Facebook, Google to be required to pay tax in Vietnam

Foreign digital content providers in Vietnam have some payment options.

Facebook and Google are likely required to pay tax in Vietnam after years of operations in the country without fulfilling their tax obligation as claimed by the Vietnamese government.

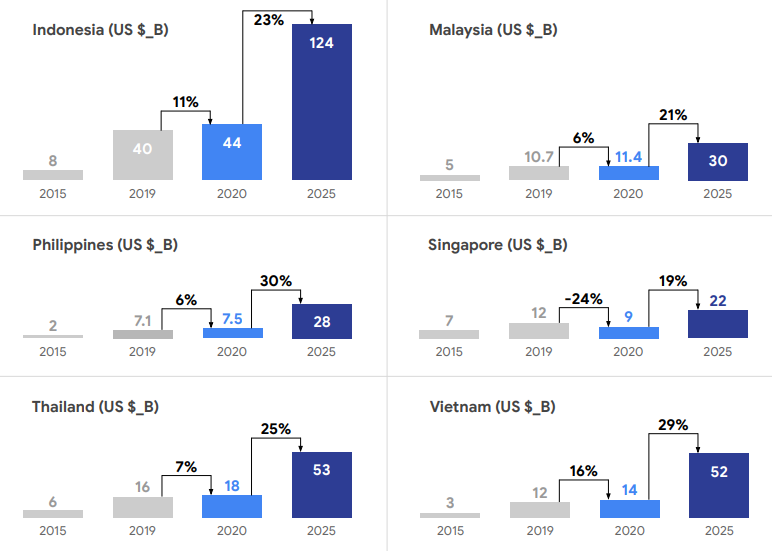

Percentage of new digital consumers out of total service consumers in Southeast Asia countries. Source: Google, Temasek, Bain & Company |

The foreign digital content providers might make tax payment online via taxation department’s portal or through authorized agents following the Ministry of Finance’s Draft Circular, which is made available for public consultation.

Under Vietnamese rules, foreign firms, which have no fixed business facilities in Vietnam but provide e-commerce services and digital-based business with local partner, are regarded as having residential offices in Vietnam.

Accordingly, Facebook, Google, or Netflix are subject to the new regulation.

With the new regulation, tax agency will provide tax code and payment options, including direct payment or via authorized agents to foreign taxpayers.

So far, a number of foreign e-commerce providers and technology firms working in Vietnam like Facebook, Amazon, YouTube, Netflix (the US), iflix (Malaysia), WeTV, iQiYi, Alibaba (China) make good profit worth billion dollars.

Speaking at an interpellation at the National Assembly in November 2020, Vietnam’s Minister of Information and Communications (MIC) Nguyen Manh Hung said Google, Amazon, Facebook, and Apple earned billions of dollars in Vietnam but paid no tax.

The situation has prompted some actions by the MIC and the Ministry of Finance.

Vietnam’s Internet economy is expected to reach US$14 billion in 2020 and likely US$52 billion by 2025 with a 29% compound annual growth rate (CAGR), according to the “e-Conomy SEA 2020” report by Google, Temasek, Bain & Company.

| "Vietnam’s digital economy is expected to post a 29% compound annual growth rate (CAGR) through 2025. Source: Google, Temasek, Bain & Company". Source: Google, Temasek, Bain & Company |