Foreign investors call for greater flexibility in Vietnam's upcoming PPP law

A lack of a unified legal framework governing PPP is the main factor that Vietnam’s infrastructure sector growth potential is capped at 6.1% per year through 2029.

There may be concern that an open and flexible public-private partnership (PPP) law may lead to policy abuses, but on the contrast, limited investor protection to a greater extent can be disincentive to “good investors”, according to Toru Aguin, chief representative of Japan Bank for International Cooperation (JBIC) in Vietnam.

| Overview of the online conference. Source: IPS. |

More flexibility in PPP law needed

As the Covid-19 pandemic has led to growing global uncertainties, foreign investments are becoming risk-averse and may slowdown, Aguin said at an online conference discussing the prospect of Vietnam’s upcoming PPP law on May 13.

| Toru Aguin, Chief Representative in Vietnam of Japan Bank for International Cooperation (JBIC). Source: IPS. |

“In this context, for Vietnam to develop quality PPP infrastructure, it is essential to develop a legal environment which more than ever responds to the expectations and concerns of foreign investors,” Aguin suggested.

Referring to recent estimation made by the Economic Commission of the Party's Central Committee that Vietnam would need US$15 billion annually for energy investments, Aguin said he has “high hopes” for the PPP, especially as national budget is limited and cannot afford such a huge amount.

Aguin recommended the PPP law to provide appropriate support from the government, saying this is essential for foreign investors and lenders to see high predictability and stability of PPP business in the long run.

This would include guarantees for contractual performance and foreign currency convertibility, as well as proper recognition of the Step-in Right of foreign lenders in case of emergency as a security holder.

Moreover, every single PPP project is different. Therefore, the law should leave room for parties’ agreement on a project-by-project basis, he said.

On this issue, Nguyen Thanh Hai, lawyer at Baker McKenzie, said investors expressed concern over risk sharing mechanism and project’s financial feasibility.

“The law should allow greater flexibility for investors during the contract negotiation process. The government should have a long-term vision of 10 years or more”, Hai said.

| Managing Director of KIND in Vietnam Park Jae Hyun. Source: IPS. |

Managing Director of Korea Overseas Infrastructure and Urban Development (KIND) in Vietnam Park Jae Hyun said while it is clear that the government should share risks with investors in public projects, the government should reconsider the risk sharing mechanism in terms of revenue.

Park said the government should raise the threshold to trigger risk sharing mechanism when the actual revenue is equal to 90% of the financial plan, instead of 75% as in the current draft law.

Efficient PPP law to boost economic growth

Regarding suggestions from foreign businesses and investors, Chairman of the Vietnam Chamber of Commerce and Industry (VCCI) Vu Tien Loc said the government expects the PPP law to create breakthrough in Vietnam’s infrastructure development, otherwise, Vietnam would fail to attract high quality foreign capital inflows.

As the country is further integrating in global economy, a well-developed legal environment would make an investment destination more attractive than the others, Loc stressed.

Loc agreed with previous opinions there should be clear details in the law to ensure mutual benefits, as well as risk sharing between all parties involved.

According to Loc, PPP mechanism should be expanded to other fields of energy and public services, and not only limited to transportation infrastructure, a move Loc said would help utilize experience and expertise of private investors.

Loc noted as government agencies are still struggling to disburse the target amount of US$30 billion in public investment, partly due to complicated administrative procedures.

“It is essential for Vietnam to avoid a similar situation in drafting the PPP law, so that more resources are utilized in the most efficient way and lay the foundation for stronger economic growth,” Loc urged.

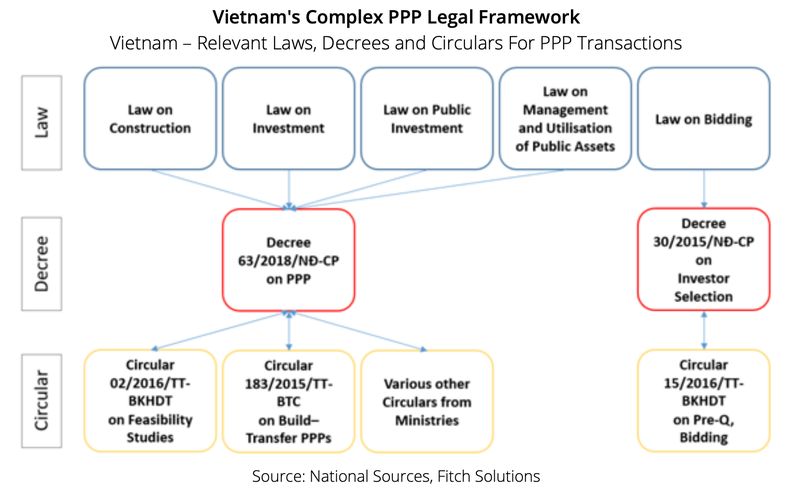

There is currently an absence of a unified legal framework governing PPP in Vietnam similar to that seen in some of its regional peers (e.g. the Philippines, Thailand).

Instead, there are provisions covering PPP dispersed in other pieces of legislature, such as the Law on Investment, Law on Construction and the Law on Bidding, continues to government directives on PPPs alongside Decree 63. As such, in a bid to further improve the current PPP framework, the Standing Committee of the National Assembly had passed a resolution for the creation of a PPP law back in 2017.

While certain types of government guarantees are provided for through various laws and decrees, the inadequacy of these guarantees and the lack of clarity of related articles and provisions have been a common stumbling block for foreign participation in Vietnamese PPPs.

Furthermore, there is no guarantee for project revenues, considered a major financial risk for investors and a key issue which is currently being addressed by the implementation of the new PPP law.

Fitch Solutions, a subsidiary of Fitch Group, said a lack of a unified PPP legal framework is the main factor that Vietnam’s infrastructure sector growth potential is capped at 6.1% per year through 2029, despite having one of the fastest growing economies in the world.

Fitch forecast Vietnam’s economy to grow at an average of 6.4% year-on-year in real terms over the next decade through 2029, as it emerges as a choice for manufacturing hub and continues to attract foreign direct investments.

“A comprehensive PPP law is currently being crafted and discussed in Parliament. When passed, we believe the law will reduce project risk and be a boost to growth of Vietnam’s PPP market,” stated Fitch.

.jpg)