Vietnamese consumers to shift for online shopping in 2022

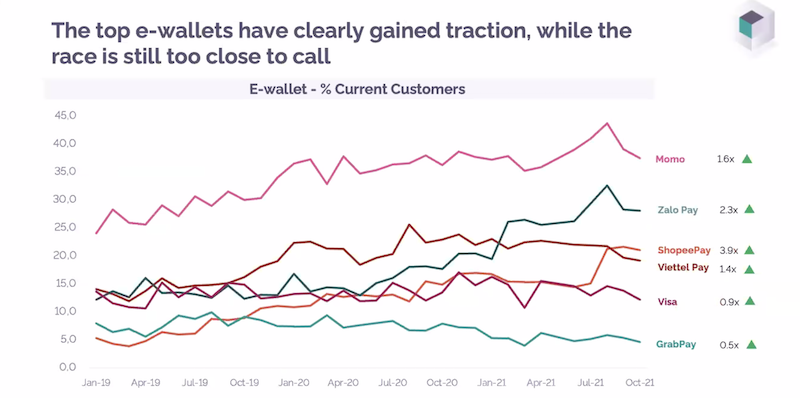

E-wallet channel maintains strong growth in the coming time.

Vietnamese consumers will likely shop online more next year with more than half of the people saying they would do so when being surveyed by YouGov, an online market research firm.

| Source: YouGov |

At the webinar “How Covid-19 changed personal finance in Vietnam?” on November 11, Thue Quist Thomasen, CEO of YouGov, said 24% of the respondents said they intend to shop more in-store compared to 28% last year.

The Covid-19 pandemic has changed the habit of purchasing and payment methods in the world and Vietnam. The consumers had a quick response to the situation of the disease developments through flexibly using online and offline channels.

“Preference differs by the market with the Chinese most likely to purchase financial products online, whilst consumers in Vietnam showing a preference hybrid,” the report noted.

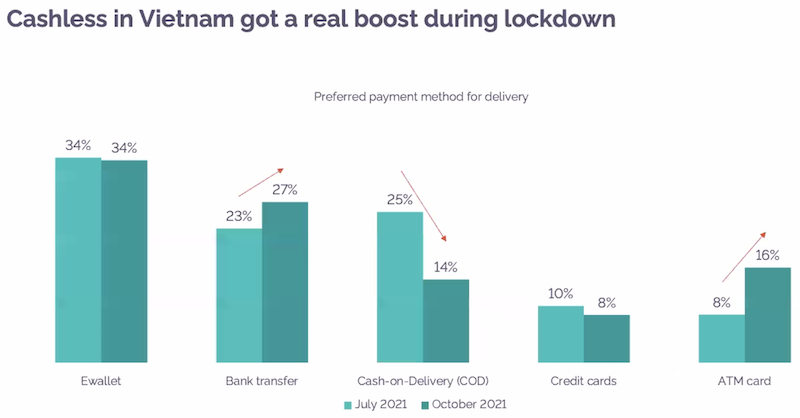

Thomasen also highlighted impressive growth in cashless when giving a comparison between the time of social distancing (July) and the subsequent period (October) in Vietnam. About 14% of shoppers used cash-on-delivery (COD) which is known as the most preferred payment in October while the figure in July was 25%.

| Source: YouGov |

Among the payment methods, bank transfers increased by 27% in October from 23% in July. Meanwhile, e-wallets maintained strong growth during the period. Momo, Zalo Pay, Shopee Pay, and Viettel Pay enjoyed two-digit growth in the Southeast Asian country during July-October.

Forecasting personal financial issues in 2022, YouGov found Vietnamese consumers will focus on saving money for unexpected hardship with the 47% of respondents, ensuring that families are adequately protected in case of an emergency (34%), and making money by investing (30%).

In 2021, nearly 60% of the respondents said their families in Vietnam saw their source of income decrease or disappear in 2021 while as many as 22% said their income increased by 10-20% or more.

According to Thomasen, more than half of the Vietnamese respondents said they have cut down on non-essential spending in the last six months. Most of the surveyed people (81%) said they will continue to do this in the future. The percentage is higher than the average figure of APAC and the US markets.

He added digital service experience will be even more important as many have become used to living in an accelerated digital world.

With the predicted surge in using digital service channels, he also recommended local banks need to differentiate their brands while managing reputation and increased advertising in order to engage and capture consumers' attention and trust in the changing market.