Vn-Index to reach new height of 1,370 in May

The participation individual investors and margin expansion in upcoming times from share issuance of securities firms are serving as key driving forces to boost market growth.

The strong recovery from the first quarter would be good base for businesses to achieve double-digit earnings per share (EPS) growth in 2021, in turn taking the benchmark Vn-Index in range of 1,240 – 1,370, according to Viet Dragon Securities Company (VDSC).

| Investor at a securities firm. File photo |

In its latest strategy report, VDSC also pointed out other supporting factors, including the continuous fund inflows into Vn30 Index, formed by the largest 30 largest and most liquid stocks, from names such as Fubon EFT and Vn Diamond along with the participation of Vietnam DC25, a fund from Dragon Capital.

Meanwhile, the participation individual investors and margin expansion in upcoming times from share issuance of securities firms are serving as key driving forces to boost market growth, noted the report.

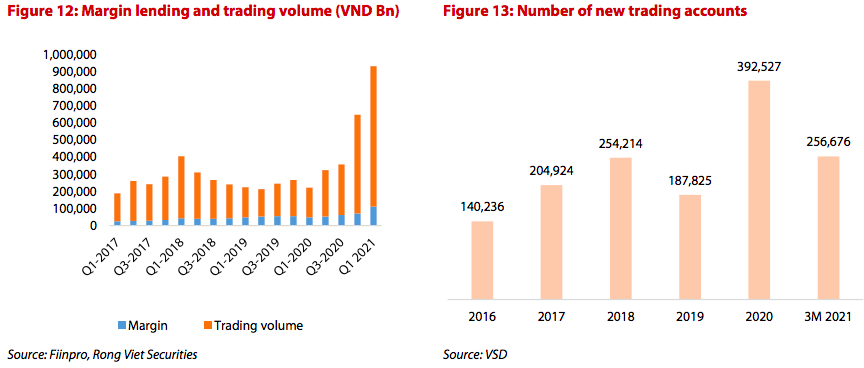

In the January – March period, the number of individual accounts have growth strongly and reached 65% of that figure in 2020.

“We expect this number will continue its growth trend given the low-interest rate environment,” it added.

Moreover, this flow is pure money as the margin only accounted for 13% of total trading volume. As such, the money inflows would be more sustainable as it comes from new money instead of heavy dependence on leverage.

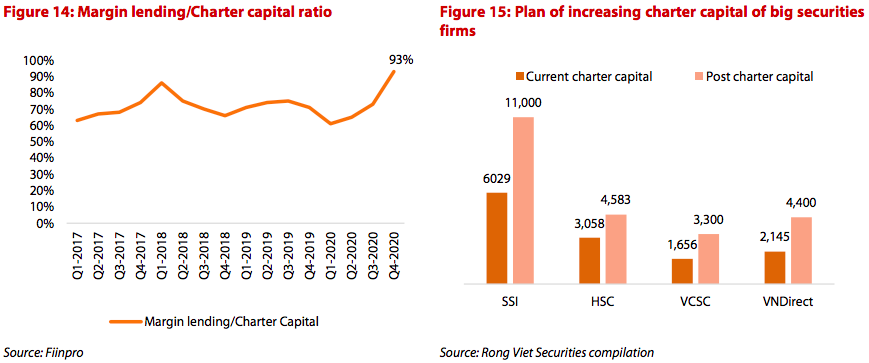

As of the fourth quarter of 2020, the margin lending/charter capital rate peaked in last three years, while some securities firms nearly reached the maximum level of this ratio.

According to VDSC, this would partly limit the market further growth as securities firms have not enough sources for lending.

However, the securities firm expects this would not be a considerable factor to limit VN-Index upward movement as many securities firms, especially large firms (accounted for 37% of margin lending balance as end of the fourth quarter of last year) have presented their plan to shareholders to increase charter capital.

The Vn-Index in April edged up 3.75% month-on-month to finish at 1,240. The average liquidity in HOSE, home to the majority of large caps, was VND14.8 trillion (US$641 million) via matching orders, or an increase of 21.5% month-on-month, while the VN30 Index recorded a strong surge of 47.8%.

In April, foreign investors continued as net sellers for seven consecutive months on HOSE. In terms of matching-order transactions, they reduced their selling value with a total net value of VND4.3 trillion (US$186.2 million), or a decline of 68% month-on-month.