NA Chairman calls for Samsung to invest in semiconductor business in Vietnam

Vietnam prioritizes protecting the legitimate interests of both domestic and foreign investors, especially strategic investors.

Samsung should consider investing in semiconductor technology R&D activities in Vietnam, Chairman of the National Assembly Vuong Dinh Hue made the request during a meeting with the tech giant’s President and CFO Park Hark Kyu on February 28.

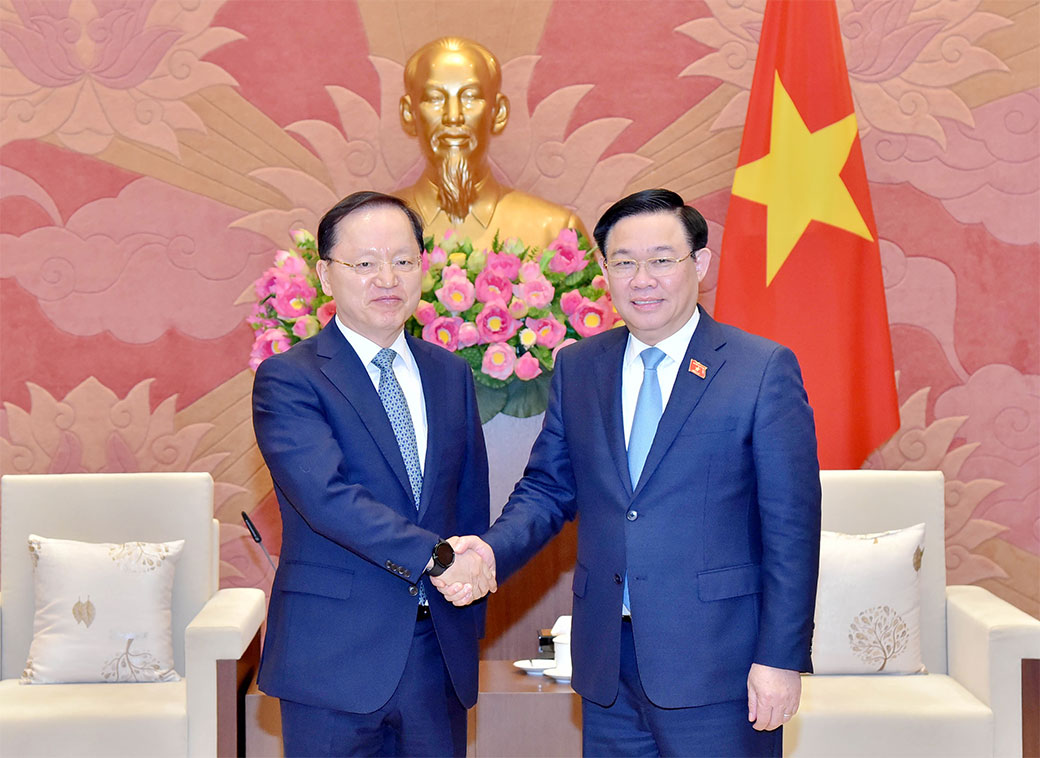

National Assembly Chairman Vuong Dinh Hue (r) and Samsung's President and CFO President and CFO Park Hark Kyu. Photos: Dai bieu nhan dan |

At the meeting, Samsung’s representative emphasized the importance of the "Comprehensive Strategic Partnership" between Vietnam and South Korea, effective from December 2022.

He acknowledged that the relationship between the two countries has grown closer through various activities such as political, economic, and cultural exchanges.

Park added that Samsung Vietnam's achievements over the past 15 years have played a crucial role in the Samsung Group's global success, and thanked the National Assembly, the Vietnamese Government and local leaders for their support.

He shared that Samsung Vietnam achieved an impressive export turnover of approximately US$65 billion in 2022, with a cumulative investment of around $20 billion in Vietnam.

Park also highlighted the inauguration of Samsung's $220 million R&D Center in Vietnam and emphasized Samsung's commitment to making it a global development center.

Samsung is currently the largest foreign-invested enterprise in Vietnam, and it will continue to make every effort to maintain that position, he added.

