Vietnam’s financial markets respond positively to Fed rate cut

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

Vietnam’s financial markets responded positively to the Federal Reserve (Fed)’s decision to cut interest rate by a quarter point for the third time this year, according to a report by BIDV Training and Research Institute.

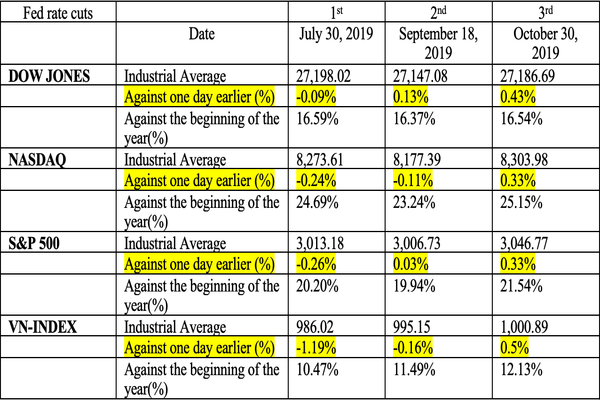

| Responses from US and Vietnam's stock markets to Fed rates cuts. Data: Bloomberg, BIDV. |

On October 30, the Fed lowered the target for its benchmark rate by a quarter point to a range of 1.5 – 1.75%, and at the same time signaled to the financial markets that it had no immediate intention to cut the cost of borrowing further, unless the US and global economies go into a recession.

Fed’s decision provided good news to global financial markets and the US economy, particularly in the context of the world’s economy slowdown and GDP in the third quarter of the US expanded 1.9%, lower than the 2%-rate recorded in the previous quarter.

This time, Vietnam’s stock market responded differently compared to the previous two rate cuts with minimal impacts.

After the first rate cut on July 30, 2019, the market reacted negatively in the context of US – China trade war escalation and signs of slowdown from the US and other major economies.

Meanwhile, the Fed announced the second rate cut on September 18, 2019 without providing a clear message on managing the interest rate in the time ahead, as well as not having a common consensus among Fed’s management in cutting the benchmark rate.

In this third rate cut, both stock markets in the US and Vietnam witnessed hikes in stocks on the first day, with major indexes going up 0.33-0.5% compared to a day earlier.

The report suggested three main reasons for such positive responses: (i) the latest rate cut had been widely predicted; (ii) the Fed provided positive assessment on the US economy, which led to its hesitance to further cut rates in the future; (iii) the markets welcomed positive news on macro-economic and business conditions. Specifically, the US’s GDP growth rate in the third quarter exceeded the expectation of 1.6% and inflation rate was in line with the target of 2%, the US and China agreed on a partial trade deal and positive business performances of companies listed on the US stock market.

Nevertheless, the report expected Vietnam’s authorities and companies to continue monitoring activities from the Fed and major central banks, fluctuations in the global financial market and the US – China trade war, among others, aiming to prepare for any external shocks and ensuring healthy development of Vietnam’s financial-monetary markets.