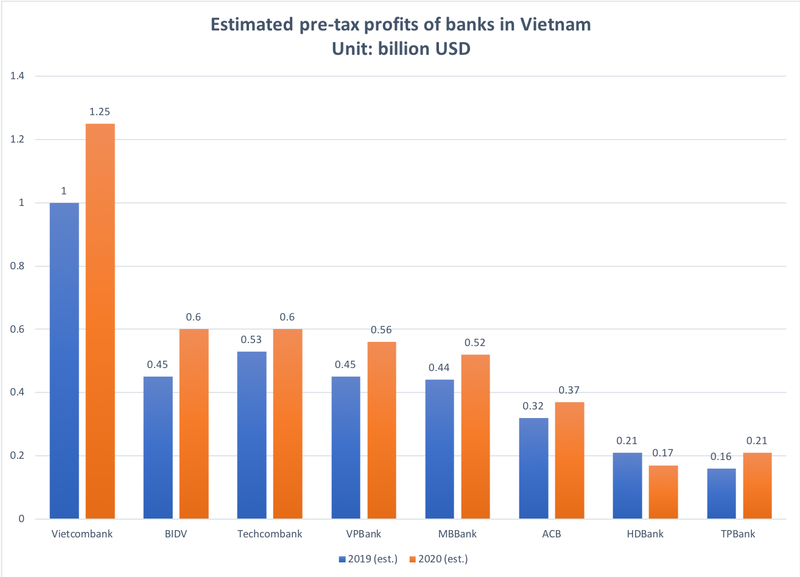

Pre-tax profit of Vietnam’s banking sector is predicted to expand 22.5% in 2020, slightly lower than a 23% growth rate in 2019, thanks to strong recovery of some banks, higher revenues from bancassurance and fees, according to SSI Research.

| Data: SSI. Chart: Hai Yen. |

Banks that are set to have the strongest profit growth in 2020 include Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), Commercial Bank for Investment and Development of Vietnam (BIDV), Vietnam Prosperity Bank (VPBank), Military Bank (MBBank), and Vietnam Technological and Commercial Bank (Techcombank), VnExpress reported.

In 2020, the credit growth is expected to be in range of 13 – 13.5%, down from 13.7% last year. According to SSI, such target growth is suitable in the context of tightening lending procedures and the development of corporate bond market.

Major corporations chose to issue corporate bonds instead of seeking bank loans, while there are a growing number of individual investors buying corporate bonds.

Techcombank Securities (TCBS) issued VND39.5 trillion (US$1.7 billion) in corporate bonds between January and September of 2019, higher than VND37 trillion (US$1.59 billion) in 2018.

SSI added more securities firms, including foreign-owned ones, are expanding this business.

Another driving force for credit growth in 2020 is personal loan, particularly at state-run banks such as BIDV, VietinBank and Vietcombank with the share of retail loans lower than that of privately-run banks.

Among the 12 largest banks in terms of market capitalization, retail loans formed 40% of total loans as of the end of the third quarter in 2019, significantly increasing from 32.2% in 2017 and 35.5% in 2018.

Regarding potential risks, the adoption of Basel II requirements on capital adequacy ratio (CAR) would lead to increases in banks’ expenditures.

The slowdown in credit growth of the banking sector in the first nine months of 2019 was due to modest credit growth rate of small banks and three major state-run banks, including Agribank, VietinBank and BIDV, with combined outstanding loans accounting for 38% of the total in the country’s banking system.

Meanwhile, banks qualified for Basel II recorded average credit growth of 13.8% as of the end of the third quarter in 2019, higher than the 9.54% rate of the banking system.

SSI expected the trend to continues, as banks meeting Basel II requirements would be given larger quotas for credit expansion compared to those that have not qualified, the report suggested.