Vietnam set to stay among Asia highest growing economies in 2021: HSBC

In 2021, Vietnam is set to benefit from a tech-led recovery, consistent FDI inflows and numerous trade agreements.

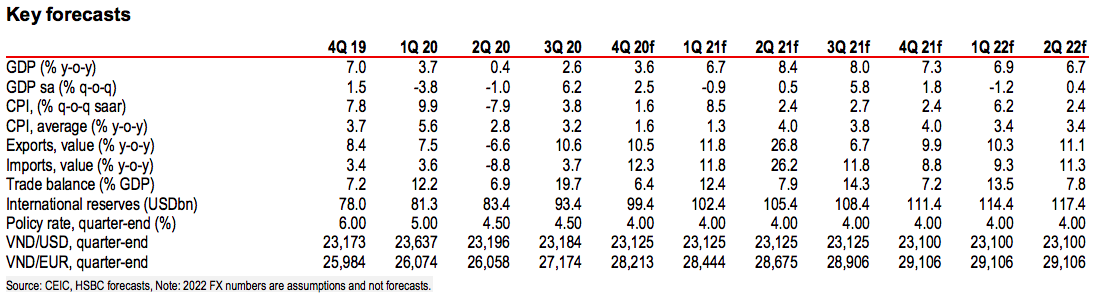

While Vietnam had the highest growth rate in Asia in 2020 at 2.91%, the country is likely to be among the top in the region again for this year with an estimated GDP growth of 7.6%, according to HSBC.

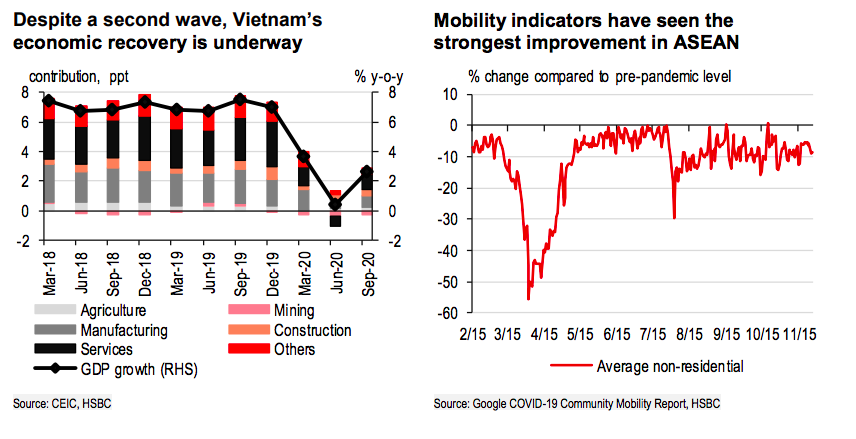

Despite unprecedented challenges, Vietnam has emerged out of the crisis stronger. With a population of over 95 million, the country has managed to flatten the Covid-19 curve much earlier and maintained a total number of cases of around 1,400, thanks to the authorities’ rapid and effective containment efforts, noted HSBC’s report.

While there was a short-lived second wave at the end of July, Vietnam’s recovery, nonetheless, remains on track.

“The crisis has accentuated Vietnam’s strengths as a resilient economy and production base, and will allow it to retain its place as the region’s shining star,” noted the report.

In 2021, Vietnam is set to benefit from a tech-led recovery, consistent FDI inflows and numerous trade agreements. However, HSBC trims down its 2021 growth slightly to 7.6% from the previous 8.1%, accounting for a prolonged recovery in tourism.

Policy issues

While Vietnam has emerged stronger from Covid-19 than others, its economy, nonetheless, needs support for those hard-hit businesses and consumers, noted HSBC.

However, fiscal support is limited, given the government’s self-imposed 65% pubic debt-to-GDP ratio. Although Vietnam is unable to implement a sizeable fiscal stimulus packages, it has introduced some targeted and short-term assistance worth 4.6% of GDP in 2020.

In mid-November, Vietnam’s National Assembly approved a VND12-trillion (US$520 million) rescue package for its national carrier Vietnam Airlines, consisting of a capital increase of VND8 trillion (US$346.3 million) and soft loans of VND4 trillion (US$173.1 million).

Meanwhile, Vietnam’s Ministry of Finance also proposed an extension of the 30% reduction in jet fuel environment tax to 2021, aiming to further support the aviation sector.

Vietnam’s fiscal deficit is expected to widen to 5.2% of GDP in 2020, before resuming a gradual consolidation drive, while the country’s 2021 deficit could improve to 4.6% of GDP, bringing down its public debt to below 60% of GDP.

Given Vietnam’s limited fiscal space, monetary policy has done most of the heavy lifting to drive growth. On September 30, 2020, the State Bank of Vietnam (SBV) announced another 50 basic points (bp) cut of its annual refinancing interest rate, effective October 1, 2020, bringing down its refinancing rate to 4%. The magnitude of the rate cut signaled the SBV’s sense of urgency, given the government’s 2020 growth target of 2.5-3%.

HSBC expects the central bank to keep its monetary policy on hold until the second quarter of 2022, before possibly delivering a 25bp rate hike in the next quarter, bringing its refinancing rate to 4.25% by year-end 2022.

Risks

While Vietnam is poised to outperform the region in 2021, there are, nonetheless, risks to its economic recovery.

First and foremost, tourism prospects remain impeded. Even though the worst has likely passed after the first half of 2020, tourism-related services, such as accommodation and transportation, remain stuck in the doldrums. This is not surprising, given ongoing border restrictions, despite some selected travel arrangements Vietnam has with neighboring countries.

Although the second wave was quickly contained, it likely turned the government more cautious in terms of border re-opening and welcoming international tourists. As such, there is unlikely to be a meaningful recovery in the sector in the near term until there is an effective vaccine and a coordinated global approach on international travel.

Domestically, Vietnam’s soft labor market remains a challenge. Despite some improvements in the third quarter of 2020, unemployment rates remained elevated with lower wages. If this continues, it will likely result in a prolonged recovery in consumer spending, which has been a key pillar of growth, warned HSBC.