Business conditions slightly improve in July: PMI

Firms remained optimistic overall of output growth over the coming year.

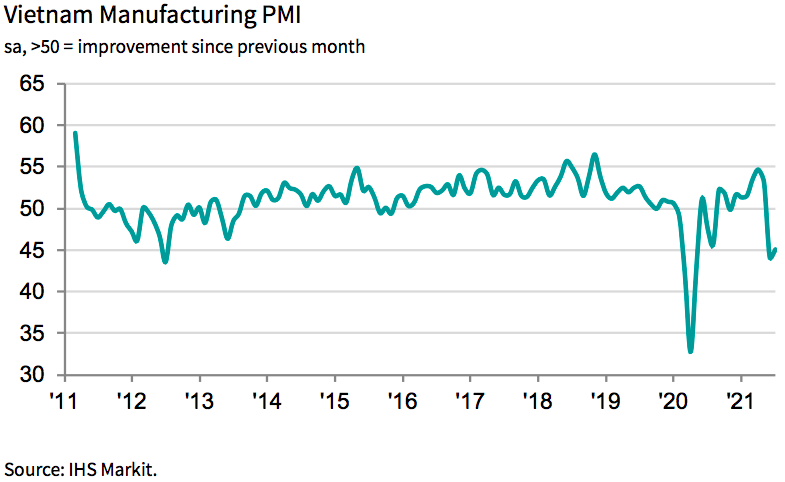

The Vietnam Manufacturing Purchasing Managers' Index™ (PMI) ticked up to 45.1 in July from June's reading of 44.1, which, however, signaled deterioration in business conditions across the sector for the second month in a row, according to Nikkei and IHS Markit.

| Production at New Wing Interconnect Technology in compliance with Covid-19 countermeasures in Van Trung Industrial Park. Photo: Minh Linh |

A reading below the 50 neutral marks indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

“The current wave of the Covid-19 pandemic is having a severe impact on Vietnamese manufacturers, with company closures and social distancing contributing to a steep drop off in production. Rules are also limiting how many staff members can be on-site at any time, further disrupting production lines,” stated Andrew Harker, economics director at IHS Markit.

"The sector is likely to remain under pressure and struggle to generate growth until the outbreak can be brought under control, so it will be important to keep watching the Covid-19 case numbers for signs of improvement," he noted.

According to the report, the current outbreak in Vietnam led to further disruption across the manufacturing sector during July.

Anecdotal evidence from manufacturers highlighted the impact that the latest Covid-19 outbreak has had on operations. Some firms have been forced to close temporarily, while others are having to operate with reduced capacity due to social distancing measures.

These effects, alongside a marked drop in new orders, resulted in a further sharp reduction in manufacturing production at the start of the third quarter. The decline in output was softer only than those seen following the initial outbreak of the Covid-19 pandemic in March and April last year.

Alongside lower total new orders, new business from abroad was also down. That said, the reduction in exports was softer than that seen for the total number of new businesses amid some reports of improving demand in international markets. Lower workloads, temporary closures, and limits on staff numbers due to social distancing requirements meant that employment decreased markedly for the second month running. While disruption to operations led to backlogs of work to build up at some firms, this was outweighed by a sharp drop in new orders. Overall, outstanding business decreased moderately.

Severe disruption to supply chains was noted in July, with the extent of delivery delays the most marked since the survey began more than a decade ago. Panelists linked longer lead times to difficulties with transportation both domestically and internationally due to the pandemic, as well as raw material shortages.

Manufacturers were also faced with surging input costs. The rate of input price inflation accelerated to the fastest since April 2011. Higher costs for raw materials such as iron and steel, products imported from China, and freight charges were all reported by respondents.

While some firms passed on these higher cost burdens to clients, others were reluctant to do so given a weak demand environment. As a result, the rate of output price inflation was much softer than that seen for input costs, suggesting pressure on profit margins.

Concerns around the ongoing impact of the pandemic meant that business confidence remained below the series average in July, although firms remained optimistic overall of output growth over the coming year.