EuroCham's business confidence its seven-year high as Vietnamese economy's outlook strengthens

European business confidence in Vietnam surged in late 2025, with EuroCham’s Business Confidence Index reaching its highest level in seven years, reflecting stronger performance, improving outlooks and sustained optimism despite global uncertainties.

THE HANOI TIMES — Vietnam’s Business Confidence Index (BCI) reached its highest level in seven years last year, signaling a clear shift in European sentiment, according to the latest report by the European Chamber of Commerce in Vietnam (EuroCham).

The index climbed to 80.0 points in Q4/2025, marking a return to solid confidence after nearly a decade shaped by disruptions, volatility and prolonged neutrality. The rebound came even as global trade tensions and geopolitical risks persisted.

Workers at May 10 Corporation's factory in Hanoi. Photo: Khac Kien/The Hanoi Times

The increase ranks among the strongest upward moves since the BCI launched in 2011, reflecting broad gains in current business conditions and future expectations.

In the past quarter, 65% of respondents rated their current business situation as positive, while 69% expressed confidence in their outlook for the first quarter of 2026.

Actual performance exceeded earlier expectations. Only 56% of respondents anticipated favorable conditions for Q4/2025 when surveyed in the previous quarter, yet the realized figure reached 65%, signaling stronger-than-expected results.

Beyond short-term gains, the survey points to robust medium-term confidence. A total of 88% of respondents expressed optimism about their organization’s prospects in Vietnam during 2026-2030, including 31% who described themselves as very optimistic.

EuroCham Chairman Bruno Jaspaert said the figure reflects rational confidence, noting that Vietnam could enter a golden phase of growth and transformation over the next five to seven years if it sustains the right policy direction.

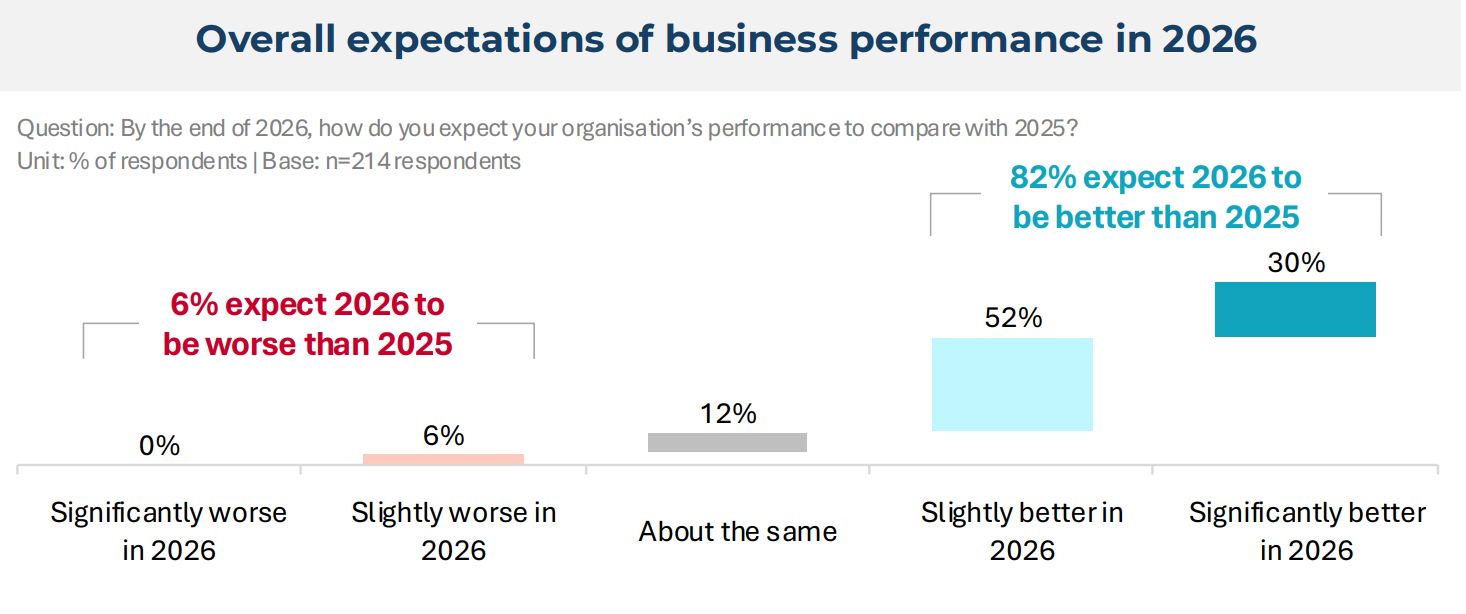

Recent performance trends support this view. About 60% of companies reported improved business results in 2025 compared with the previous year, while 82% expect further gains over the next 12 months, indicating confidence that momentum will carry forward.

Vietnam’s investment appeal also shows in strong peer endorsement. Nearly 87% of respondents said they would recommend Vietnam to other foreign businesses, with confidence highest among large employers that have built substantial operations in the country.

As confidence builds, European firms enter 2026 with clear priorities. Business development and portfolio diversification top the agenda, cited by 50% of respondents.

Talent follows closely, with 45% prioritizing recruitment and retention, reflecting ongoing pressure on skilled labor supply and the central role of human capital in sustaining growth.

Meanwhile, 41% highlighted greater use of technology, automation and artificial intelligence, signaling a parallel focus on efficiency, productivity and long-term competitiveness.

While companies continue to face challenges, particularly administrative complexity and global volatility, the data shows that Vietnam’s growth momentum, reform path and investment fundamentals continue to underpin strong optimism.

As 2026 approaches, businesses move forward with measured confidence, supported by performance data, reforms under way and a growing belief that Vietnam plays an increasingly central role in their long-term strategies.

Administrative complexity remains major challenge

Administrative complexity and regulatory inconsistency remain the most cited challenges, though Q4 data points to improvement, the report says.

A chart shows improved sentiment among foreign investors in Vietnam. Source: EuroCham

About 53% of respondents flagged administrative burdens as a key concern, down 12 percentage points from the previous quarter.

Other frictions include unclear or inconsistently applied regulations, cited by 52%, followed by customs procedures, trade barriers and visa or work permit constraints, each mentioned by roughly one-third of respondents.

These issues most often lead to operational delays or uncertainty, reported by 59% of businesses, followed by higher compliance costs at 31% and productivity losses from diverted resources at 20%.

Recent reform efforts are beginning to show results, although their impact remains uneven. The Politburo’s Resolution 68, issued in May 2025, has drawn positive reactions in principle, though tangible effects continue to unfold.

The resolution aims to strengthen the private sector by cutting bureaucracy, expanding digital procedures, shifting from pre-approval to post-audit regulation and reinforcing fair competition safeguards.

Businesses broadly support this direction but continue to call for clearer and more consistent implementation.

By Q4/2025, 25% of respondents reported some improvement in their operating environment, including 8% citing major progress. Meanwhile, 61% saw no clear change, reflecting the early stage of implementation, while 5% reported new difficulties.

Digital reforms show a similar pattern. The rollout of VNeID signals progress alongside persistent challenges. By the end of 2025, 76% of respondents had completed enterprise registration, reflecting broad adoption after its mandatory launch in July 2025.

However, around 24% of businesses still face obstacles, highlighting the need for greater flexibility and targeted support for foreign-invested enterprises as implementation continues.