Hanoi sees capital surge despite fewer new firms in May

Business optimism remains strong in the capital, as investors continue to inject more funds into a select number of startups.

THE HANOI TIMES — Hanoi recorded a sharp rise in newly registered business capital in May, even as the number of new firms fell, making an uneven recovery and continued strain on smaller enterprises.

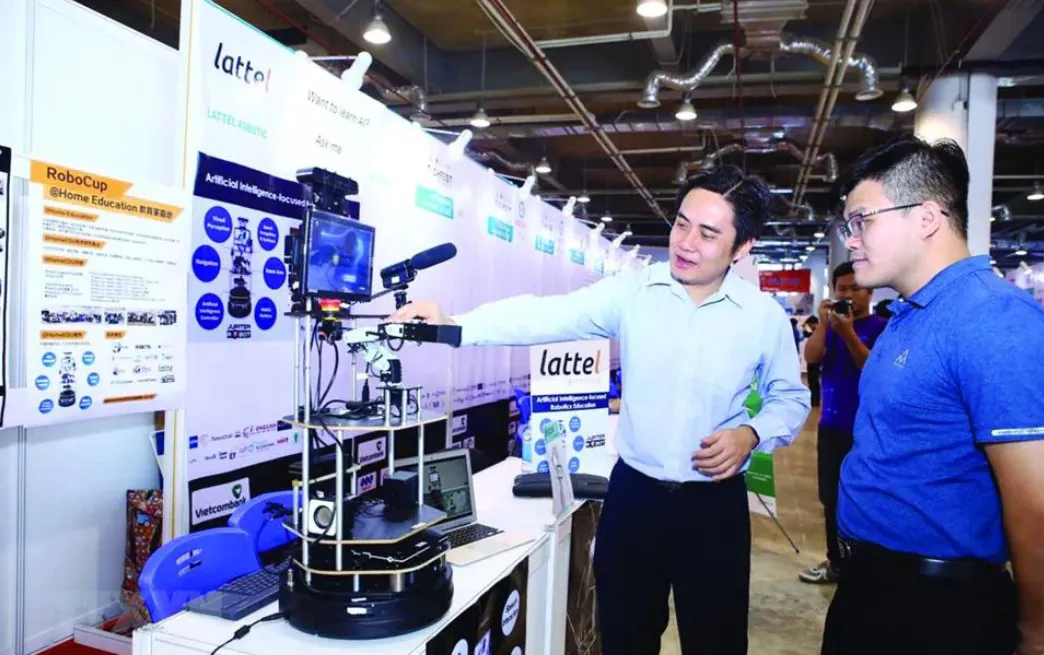

Startup founder presents product at Hanoi event. Photo: Minh Quyet/The Hanoi Times

New business registrations dropped nearly 20% year-on-year to 2,283, according to the city’s Department of Planning and Investment. Yet total registered capital surged 53.3% to over $1.3 billion, signaling a shift toward larger or better-capitalized ventures.

About 700 firms resumed operations during the month, up 13.6% from a year earlier. However, the business environment remains volatile, as 1,489 firms temporarily suspended operations, and 399 were officially dissolved, suggesting that operational costs and market uncertainty continue to take a toll.

In the first five months of this year, Hanoi logged 11,600 new enterprises with a total capital of $4.17 billion, down 7.2% and 9.7%, respectively, from the same period last year. Business closures jumped 26.6%, highlighting the vulnerability of small and medium-sized enterprises (SMEs) to rising input costs, weak domestic demand, and limited financial resources.

The State Bank of Vietnam kept policy rates steady in May and instructed commercial lenders to lower borrowing costs. Short-term loans to priority sectors averaged 3.9%, below the 4% cap, aiming to ease the financial burden on struggling producers.

As of May 31, total deposits in credit institutions reached $245 billion, up 3.51% from the end of 2024. Outstanding loans stood at $191 billion, marking an 8.32% year-to-date increase, with short-term credit expanding 10.51%. These figures indicate stronger financial support for short-cycle production and business needs.

Priority sectors, including SMEs, agriculture, exports, supporting industries, and high-tech applications, continue to receive targeted credit allocations as part of national efforts to stimulate industrial resilience and innovation-driven growth.

Nevertheless, businesses report persistent challenges. High input costs, mounting debt, slow consumer spending, and complex lending procedures continue to impede recovery efforts, particularly for smaller firms with limited capital reserves.

Business associations have proposed policies to streamline loan processes, expand preferential credit programs, boost technical and digital transformation support, and improve labor-market matching to better align workforce skills with business demands.

Hanoi authorities have reaffirmed their commitment to fostering long-term enterprise growth by creating a transparent, stable investment climate and removing institutional bottlenecks.