Corporate bond issuance almost triples in H1

Institutions purchasing corporate bonds in the primary market accounted for 94.8% of the issuance volume, with credit institutions (53.5%) and securities companies (21.9%) being the main buyers.

More than 40 companies issued privately placed bonds worth VND110.2 trillion (US$4.7 billion) in the first half of the year, 2.6 times more than the same period in 2023, according to the Ministry of Finance (MoF).

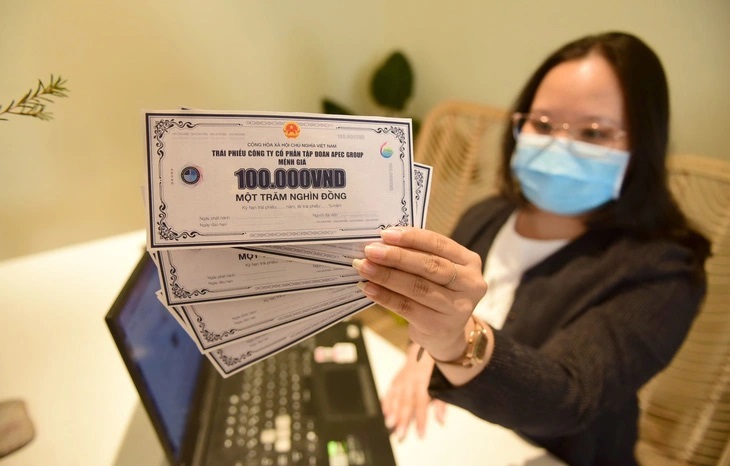

| Vietnam's bond market has been growing over the years. Photo: Ngoc Phuong/The Hanoi Times |

A June report from the ministry shows that out of the total, credit institutions accounted for 63.2% with VND69.6 trillion ($3 billion). Real estate companies made up 28.6% with VND31.5 trillion ($1.3 billion).

Regarding the investor structure, institutions purchasing corporate bonds in the primary market accounted for 94.8% of the issuance volume, with credit institutions (53.5%) and securities companies (21.9%) being the main buyers. Retail investors purchased about 5.2%.

The report also indicates that the average interest rate of the bonds issued was 7.41% per year, with an average maturity of 3.78 years. Additionally, 14.5% of the bonds issued were collateralized. However, the financial obligations of these companies to bondholders remain challenging. The MoF reports that issuers repurchased approximately VND59.8 trillion ($2.5 billion) of bonds in the first half of the year, a 39% decrease from the same period in 2023.

Earlier, a report by credit rating agency VIS Ratings also showed that the market-wide delinquency rate was 16.1% at the end of May, up 1% from the end of 2023. The agency estimates that around 30% of the bonds maturing in June are at high risk of defaulting on principal payments, with most having already missed interest payments previously.

Faced with high repayment pressure, many companies are actively negotiating with bondholders for deferrals. VNDirect estimates that by May 29, more than 90 issuers had reached agreements to extend bond maturities, with a total extended value of over VND144 trillion ($6.2 billion).

Additionally, some companies have opted to swap bonds for other assets, usually real estate in the case of property companies. They are also negotiating with bondholders to reduce interest rates and extend interest payment periods.

Even companies that have not yet defaulted are under significant payment pressure. According to the Vietnam Bond Market Association (VBMA), approximately VND140 trillion ($6 billion) in bonds are set to mature in the second half of 2024, with real estate bonds accounting for nearly VND59 trillion ($2.5 billion), or 42% of the total.

Going forward, the MoF said it will continue to monitor the corporate bond market, especially macroeconomic policies and the real estate market recovery.

The ministry stated that along with appropriate credit growth, measures to ensure transparency and improve the quality of corporate bonds will help the market regulate itself, prevent policy abuse, and promote safer and more sustainable development.

Additionally, the authorities will refine legal regulations, study policies to encourage credit rating, develop a roadmap to upgrade the stock market and enhance the institutional investor system. They also plan to increase resources and personnel for the inspection and supervisory agencies of the State Securities Commission of Vietnam and the State Bank of Vietnam.

ADB’s latest Asian Bond Monitor report showed that Vietnam’s local currency bond market rebounded to a 7.7% quarterly uptick in the second quarter, driven by increased issuances from the Government and the SBV’s resumption of central bank bills issuance in March. Treasury and other government bonds grew 3.3% from the last quarter to support the government’s funding requirements. Corporate bonds contracted 0.9% due to a large number of maturities and a low volume of issuance. The country's sustainable bond market reached a size of $800 million at the end of March. The market is made up of green bonds and sustainable bond instruments issued exclusively by corporates and mostly with short-term tenors. Government bond yields rose by an average of 56 basis points across all maturities on rising domestic inflation and the US Federal Reserve’s delay in cutting its policy rate. Vietnam’s year-on-year consumer price inflation inched up to 4.44% in May, edging closer to the government’s ceiling of 4.50%. |