Vietnam’s role in reshaping Asian supply chains is growing: HSBC

While the recent trade tensions have merely accelerated the movement of supply chains to Vietnam, they were not the trigger.

Vietnam’s role in Asian supply chains has been increasing for years and is set to expand further, according to HSBC’s report.

For instance, around 60% of Samsung’s smartphone production is in the country (not just assembly, but some parts, too) and the company is setting up an R&D center there. The South Korean’s tech giant ceased nearly all smartphone production in China this year. Its subsidiaries Samsung SDI, Samsung Electromechanics and Samsung display have factories in Vietnam, too.

Another example is in the auto industry, where Vinfast, part of Vingroup, is making a name for itself. HSBC considered Vinfast stand out in terms of Vietnamese brand execution and it arguably has among the most automotive plants in the region. “The cars produced at the Vinfast facilities were impressive,” stated the report. And it has all happened quickly – this plant was completed in 21 months, ahead of schedule and apparently the quickest construction project of its kind in the world. This is not a completely knocked-down (CKD) plant, where individual parts are imported and assembled, but a full-scale production facility, with many suppliers situated next to the factory.

GoerTek has been manufacturing acoustic and TWS products in Vietnam on a sizeable scale for years. HSBC’s Head of A-share Technology Hardware Research Frank He expected that more sophisticated production lines and export products to the US, such as AirPods, are likely to move to Vietnam once the labor quality has improved through training. The Vietnam plant in Bac Ninh now has 15,000 employees; this number should rise to 23,000 by end-2019 and 30,000 in 2020. The company expects to double its production lines in 2020.

The capacity expansion is driven mainly by new product design wins and by order relocation from China to Vietnam in light of uncertainties on export tariffs to the US. A big portion of GoerTek’s customers have set up test-run production lines in Vietnam to prepare for prolonged trade frictions between China and the US.

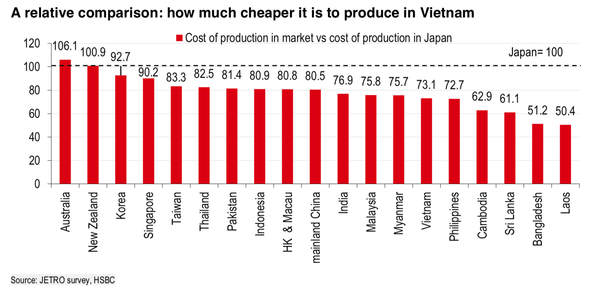

More importantly, Vietnam is a cheaper manufacturing destination, as it costs 73.1% of the amount it would cost in Japan to manufacture an item in Vietnam. This was among the lowest manufacturing costs in Asia, though still above that of the Philippines, Cambodia, Sri Lanka, and Bangladesh – but these markets usually manufacture less sophisticated products and do not have the same kind of manufacturing capabilities that Vietnam possesses.

Challenges remain

Although tremendous progress has been made over the past decade, Vietnam still has a long way to go in terms of developing self-sufficient supply chains. On the plus side, Vietnam is an increasingly attractive destination for many companies. While the recent trade tensions have merely accelerated the movement of supply chains to Vietnam, they were not the trigger. Vietnam’s share of world exports has been rising at a fast pace, a trend that began in the mid-1990s but then accelerated after the 2008 global financial crisis.

As Herald van der Linde, HSBC’s Head of Equity Strategy, Asia Pacific, argued, while there is some movement, there has not been any evidence of large-scale changes in supply chains. Yes, Vietnam has gained some market share in global exports, and some Taiwanese producers in mainland China have moved back to Taiwan. But, overall, no imminent large-scale shift is likely because of (1) the advantages of staying with existing complex production networks, (2) the existence of first-mover disadvantages, and (3) the complex legal issues big shifts in production can entail.

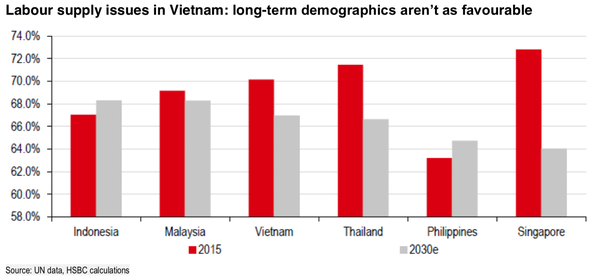

Scale matters. A local supply chain and logistics expert said Vietnam would need to boost its capacity by 70% to absorb 5% of the output of Chinese factories. This is a daunting task. As it is, companies already face land and labor shortages. Local experts say Vietnam will probably run out of spare land that can be developed over the next 3-4 years if the current pace of demand from foreign manufacturers is sustained. Labor availability and cost is another issue, not to mention the demographics in Vietnam are not as favorable as in other emerging markets.

Nevertheless, Vietnam remains one of the most interesting and exciting growth stories in Asia. HSBC’s economists forecast that the size of the economy is going to double to USD500bn over the next decade.

Vietnam’s is a bright spot even as growth has been slowing in the region. The economy expanded an impressive 7.3% year-on-year in the third quarter, up from 6.7% in previous quarter and above consensus estimates of 6.7%. This makes Vietnam among the fastest growing economies in the world. In the past, inflation has been an issue for many investors. However, inflation remains in check and is well below the State Bank of Vietnam’s 4% target. HSBC economists think the inflation trajectory should remain benign for the rest of 2019 with the trend likely to persist in 2020.