Fitch Solutions revises up Vietnam GDP growth forecast in 2020 to 3%

Vietnamese economy’s resilience, the government’s capable handling of the pandemic, and it being a beneficiary of supply chain relocation could help the country rebound quicker versus the region.

Fitch Solutions, a subsidiary of Fitch Group, has revised up its 2020 real GDP growth forecast for Vietnam to 3% from 2.8% previously.

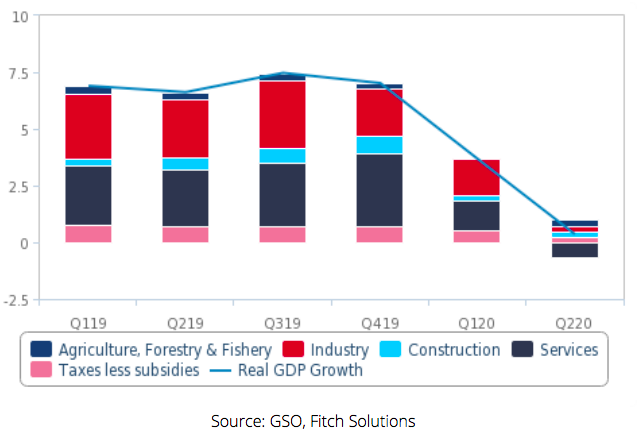

The country’s General Statistics Office (GSO) estimated real GDP to have grown by 0.4% year-on-year (y-o-y) in the second quarter, its weakest print since the series began in 2000, marking a further slowdown from a revised 3.7% y-o-y in the first quarter.

Worst Likely Over Vietnam – Real GDP By Production, pp contribution to y-o-y growth |

The slowdown in the second quarter was expected, given that stringent Covid-19 containment measures were implemented during the month of April.

As a result, Vietnam’s real GDP growth in the first half of the year was thus estimated at 1.8% y-o-y. Growth during the second quarter was mainly dragged down by a sharp slowdown in manufacturing growth and a contraction in services.

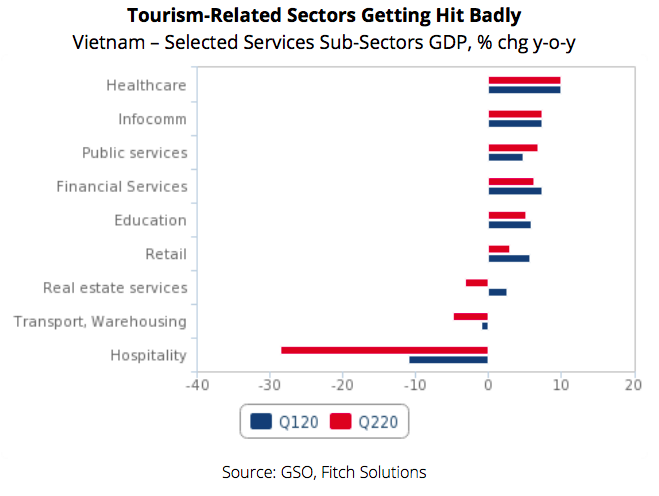

Given that Vietnam appears to have contained the Covid-19 pandemic domestically, Fitch Solutions expected manufacturing and services growth to stage a recovery over the second half of this year. That said, the extent of recovery in manufacturing will be capped by weak external demand in a global recession, while a controlled reopening of borders only to ‘foreign experts, high level workers and investors’, according to a statement from Prime Minister Nguyen Xuan Phuc on June 25, will continue to hamper a recovery in tourism related services such as retail, accommodation and catering (i.e. hospitality), and transport.

