Vietnam considered as one of the top 10 global investment destinations: EuroCham

Vietnam's business sector is poised for growth in 2024, according to the latest EuroCham survey.

European businesses operating in Vietnam have ranked Vietnam among the top 10 global investment destinations, according to the latest Business Confidence Index (BCI) from EuroCham. The report, conducted by Decision Lab, highlights this expectation with a 62% response rate from surveyed businesses.

The survey noted that among them, 17% placed Vietnam as the top global investment destination. “Vietnam's status as an investment hotspot rose significantly in Q4,” it said. “In line with this strong endorsement, 53% of respondents expect FDI inflows into Vietnam to increase by the end of Q4.”

The survey also highlights Vietnam's strategic location within the ASEAN region. While only a small fraction (2%) consider it an 'industry leader', a significant 29% rank it among the 'most competitive countries' in ASEAN.

Thue Quist Thomasen, CEO of Decision Lab, said Vietnam's long-term economic trajectory suggests a promising path of continued growth.

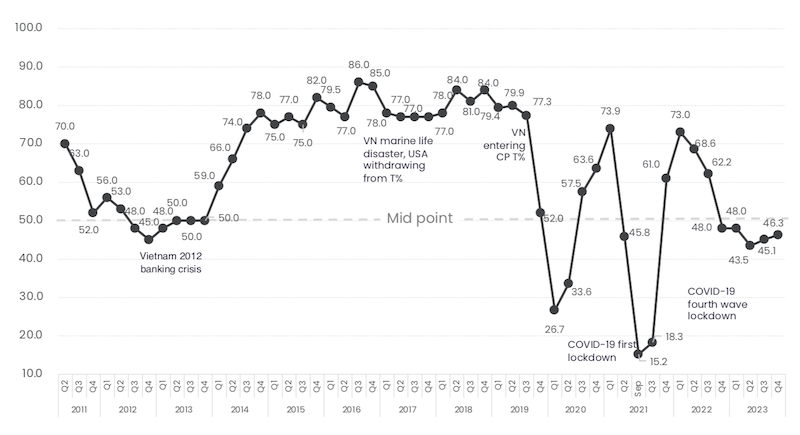

"In the short to medium term, Vietnam is showing its trademark ability to deliver a stable business climate even in turbulent times, as we observe the fifth quarterly reading in the range of 40 to 50 index points. Continued stability and potential improvement in 2024 will underpin the case for further FDI into the country," Thomasen said.

Last year, foreign direct investment reached $36.61 billion, a 32.1% jump from 2022. This is a clear indication of growing confidence in Vietnam's economy.

EuroCham Chairman Gabor Fluit said the BCI is still below the midpoint and more than a third of businesses still expect to underperform.

"Given the intense economic competition in the region, Vietnam should remain vigilant. It's crucial that the country continues to refine its policies and strategies to attract and retain European FDI. One important area to focus on is the simplification of administrative procedures, a well-known obstacle for businesses," he added.

| EuroCham Chairman Gabor Fluit (second from right). Photo: VNA |

European businesses operating in Vietnam are displaying resilience, as indicated by the latest Business Confidence Index (BCI) from the European Chamber of Commerce in Vietnam (EuroCham), conducted by Decision Lab.

The BCI reached 46.3 in Q4 2023, showing signs of gradual stabilization. However, it's important to note that the BCI has remained below the midpoint since Q4 2022. Over one-third of firms expect to underperform, reflecting a cautious outlook due to ongoing market weakness.

EuroCham Chairman Gabor Fluit commented: "There is a positive trend underway. While we are still a long way from a full recovery, businesses are feeling more hopeful. The European business community is increasingly optimistic that the most challenging economic period is behind us."

The last quarter of 2023 saw a significant increase in business satisfaction, with the number of companies confident in their current situation rising from 24% in Q3 2023 to 32% in Q4 2023.

The outlook for Q1 2024 is also positive, with 29% of businesses viewing their prospects as 'excellent' or 'good' - a sign of diminishing concerns, as extreme worries fell from 9% to 5%, according to the BCI report.

The report also found that Vietnam's business sector is poised for growth. Some 31% of companies plan to expand their workforce in Q1 2024, and 34% intend to increase their investments, a clear uptick from 2023. These statistics signal a strong momentum for growth and opportunity as Vietnam enters 2024.

| BCI Q4 2023 |

The survey sheds light on the European business community's nuanced assessment of Vietnam's workforce.

The statistics show that while 32% of respondents recognize good skills in the workforce, this figure suggests that a majority perceive room for improvement in terms of skills and expertise. Similarly, the 24% satisfaction rate with the availability of labor suggests that while there is a pool of talent, it may not be fully aligned with the specific requirements or scale desired by international companies.

| Electronics production at Kefico Vietnam Company in Thang Long Industrial Park, Hanoi. Photo: Hai Linh |

The results also show that 40% of respondents consider Vietnam's workforce moderately competent, indicating a mix of basic and intermediate skills. In addition, 50% rate the availability of the workforce as moderate, reflecting some challenges in finding qualified candidates.

"These results point to the fact that further development and training could improve the skills and availability of the workforce to meet the demands of the global market," the survey emphasized.

The EuroCham Chairman stressed that investment in infrastructure to reduce logistics costs and upgrading workforce skills are equally important. This will help Vietnam remain competitive and maintain its growth trajectory.