Vietnam gov’t encourages foreign investment into banking sector

The Vietnamese government welcomes Sumitomo Mitsui Banking Corporation’s deal worth US$1.4 billion to acquire 49% stake at local consumer finance firm FE Credit.

The Vietnamese government encourages foreign investment into local credit institutions in a bid to enhance efficiency and safety of the banking sector.

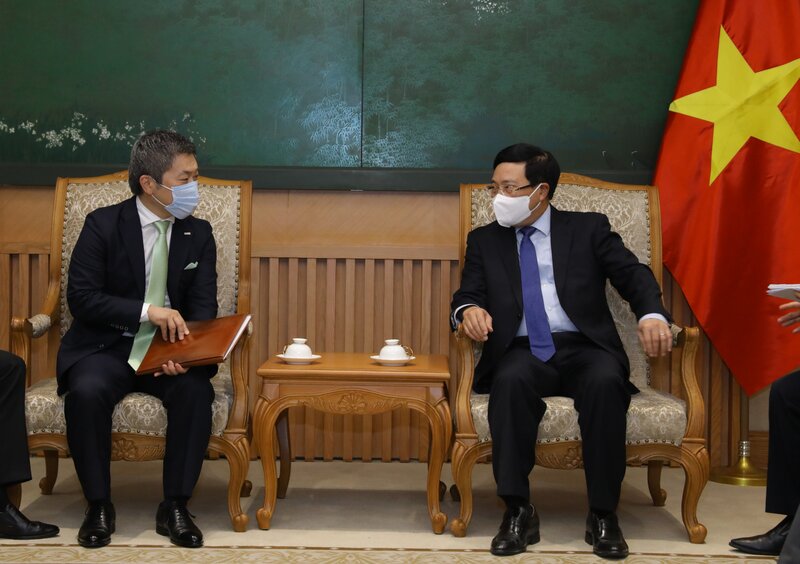

| Deputy Prime Minister Pham Binh Minh (r) and SMFG's General Manager of Business Development Masahiro Yoshimura (l). Photo: Hai Minh |

Deputy Prime Minister Pham Binh Minh gave the remarks in a meeting with General Manager of Business Development at Japan-based Sumitomo Mitsui Financial Group (SMFG) Masahiro Yoshimura on April 28.

Minh welcomed the deal, which is worth an estimated US$1.4 billion from Sumitomo Mitsui Banking Corporation (SMBC), to acquire 49% stake at consumer finance firm FE Credit from Vietnamese VPBank, urging the two sides to soon complete the procedures in accordance with the law. SMBC is one of Japan’s largest commercial bank and a member of SMFG.

The Deputy PM expected SMFG and SMBC to continue expanding their operation in Vietnam, in turn serving as a bridge to promote Japanese investment capital to the country.

“Japanese financial institutions, including SMFG, have made a positive contribution to strengthening bilateral economic cooperation,” Minh added.

On his part, Yoshimura stressed SMFG’s commitment to expanding its business activities in Vietnam, expressing his confidence Vietnam – Japan relations would continue to improve in the future.

For the past 20 years, SMBC has been operating in Vietnam under the form of a foreign branch and a strategic shareholder at Eximbank.

“The bank so far has been providing financial services, while supporting major energy and infrastructure projects worth a total of US$20 billion in Vietnam,” he noted.

Referring to the stake acquisition at FE Credit, Yoshimura noted the deal is currently the largest investment project in Vietnam’s banking sector, indicating SMFG’s strong commitment for Vietnam’s development.

Japan is Vietnam’s largest ODA donor with around US$27 billion, and also the second largest investor by pouring US$60.3 billion into the country, or 15.7% of total registered FDI in Vietnam. In 2020, Japan remained Vietnam’s fourth largest trading partner with bilateral trade turnover of US$60 billion. In the banking sector, Japanese firms have the third largest foreign presence in the country with six branches, two wholly foreign-owned financial companies and 10 representative offices. Major Japanese banks have also been strategic shareholders at several banks in Vietnam, including Mizuho Bank with 15% stake at Vietinbank, and SMBC with 15% at Eximbank. |