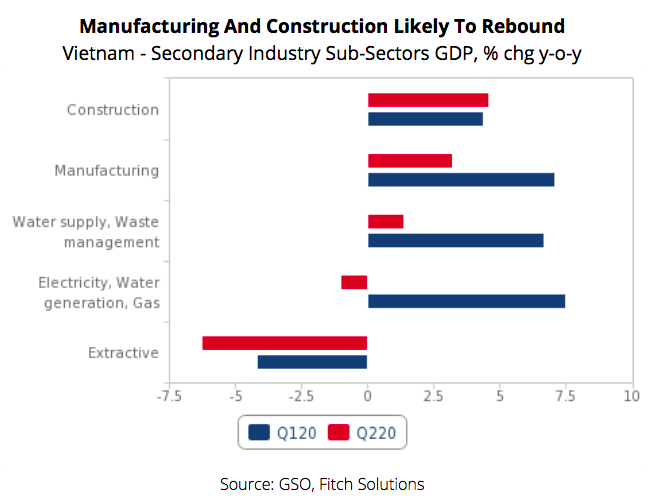

Fitch Solutions also expected growth of the ‘industrial and construction’ (secondary) sector, which account for about 35% of GDP, to recover somewhat over the second half of this year. Growth of the industrial sector slowed significantly in second quarter to 0.7% y-o-y, from 5.1% y-o-y in the previous ones.

Meanwhile, growth of manufacturing, the largest sub-sector at 17% of GDP, slowed to 3.2% y-o-y, from 7.1% y-o-y in the first quarter as activity stalled due to Vietnam’s movement restrictions in April. With Vietnam’s restrictions having been lifted, it is expected manufacturing growth to recover over the second half of the year.

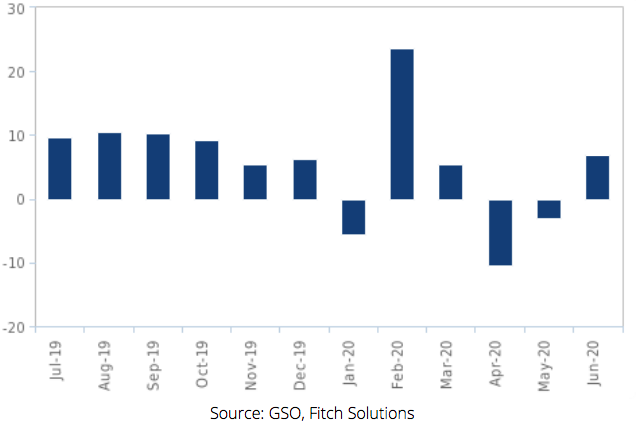

Normalising Post-Lockdown In April Vietnam – Industrial Production, % chg y-o-y. |

Indeed, industrial production growth trends already indicate a sharp recovery underway and are set to be sustained over the remaining period of the year. In particular, the EU-Vietnam Free Trade Agreement (EVFTA), which will come into effect in August 2020, is predicted to deliver a boost to export manufacturing activity.

Vietnam’s manufacturing sector will also gradually receive support from companies relocating from China and around the region. That said, weakened external demand amid a global recession will cap the extent of Vietnam’s manufacturing activity rebound. Construction growth remained steady at 4.6% y-o-y in the second quarter, versus 4.2% y-o-y in the first ones and Fitch Solutions expected a ramping up of the government’s public infrastructure drive to aid the sector over the second half.

In June, Vietnam’s National Assembly approved a change in the financing method for three sub-projects under the Eastern North-South expressway project from public-private partnership (PPP) to public investment, likely intended to expedite these projects.

Fitch Solutions expected services (42% of GDP) growth to also recover somewhat over the second half. The services sector contracted by 1.8% y-o-y in the second quarter, weakening further from 3.3% y-o-y in the first quarter. This was mainly due to domestic movement restrictions in April and a collapse in tourism during the quarter affecting retail, hospitality, and transport and warehousing services. Given that tourism accounts for 9.2% of GDP, continued border closures to international tourists will see these three tourism-related sub-sectors (17% of GDP combined) suffer steep yo-y declines.

Income losses due to the Covid-19 economic shock will also see consumers tighten their purse strings, which would also hamper a recovery in these sub-sectors. That said, an increase in domestic tourism in light of ongoing limitations on international leisure travel and consumer worries of contagion in the absence of a Covid-19 vaccine should help to cushion the loss in business for these sectors.

Finally, Fitch Solutions expected growth of the ‘agriculture, forestry, and fishing’ sector (14% of GDP) to remain fairly stable and weak, thus providing no real thrust to headline growth. The sector as a whole grew by 1.7% y-o-y in the second quarter, up from 0% in the first ones.