Vietnam’s corporate bond market could grow to US$100bn: Finance Minister

The Ministry of Finance is expected to establish a separate bond market, strengthen inspection and auditing, and create conditions for businesses to raise capital.

Vietnam’s corporate bond market remains a good channel for capital mobilization, with the potential to grow to VND2,500 trillion (US$102 billion), Minister of Finance Ho Duc Phoc told the local media.

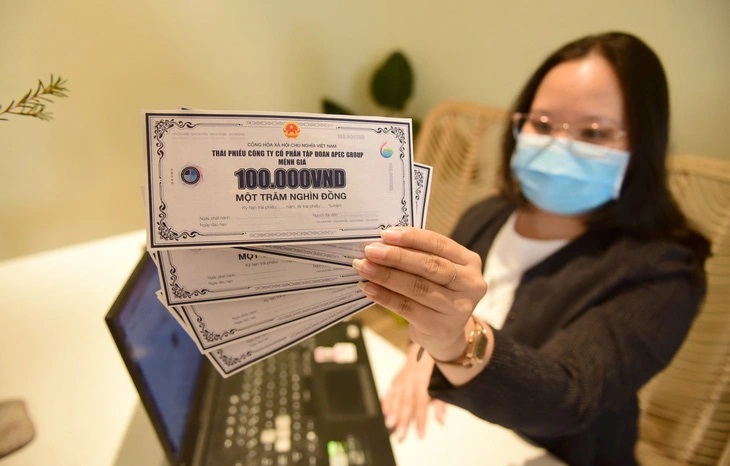

| Vietnam's corporate bond market has been on the rise. Photo: Ngoc Phuong/The Hanoi Times |

"The incident involving SCB Bank and Van Thinh Phat Group at the end of 2022 continued to pose challenges for the corporate bond market in the first three months of 2023. However, after the government issued Decree 08 in March 2023, the market showed signs of recovery, and investor confidence returned," Phoc said.

Phoc referred to the national strategy for corporate bond market development, which expects the individual corporate bond mobilization channel to account for around 25% of GDP. The outstanding corporate bond loans are only VND1,000 trillion ($40.1 billion), or 10% of GDP, mainly through commercial bank issuance, which remains low.

He stated that there is still room for mobilizing about 15-16% of GDP, equivalent to around $61.3 – 65.4 billion in individual corporate bonds. This capital source will address capital constraints and support business development.

Nguyen Tung Anh, Director of FiinRatings, echoed the view that bonds remain an important channel for raising capital, pointing out that in recent years, without raising funds through bond issuance, many businesses and the banking system would have faced significant capital burdens and pressures.

Anh cited data showing strong growth in the corporate bond market between 2018 and 2021, with an average annual growth rate of about 45%. At its peak in mid-2022, the total corporate bond debt was nearly VND1,500 trillion ($61 billion), equivalent to about 14% of GDP in 2021 and 12% of the total credit debt of the banking system.

According to the Ministry of Finance's report, in 2023, thanks to the provision in Decree 08 to delay the credit rating of businesses, 78 companies successfully issued individual corporate bonds, raising about VND237.4 trillion ($9.7 billion). Of these, about VND236.5 trillion ($9.67 billion) of bonds were issued after Decree 08 came into effect.

Some notable cases include Capitaland Tower Company issuing bonds totaling about VND12.24 trillion ($500.6 million), Nam An Investment and Business Company raising VND4.7 trillion ($192.2 million), Hung Yen Urban Investment and Development Company raising VND7.2 trillion ($294.4 million), and Saigon Capital Company issuing VND3 trillion ($122.7 million), among others.

Although the volume of issuances has increased and the market is more active, analysts also note the ability to pay bonds at maturity. This year, the total volume of individual corporate bonds maturing is over VND310 trillion ($12.67 billion). The real estate and credit institution groups have the highest maturities at 34.9% and 29.7% respectively.

To address the cash flow for bond repayments, Anh from FiinRatings suggested that under normal conditions, businesses will seek new sources of capital through bond issuance, bank loans, and share issuance to repay debts and maintain and develop production and business.

However, he forecasted that the ability of businesses to raise capital shortly will be challenging as the market still needs time to adjust and rebuild confidence, especially regarding professional investors and mandatory credit ratings in some cases that have not yet been implemented. Additionally, the credit funding available for this purpose is limited due to the prioritization of production and business, with credit growth still at around 14% to control inflation.

The Finance Minister also stated that raising capital through the stock market is difficult given the unfavorable ongoing economic situation, and it is not easy to sell assets to repay debt due to the sluggish real estate market and the slow recovery. As a result, some businesses, especially in real estate, face the risk of delayed bond repayments.

Given the high volume of maturing bonds, Phoc believed that the current macro and credit conditions are more stable than during the SCB Bank incident.

“These are favorable conditions for businesses to stabilize their production and business operations, with cash flow to repay principal and interest to investors,” said Phoc.

He said that the recovery and development of each industry vary according to their specific operational characteristics. Especially the real estate sector is showing signs of recovery, and legal obstacles are gradually being removed, creating conditions for businesses to complete projects early and have the funds to fulfill obligations to investors.

However, to avoid risks, Phoc stated that businesses issuing bonds must repay them on time. He urged companies to use the funds raised for the intended purposes, not to use them to pay off other debts, which could lead to default and loss of trust from investors and the public, which would affect the corporate bond market.

Phoc also noted the Ministry of Finance will establish a separate bond market, strengthen inspection and auditing, and create conditions for businesses to raise capital while establishing order and discipline to ensure transparency in the financial market.