Vietnam bond market posts strongest growth among emerging East Asia in 9 months

This growth was supported by expansion in both the government and corporate bond segments, stated the ADB.

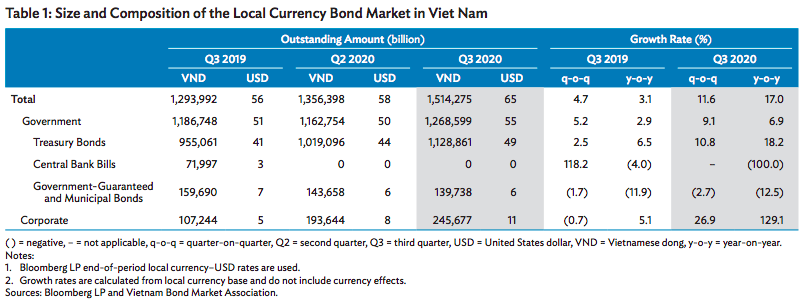

Vietnam’s local currency bond market posted quarterly growth of 11.6% at the end of September this year - the fastest quarterly growth rate in emerging East Asia - to reach US$65.3 billion, according to the latest edition of the Asian Development Bank (ADB)’s Asia Bond Monitor.

This growth was supported by expansion in both the government and corporate bond segments, added the report.

Vietnam’s government bond segment grew 9.1% quarter-on-quarter at the end of September 2020 to reach US$54.7 billion - accounting for 83.8% of the country’s total bond stock.

The expansion was driven by Treasury bonds, which grew 10.8% quarter-on-quarter in the third quarter, or double the growth rate of the previous one, on the back of increased issuance from the State Treasury.

There were no outstanding central bank bills at the end of the third quarter as the State Bank of Vietnam (SBV), the country’s central bank, continued to support liquidity in the market.

Issuance of government bonds in the third quarter totaled VND116.9 trillion (US$5.06 billion), more than doubling the amount issued in the second quarter. The State Treasury had a higher bond offering volume as it continued to raise funds for the government’s Covid-19 pandemic response. Auctions were met favorably by investors as safe assets like government bonds remained attractive amid lingering uncertainty, stated the ADB report.

The corporate bond segment, meanwhile, sustained its growth momentum, increasing by 26.9% quarter-on-quarter in the third quarter to reach US$10.6 billion. On an annual basis, growth in corporate bonds stood at 129.1% at the end of September this year.

While the corporate bond market grew, issuance activity in the third quarter was rather meek. Debt sales by corporates amounted to VND67 trillion (US$2.9 billion), down from VND83 billion (US$3.6 billion) in the second quarter. The decline is attributed to the government’s Decree No. 81/2020/ND-CP, which raises the standards for corporate bond issuance in the market.

The combined bonds outstanding of the top 30 issuers in the corporate market amounted to VND189.4 trillion (US$8.21 billion), or 77.1% of the total debt stock in the corporate segment.

Nearly half of the outstanding bonds, totaling VND93.7 trillion (US$4.06 billion), were from the banking sector, followed by property firms with VND47.5 trillion (US$2.06 billion), or 25.1% of the total.

Positive sentiment boosts bond markets in East Asia

Overall, the report suggested accommodative monetary stance sustained the growth of local currency bond markets in emerging East Asia, with currencies and equity markets gaining in early November.

“We saw an improvement in the global investment sentiment, but uncertainty over the trajectory of the Covid-19 pandemic still weighs on the region’s economic outlook,” said ADB Chief Economist Yasuyuki Sawada. “The region’s large and growing local currency bond markets can help finance a sustainable and inclusive post-Covid-19 recovery.”

Local currency bonds outstanding in emerging East Asia reached US$18.7 trillion at the end of September, a 4.8% expansion from June this year and 17.4% higher than a year ago. Emerging East Asia’s bond issuance in the third quarter climbed to US$2.2 trillion, up 6.4% quarter on quarter and 39.8% year on year, as governments borrowed to support large-scale stimulus programs.

As a share of gross domestic product (GDP), emerging East Asia’s bond market rose to 95.6% at the end of September from 91.6% at the end of June. The rising share of bonds outstanding to GDP was mainly due to regional governments’ increased financing to combat the adverse effects of the Covid-19 pandemic.

Covid-19 remains the biggest downside risk to emerging East Asia’s bond market and the global outlook, particularly the possibility of new waves of positive cases and related lockdowns and other restrictions on economic activities. Ongoing trade tensions between China and the US is an additional risk, it added.