Chairman Hue assured Park that the Vietnamese National Assembly and Government prioritize protecting the legitimate interests of both domestic and foreign investors, especially strategic investors, saying that the difficulties and obstacles Samsung faced when investing in Vietnam have been addressed and resolved.

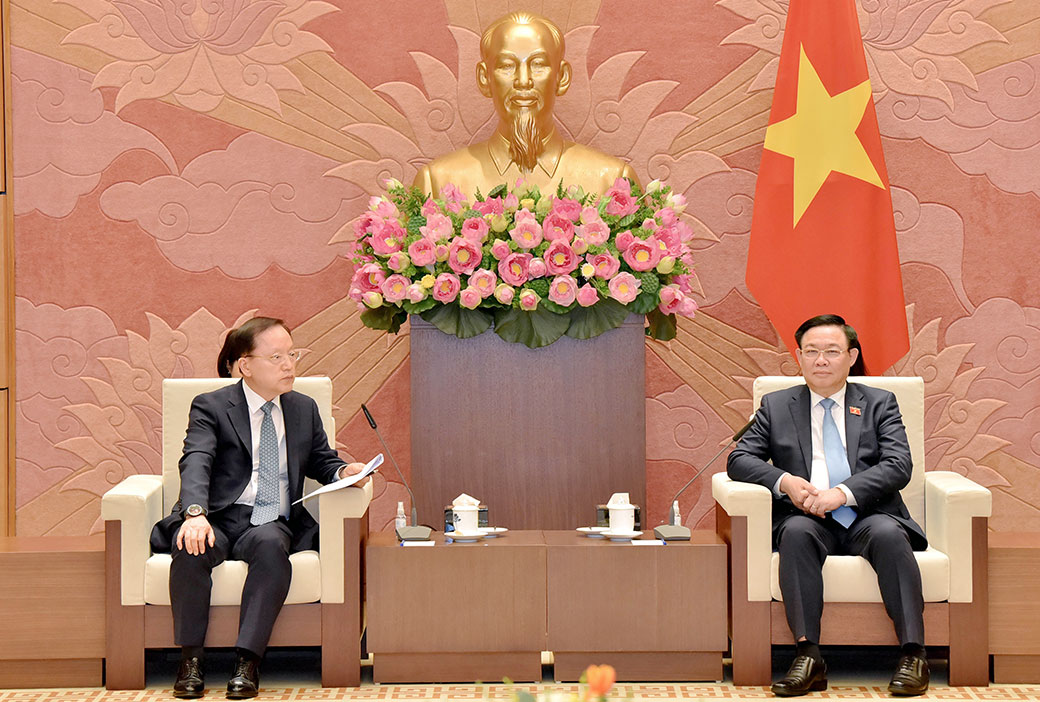

| Overview of the meeting. |

He expressed interest in developing supporting industries within the Samsung ecosystem in Vietnam and commended the timely completion of the R&D Center construction in Hanoi.

The Chairman expected Samsung to continue making long-term investments in Vietnam and affirmed that the Vietnamese National Assembly and Government are committed to improving the business and investment environment, enhancing competitiveness, and creating the most favorable conditions for investors to operate in a long term and sustainable manner.

During the meeting, the two sides discussed the application of the Organization for Economic Cooperation and Development (OECD) global minimum tax rate and its impacts on the current international tax system.

Hue highlighted that the global minimum tax rate is an important international issue that has far-reaching impacts. He emphasized that Vietnam is committed to complying with international regulations, including the OECD's global minimum tax regulations, to ensure transparency, openness, and fairness.

While protecting the interests of multinationals, the interests of small investors must also be taken into account, as well as the legitimate interests of both the state and investors, Hue said. He also stressed the importance of not passing on to the Vietnamese government the risk of contravening the regulations on global minimum taxation and that the legal provisions in this regard are simple and easy to apply.

The National Assembly Standing Committee is interested in this issue and has directed relevant agencies to report to the National Assembly. The Government has established a Special Working Group to study and propose solutions related to the OECD's global minimum tax rate, with a particular focus on amending the Corporate Income Tax Law, Hue said.