Vn-Index sets sight on surpassing 1,500

The low-interest-rate environment remains the key driving force for the stock market.

The benchmark Vn-Index could soon reach the new height of 1,500 points as earning per share (EPS) expanded by 20% and the target for the market’s price-to-earnings (P/E) ratio at 16.2x, according to Viet Dragon Securities Company (VDSC).

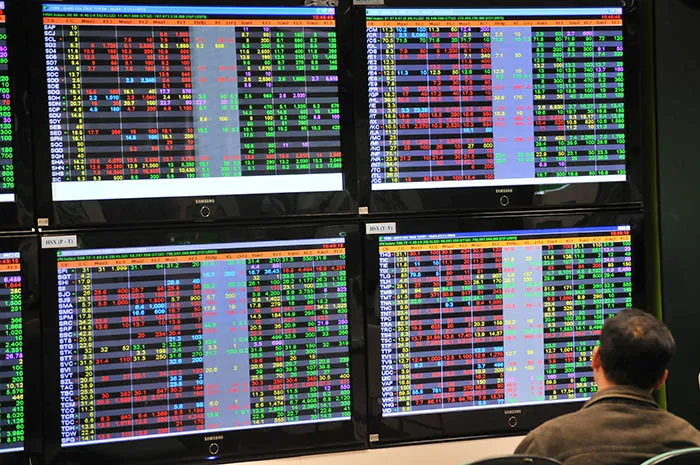

| An investor in a securities company in Hanoi. Photo: Pham Hung |

“The Covid-19 situation, foreign capital inflow, interest rate, and the sentiment from domestic investors are factors that would impact market trend,” noted the VDSC’s strategy report, which added the low-interest-rate environment remains the key driving force for the stock market.

According to the VDSC, as the central bank keeps the policy rates at a low level to aid the economy amid a serious Covid-19 situation, investors would continue to turn to the stock market as an attractive investment channel.

As of the end of the second quarter, the total amount of unused capital in securities accounts is estimated at VND86 trillion ($3.76 billion).

“There is a high chance that people continue to move their money from banks’ saving accounts to the stock market,” it added.

This is demonstrated by the fact that the number of new securities accounts has been on the rise since the first Covid-19 outbreak, which stood at 721,000 in the first seven months of 2021, nearly double that of the whole of last year and four times that of 2019.

“The figure, however, remains low compared to the region, and there is room for improvement,” stated the report.

Meanwhile, the VDSC also expects the return of foreign capital. In July, foreign investors turned to a net buying position for the first time since January 2020 with a total of VND3.6 trillion ($157.42 million). The Fubon ETF fund played a key role in mobilizing VND4 trillion ($175 million) for the Vietnamese market.

VDSC referred to an assessment from the Fubon ETF with a strong impression on the government’s handling of the pandemic and efforts to develop the stock market.

On the contrary, the pandemic situation is set to only add more uncertainties to market sentiment.

VDSC, nevertheless, expected the vaccination program in Ho Chi Minh City to help economic activities resume in the fourth quarter, saying investors would become more optimistic as the infection number passes its peak, a similar situation that had happened in foreign markets such as Taiwan, India or Canada.

Vietnam emerged as one of the outperforming markets in the first six months of this year with a rate of return of 27.6%.

The domination of domestic investors, accounting for 80% of total transactions, was the highlight of the market and pushed the liquidity to an average of VND17 trillion ($743 million), nearly triple the figure in 2020.