Vietnam’s business environment favorable for foreign investors: Warburg Pincus

The capital market, digitalization, energy transition, climate change, and strategic infrastructure are key potential fields for Warburg Pincus to focus on in Vietnam.

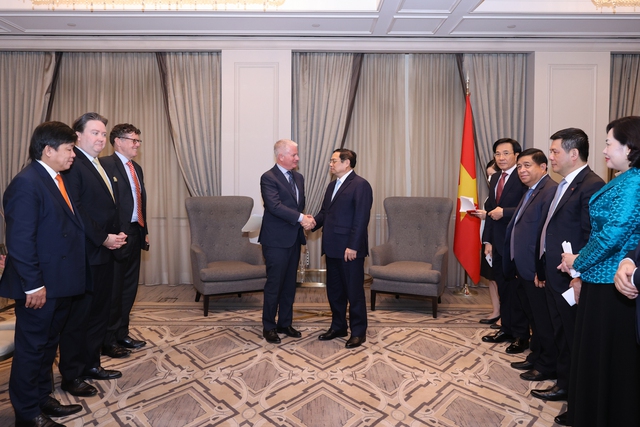

Vietnam’s business environment and macroeconomic conditions have become more stable and favorable for foreign investors, said CEO of global private equity firm Warburg Pincus Charles Kaye at a meeting with Prime Minister Pham Minh Chinh on May 15.

Prime Minister Pham Minh Chinh and CEO of global private equity firm Warburg Pincus Charles Kaye. Source: VGP |

Kaye said investors are concerned about the four major issues, including the capabilities of local companies, macro-economic stability, infrastructure, and the authorities' responsiveness.

In this regard, Kaye said Vietnam could do more in infrastructure development as one of the measures to improve the business environment.

The CEO also revealed a plan to expand the equity firm investment portfolio in Vietnam’s real estate market and suggested the Government further ease the foreign ownership limit in the banking sector.

At the meeting, Prime Minister Chinh welcomed Warburg Pincus’s investment plan in Vietnam, including the Grand Ho Tram resort project in Ba Ria – Vung Tau Province.

“Warburg Pincus with a large network of customers all over the world could serve as the bridge to promote investments in Vietnam, including those from the US,” Chinh said, referring to the capital market, digitalization, energy transition, climate change, and strategic infrastructure as key potential fields.

Stressing the Government’s commitments to businesses and investors, Chinh noted he “has not declined any request for dialogue from local and foreign companies, or forgotten to reply to any letters sent from the business community.”

With sincerity, credibility, and responsibility to address any concerns from businesses, Chinh said the Vietnamese Government would continue to support foreign investors to ensure their long-term success in Vietnam.

Founded in 1966, Warburg Pincus has raised 19 private equity funds, which have invested more than $94 billion in over 940 portfolio companies in more than 40 countries. The equity firm currently has more than $64 billion in private equity assets under management, while its active portfolio of more than 205 companies is highly diversified by stage, sector, and geography. Vietnam is Warburg Pincus’s third-largest investment destination in Asia, after China and India, Since 2013, it has invested nearly $2 billion into Vietnam’s major companies, including Vingroup, VinaCapital, Techcombank, Becamex, and MoMo. |