Vietnam business confidence at 22-month high

It was a solid start to the year for the Vietnamese manufacturing sector as firms ramped up output in response to stronger new orders

THE HANOI TIMES — Business optimism among Vietnamese manufacturers continued to strengthen at the start of 2026, reaching its highest level since March 2024, according to S&P Global.

In its latest Vietnam Manufacturing PMI report, S&P Global said 55% of surveyed firms expect output to rise over the next 12 months. Companies cited sustained growth in new orders and improving market conditions as key drivers of confidence.

Production expanded at a faster pace in January alongside continued growth in new orders, reinforcing positive expectations for the year ahead. Stronger output needs have also led firms to step up hiring and purchasing activity.

Inflationary pressures, however, remained elevated. Manufacturing selling prices rose at the fastest pace since April 2022 as higher input costs persisted.

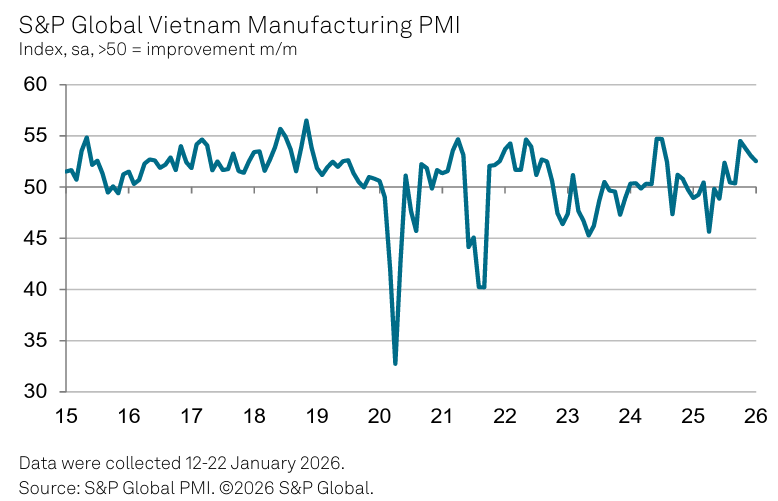

The Vietnam Manufacturing Purchasing Managers’ Index posted 52.5 in January, easing slightly from 53.0 in December but remaining well above the 50.0 threshold that separates expansion from contraction.

This marked the seventh consecutive month of improving business conditions.

“It was a solid start to the year for the Vietnamese manufacturing sector as firms ramped up output in response to stronger new orders,” said Andrew Harker, economic director at S&P Global Market Intelligence.

He added that momentum carried over from late 2025 suggests the sector is well-positioned for a strong 2026.

Manufacturing activity at Quang Minh Industrial Park in Hanoi. Photo: Pham Hung

Harker cautioned that inflation remains a potential risk. Material shortages continued to push up prices in January, prompting firms to raise selling prices further. While demand has so far remained resilient, he noted that new order trends will need close monitoring in the months ahead.

Despite the slight moderation in the headline PMI, manufacturing output rose sharply in January. Survey respondents largely attributed the increase to higher new orders supported by improving customer demand.

Total new business was also lifted by a renewed expansion in export orders, marking the third rise in four months. Some firms reported receiving new orders from other Asian markets, including India.

Employment increased for a fourth consecutive month, with job creation accelerating to its fastest pace since June 2024, although some hiring was reported to be temporary. Purchasing activity also rose for the seventh straight month to meet higher production needs.

Input inventories declined for the first time since September as materials were drawn down to support output growth. Stocks of finished goods also fell at the fastest pace in four months, reflecting timely deliveries to customers.

Manufacturers were generally able to keep workloads under control. Backlogs of work fell for a second month in a row, while suppliers’ delivery times lengthened at the slowest rate in eight months due to strong demand and material shortages.

Higher demand and supply constraints continued to drive up input costs, keeping inflation pressures high. As a result, firms raised selling prices further, with the pace of price increases reaching its fastest level since April 2022.