Vietnam c.bank’s latest rate cut expected to reduce pressure on budget spending

Cutting deposit interest rates on required reserve of commercial banks is not a further monetary easing.

The State Bank of Vietnam (SBV)’s decision to slash some of its policy interest rate for the third time this year is believed to help reduce pressure on state budget expenditure, according to securities firms.

This is particularly important, as the pressure on budget spending is growing due to the government’s economic support polices for the business community and people affected by the Covid-19 pandemic, including small and medium corporate income tax reduction packages, increasing public investment spending, among others, stated KB Securities.

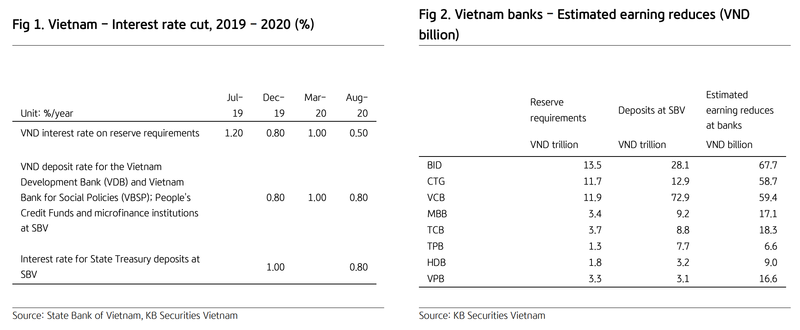

In early August, the SBV cut deposit interest rates on required reserves and required reserves extension in Vietnamese dong (VND) by 0.5 percentage points to 0.5% per annum, while interest rates of the State Treasury of Vietnam and Deposit Insurance of Vietnam at the SBV have now been lowered to 0.8% per annum, a decrease of 0.2 percentage points.

Bao Viet Securities Company (BVSC) is of the similar view that the move would aim at reducing operating costs for the country’s central bank. As a result, income of commercial banks from the required reserve deposits at the SBV will also decrease.

Nevertheless, the reduction of deposit interest rates on required reserves would have little impact on the earnings of credit institutions as the reserve requirement ratio of banks is small, only about 3% for demand deposits and deposits for term less than one year and 1% for deposits for term over one year.

KB Securities estimated the impact of this cut on earnings of the banking system is about VND600 billion (US$25.83 million), of which state-owned commercial banks could lose around VND60 billion (US$2.58 million) each.

Meanwhile, BVSC added that cutting deposit interest rates on required reserve is not the same as cutting other interest rates such as supplying capital interest rates, re-discount interest rates, among others, which helps reduce borrowing costs of commercial banks, thus reduce market interest rates. Therefore, cutting deposit interest rates on required reserve of commercial banks is not a further monetary easing.

In addition, credit growth has remained very low so far. The updated data as of July 28 showed that credit growth only increased by 3.45% compared to the end of 2019, which did not improve much compared to the end of June (3,26%).

Credit is still stuck in the system despite sharp decline in interest rates. Besides, the return of Covid-19 has had a negative effect on credit growth prospect in the third quarter of this year.

BVSC believed that SBV’s priority in managing the monetary policy in the last two quarters of the year will focus on increasing the economy’s access to capital, so as to boost credit growth instead of just trying to lower the interest rate as shown in the first half of the year.

Previously, the SBV had cut its policy rates twice by a combined of 100 – 150 basis points to support the country's economic recovery. The refinancing interest rate now stands at 4.5% per annum, rediscount rate at 3%, overnight interest rate at 5.5% and interest rate via open market operations (OMO) at 3%.

The SBV also lowered the interest rate cap to 4.25% annually for deposits with maturities of one month to less than six months.