Over 65% Vietnam logistics firms expect low revenue in 2020 on Covid-19

It is estimated that 20-30% of the volume and revenue of Vietnamese shipping lines are generated from the Chinese market.

A survey conducted by the Vietnam Logistics Business Association (VLA) revealed about 15% of logistics firms expected that revenue will plunge by 50% compared to 2019, while more than half of them estimated the number of logistics services to drop by 10 – 30% year-on-year as a result of the Covid-19 epidemic.

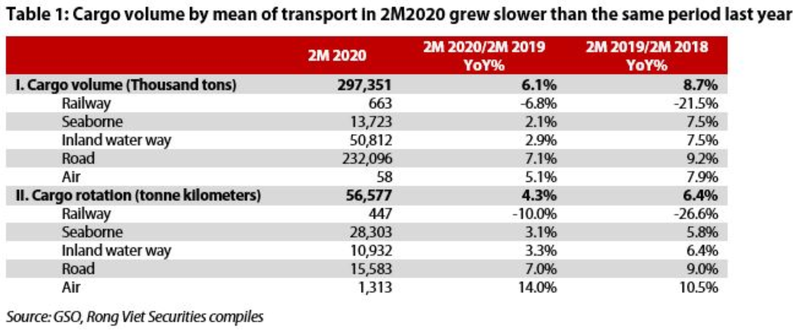

Viet Dragon Securities Company (VDSC) cited VLA’s assessment that freight operations will be affected by a decline of cargo volume caused by the suspension of factories in China.

Since the outbreak of the Covid-19 epidemic, manufacturing activity in China has been stagnant, leading to low output and export volume. This, together with other factors, has forced many international container lines to cancel vessel calls at several Chinese ports.

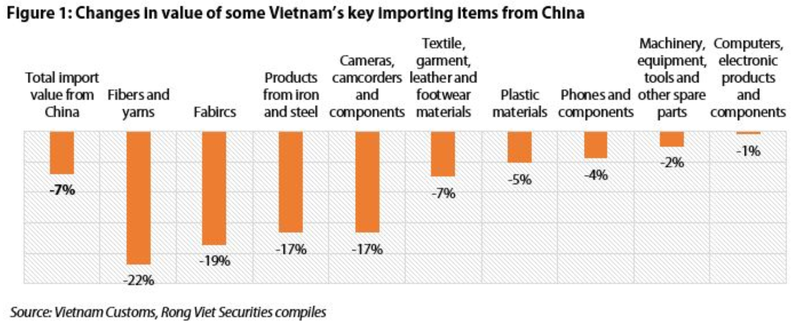

Some items that Vietnam imported from China suffered from these factors, such as fabric, yarn, iron and steel, and witnessed a sharp decline in terms of value in the two-month period. Meanwhile, goods that are often transported by air such as phones, computers, machinery and equipment experienced a lower reduction. This is due to the still normal operation of cargo flights although many passenger flights to/from China have been suspended. In total, the value of Vietnam's imports from China has declined by 7% in the first two months of 2020.

Moreover, as most of these are intermediate goods which are processed for export purpose, a prolonged epidemic could hurt Vietnam's exports to other markets, indirectly affecting logistics demand, said VDSC.

Shipping, port operations to be affected in short term

Vietnam's fleet mainly operates on short-haul routes in Southeast Asia and Northeast Asia, in which Chinese market accounts for a significant portion, VDSC's report said.

Approximately, 20-30% of the volume and revenue of Vietnamese shipping lines are generated from Chinese market. Therefore, shipping companies' revenue is likely to drop in the first quarter of 2020 when transport volume related to this market is forecast to drop sharply in the near term.

Similarly, many Vietnamese seaports also have a relatively large degree of dependence on import/export cargo related to the Chinese markets, including Hong Kong and Taiwan. In Hai Phong, for example, it is estimated that the number of vessels coming from the Northeast Asian markets accounts for 40-45% of the total number of international ship arrivals. With the low-level operation of ports in China due to the lack of workers, along with protracted loading/unloading time as ships are put under strict inspection from Chinese authorities, many major shipping lines have cut capacity at Chinese ports, leading to a reduction in container throughput in Vietnamese ports.

This resulted in the number of container throughput of Hai Phong ports could fall by 10-15% in the two-month period of 2020.