Vn-Index on track to reach 1,800 points: Pyn Elite Fund

The Vietnamese stock market can surprise investors with a “big year” returns during the 2020-24 period.

Vietnam’s benchmark Vn-Index is on track to reach 1,800 points, taking into account the companies’ earnings growth forecasts, the strong outlook of the Vietnamese economy and the opportunities presented by the modernization of the stock market, according to Pyn Elite Fund, an independent Finish fund manager.

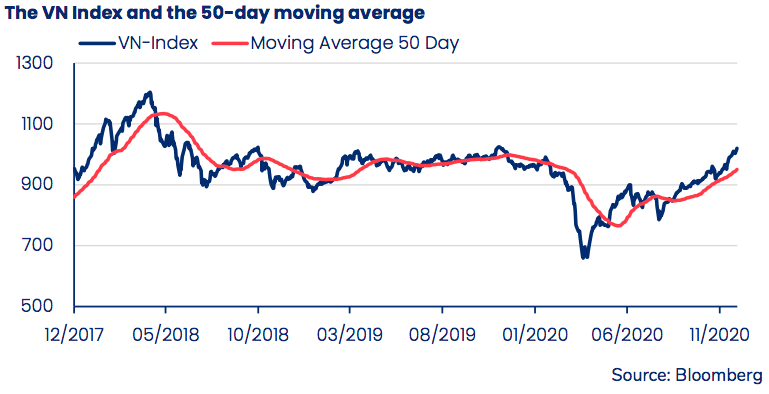

At the close last Friday, Vn-Index stood at 1,067.46 points, a 1.49% increase against the previous trading session and 2.06% during last week. The point is around 9% below its all-time high (1,204 points), which it reached in April 2018.

“The index target would be achieved with a gain of 80%,” stated the fund in its latest report.

If the earnings grow as expected, the stock market’s P/E ratio would be in the range of 15–16 to equal index level of 1,800 points. Even thereafter, Vietnam’s economic growth will surely support even higher valuations and index levels, it added.

“The surge seen in the late autumn has pushed the index higher, but listed companies are expected to achieve significant increase in earnings in 2021,”, adding this stems from a plunge in enterprises’ revenue in 2020 as a result of the Covid-19 crisis.

In light of P/E ratios in 2021, the Vietnamese stock market looks cheap compared to its historical valuations and other Asian markets. The Vn-Index is trading at a forward P/E of 13.3.

In a scenario of sideways movement in the next few years, Pyn Elite Fund’s estimated earnings growth would see the market’s P/E ratio decrease year by year as follows: 13.3 (2021), 11.5 (2022), 9.7 (2023), and 8.2 (2024).

The fund believed that the Vietnamese stock market can surprise investors with a “big year” returns during the 2020–24-time frame.

Investors remain net sellers

The net-sell trend from foreign investors, the report noted, came from the uncertainties surrounding the Covid-19 pandemic.

Back in January 2020, it looked like the year would be completely different as foreign investors were busy building their Vietnamese positions, “but that wasn’t to be,” stated the fund. In January, net foreign investment flows were US$84 million, but net flows since then have amounted to $557 million.

In the summer, foreign investors started buying back shares, but the net foreign investment flows subsequently turned negative again in the autumn. Local investors have been active in the autumn and pushed the index up. I

In November and early December, the situation with foreign investors has been balanced in terms of their buying and selling, meaning that their impact on the Vietnamese stock market has been neutral.

“PYN Elite has taken a different approach this year, with the net increase in our investments in Vietnam amounting to US$110 million,” it noted.

Things will get interesting when foreign investment flows turn back towards Vietnam. The country’s economic outlook for the next few years, the earnings growth of Vietnamese companies and the current valuation levels in the Vietnamese stock market will undoubtedly attract foreign investors back to Vietnam, the fund stressed.

Local investors act differently this time

In previous periods, Vietnamese investors often follow the moves made by their foreign peers. But this time it was different.

According to Pyn Elite Fund, this was due to the fact that the interest rates on Vietnamese sovereign bonds have declined sharply, from 5% to 2.5%, over the past two years.

In spite of this, local investors in Vietnam were cautious about putting their money in the stock market in 2018-19 due to the weak sentiment in the stock market and interest rates still being high enough to generate returns. The additional incomes they accumulated were put into deposits and the fixed income market.

Shares are now starting to look attractively priced, especially in relation to fixed income investments. Going forward, this ratio will support local money moving from deposits to the stock market.

Vietnamese investors have opened 270,400 new accounts to invest in equities during the past 11 months, bringing the total to 2.7 million, with more than 300,000 accounts set to be opened this year.

Interest in equity investments among local investors is seeing robust growth, stated the fund.

The 41,200 new accounts opened in November was the highest monthly figure ever. Of this total, 123 accounts were opened for local institutions and the rest for retail investors.

.png)