Vietnam manufacturing sector grows first time in four months

The index pointed to a strengthening in the overall health of the manufacturing sector.

THE HANOI TIMES — The Vietnamese manufacturing sector returned to growth in July for the first time in four months, driven by a renewed increase in new orders that spurred a faster rise in production, according to the latest data from S&P Global.

The PMI Index.

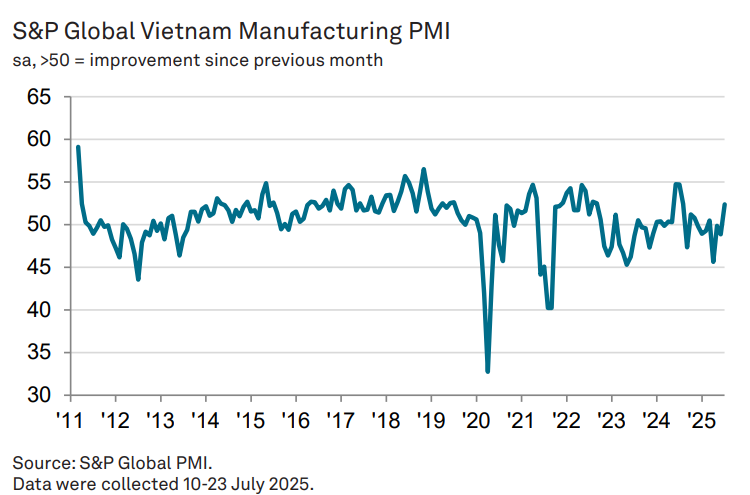

In particular, the S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 52.4 in July, up from 48.9 in June and back above the 50.0 no-change mark for the first time since April.

As such, the index pointed to a strengthening in the overall health of the manufacturing sector. In fact, the solid improvement in business conditions was the most marked for almost a year.

A reading below the 50 neutral mark indicates no change from the previous month or even contractions; above 50 points means an expansion.

"July PMI data suggested that the Vietnamese manufacturing sector is getting back on its feet following the disruption caused to operations by the US tariff announcements in recent months,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

“Although tariffs continued to cause reductions in new export orders, firms were able to secure enough business elsewhere that total new orders returned to growth," he added.

According to Harker, a key feature of the latest survey was the impact of difficulties sourcing raw materials.

“Firms linked this to widespread supplier delivery delays, declining stocks of purchases and building cost pressures. If material supplies continue to cause issues in the months ahead then we may see limits to the growth rates that can be achieved by the sector," Harker continued.

The improvement in operating conditions coincided with a return to growth of new orders in July. New business expanded for the first time in four months, and at the fastest pace since November last year, amid reports of customer demand strengthening.

Industrial production at Son Ha Group. Photo: Khac Kien/The Hanoi Times

That said, some respondents highlighted the negative impact of US tariffs on new order growth. New business from abroad continued to fall as a result of tariffs, extending the current sequence of contraction to nine months.

The renewed increase in new orders, however, helped to support production growth in July, stated the S&P report. Output rose for the third month running. Moreover, the pace of expansion was marked and the fastest in 11 months.

Higher output requirements led to the growth of purchasing activity, while the pace of expansion was the sharpest since August last year.

Meanwhile, employment neared stabilization. Although staffing levels continued to fall amid ongoing spare capacity following the recent period of declining new orders, the latest reduction was the slowest in nine months as output requirements increased.

Backlogs of work continued to fall, albeit to the smallest extent in the current seven-month sequence of depletion. Despite renewed growth of input buying, stocks of purchases declined again as panelists reported challenges securing raw materials.

Difficulties sourcing materials, particularly those from abroad, led to an increase in input costs at the start of the second half of the year. Input prices increased for the second successive month, and at a solid pace that was the fastest in 2025 so far. The pace of output price inflation also quickened in July as firms passed on higher input costs to customers. Here, the rise was the sharpest in seven months. Nevertheless, the increase in charges was only modest.

Although manufacturers remained optimistic that output would increase over the coming year, sentiment dipped to a three-month low in July, the report suggested.

Confidence was linked by panelists to hopes for more stable economic conditions, new product launches and new orders. On the other hand, concerns around the impact of US tariffs weighed on the outlook.