Vietnam’s local bond market hits US$109 billion: ADB

Vietnam’s government bond yields climbed across all tenors for September 1 - November 10 driven by a rise in inflation and the US Federal Reserve’s decision to keep interest rates high for an extended period.

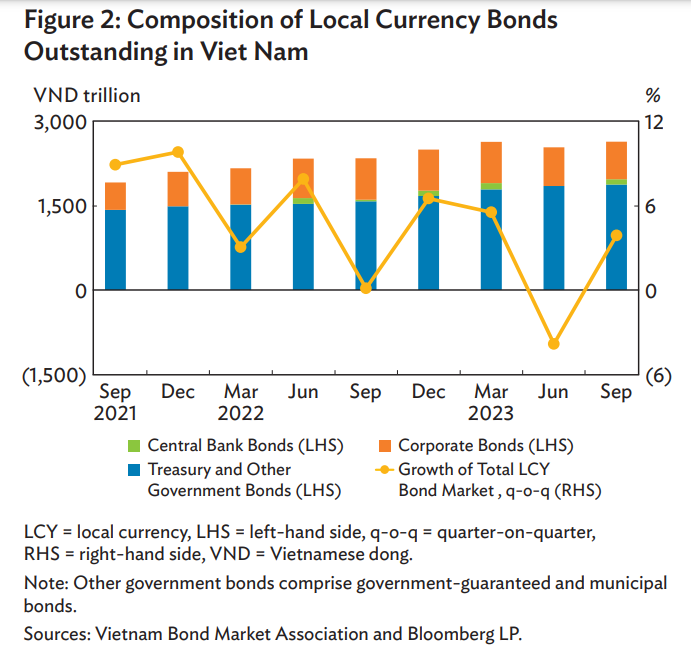

The resumption of the State Bank of Vietnam (SBV)’s issuance of central bank securities drove the economy’s local currency bond market to expand 3.9% from the previous quarter, resulting in bonds outstanding of US$108.6 billion as of the end of September, according to ADB’s latest report.

| Increased issuance from corporates drives total local bond issuance in the third quarter. Photo: Ngoc Phuong/The Hanoi Times |

Amid slow credit growth, the SBV resumed issuance of central bank securities to mop up excess liquidity in the banking system, stated the bank.

Growth in outstanding government bonds slowed to 1.5% in the third quarter against the same period last year due to the low volume of maturities and a decline in issuance.

However, Vietnam’s government bond yields climbed across all tenors for September 1 - November 10 driven by a rise in inflation and the US Federal Reserve’s decision to keep interest rates high for an extended period.

In this context, the country’s consumer price inflation rose from 2.1% year-on-year in July to 3.6% year-on-year in October but remained below the Government’s 4.5% target for the full year 2023.

Corporate bonds, meanwhile, contracted 3.1% quarter on quarter, driven by the large volume of maturities in the third quarter despite strong corporate bond issuance.

Per a news release from The Investor, Vietnamese broker VNDirect estimated that corporate bond maturities in August and September exceeded VND27.9 trillion ($1.15 billion) and VND25.8 trillion ($1.06 billion), respectively, marking them among the largest monthly maturity values in 2023.

ADB suggested that increased issuance from corporates drove total local bond issuance to expand 144.6% quarter on quarter to VND198.1 trillion ($8.17 billion) in the third quarter. Corporate bond issuance climbed more than threefold in the third quarter from the previous quarter as Vietnamese banks increased their issuance after the government issued circulars No. 2 and 3 in April, which removed some bottlenecks in debt payment rescheduling and bond repurchases.

Bond issuance from the banking sector accounted for 59.0% of the economy’s total corporate bonds issued in the period, with the largest issuance coming from Asia Joint Stock Commercial Bank on aggregated debt sales of VND13.5 trillion ($557.11 million).

On the other hand, issuance of government bonds contracted 21.6% as the government moderated issuance during the quarter, with some auctions not fully awarded. To help stabilize the foreign exchange market, the SBV resumed its issuance of central bank securities in September (VND93.8 trillion or $3.87 billion) since its last issuance in March 2023.

At the end of September, insurance firms and banks continued to hold nearly all outstanding government bonds in Vietnam’s market. Collectively, their bond holdings accounted for 99.6% of the total, up from 99.4% in the same period a year earlier.

On the other hand, the holding share of banks increased to 39.9% from 38.9% in the same period. At the end of September 2023, securities companies and investment funds, nonresidents, and other investors held a marginal aggregate share of 0.4%.

Bond yields rise in emerging East Asian markets

Like the Vietnamese bond market, government bond yields rose across most East Asian markets in response to the elevated US interest rates.

Weak external demand and a moderating growth outlook in China, combined with the Federal Reserve’s hawkish monetary stance, pushed down regional equity markets and drove up risk premiums. Capital outflows were recorded in the region’s equity and bond markets. A stronger US dollar on the back of higher US interest rates also weighed on regional currencies.

“We see softer inflation in emerging East Asia in the next few years, which is a welcome development as regional central banks may have more room to support economic growth,” said ADB Chief Economist Albert Park. “At the same time, they should remain vigilant against financial turbulence in the face of interest rates remaining elevated for a longer period. Strengthening economic fundamentals will safeguard financial stability and support growth.”

Bond issuance in emerging East Asia grew 8.6% from the previous quarter to $2.5 trillion in the third quarter of this year. Local currency bonds outstanding in the region increased 2.5% to $23.5 trillion. Government bonds expanded 3.0% amid increased issuance, accounting for 62.4% of the region’s total local currency bonds outstanding. Corporate bonds outstanding rose 1.5%.