Top 10 public firms in Vietnam post market cap of US$88 billion

Nine out of the ten largest cap companies continued to lead the classification compared to 2018, but their rankings are now changed.

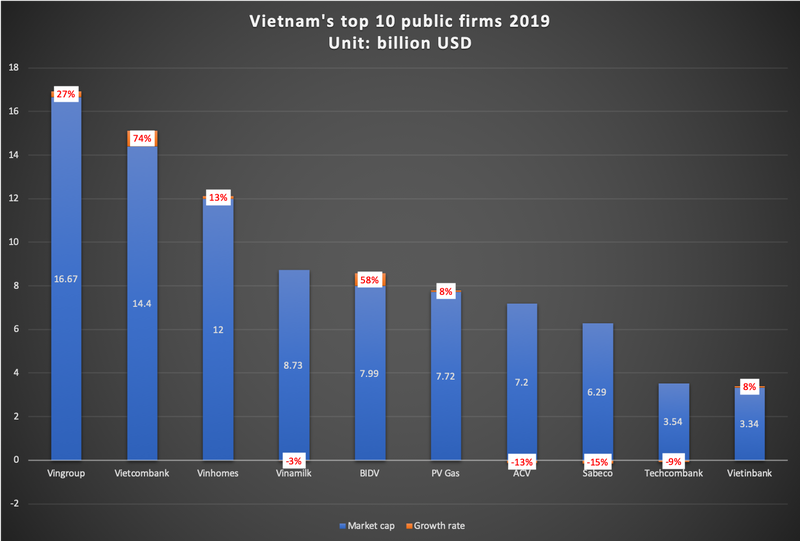

The combined market capitalization of the 10 largest firms in Vietnam’s two major stock exchanges and the Unlisted Public Company Market (UPCoM) is estimated at nearly US$88 billion in 2019, up 16% year-on-year.

Nine out of ten largest firms by market capitalization continued to lead the classification compared to 2018, but their rankings are now changed, VnExpress reported, citing data from FiinGroup.

| Data: Fiingroup. Chart: Hai Yen. |

Vingroup continues to lead the ranking in 2019 with market capitalization of US$16.7 billion, up 27% year-on-year. The firm’s rise was thanks to its share value going up by 21% from VND95,300 (US$4.13) to VND115,000 (US$4.98).

As of the third quarter of 2019, Vingroup’s total assets stood at VND357 trillion (US$15.46 billion), including VND125.4 trillion (US$5.43 billion) in equity.

In 2019, Vingroup went through a major restructuring process by withdrawing completely from the retail business, a move that allowed the conglomerate to reallocate its resources to core businesses, manufacturing and technology, to compete globally.

Vingroup decided to transfer VinCommerce and its farming subsidiary VinEco to Masan Consumer Holdings, the consumer business of Masan, in early December 2019. It later merged ecommerce platform Adayroi, operated by Vingroup’s retail arm VinCommerce, into the conglomerate’s ecosystem VinID and dissolved its electronics retail business VinPro.

Compared to last year’s ranking, state-run Commercial Bank for Foreign Trade of Vietnam (Vietcombank) rose to the second spot while Vinhomes, the property developer of Vingroup, and Vietnam’s largest dairy producer Vinamilk slid down one notch to the third and fourth ones, respectively.

The remaining place in the top 5 belonged to state-run Bank for Investment and Development of Vietnam (BIDV).

The inclusion of two lenders in Vietnam’s top 5 public firms, namely Vietcombank and BIDV, came after a surge in their respective share prices in the remaining months of 2019. Vietcombank shares ended 2018 at VND53,000 (US$2.3) and rose to VND90,000 (US$3.9) as of the end of 2019. BIDV shares climbed nearly 40% in value from VND33,000 (US$1.43) to VND46,000 (US$1.99) apiece during the period.

BIDV’s market capitalization expanded 58% year-on-year in 2019, mainly thanks to South Korea - based KEB Hana Bank’s acquisition of 15% stake in the lender. Following the deal, BIDV’s registered capital went from VND34.18 trillion (US$1.48 billion) to VND40.22 trillion (US$1.74 billion) – the highest in the Vietnamese banking system.

Meanwhile, Vinhomes’ market capitalization increased a modest 13% year-on-year, while that of Vinamilk was down 3%.

In the last half of the ranking, PetroVietnam Gas (PV Gas), Airports Corporation of Vietnam (ACV), Saigon Beer Alcohol and Beverage Corp (Sabeco) and Vietnam Technological and Commercial Joint Stock Bank (Techcombank) were familiar names from last year, with only Vietnam Bank for Industry and Trade (VietinBank) being an exception.

Three out of five in the last half of the ranking did not witness growth in market capitalization compared to 2018, as that of Sabeco, ACV and Techcombank declined by 15%, 13% and 9% year-on-year, respectively.

Sabeco’s share value is among the most expensive in the stock market, but also in the highly volatile group. In early 2019, Sabeco’s shares were around VND250,000 (US$10.83), peaked at VND290,000 (US$12.57) in mid-2019 and later slumped to VND228,000 (US$9.88) in the last four months of 2019.

Both Vietinbank and PV Gas experienced an increase of 8% in market capitalization in 2019. The former’s inclusion in the top 10 was not thanks to its growth in this regard, but due to a sharp decline in market capitalization of Masan Group, the 10th ranked firm in last year’s table.

Masan’s share prices were down from VND80,000 – 90,000 (US$3.47 – 3.90) in the first nine months of 2019 to below VND60,000 (US$2.6) in the last quarter, leading to a decrease in US$1 billion in market capitalization, representing a decrease of 27% year-on-year.