Robust growth predicted for Vietnam’s power sector despite near-term headwinds

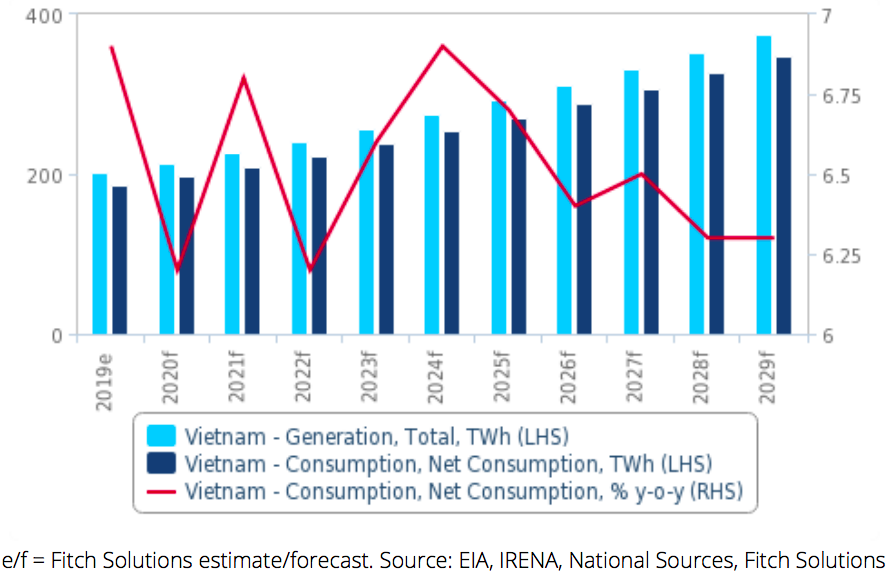

Fitch Solutions predicted power consumption in Vietnam to grow by an annual average of 6.5% between 2020 and 2029, which still remains one of the fastest growth rates in Asia.

Despite the near-term downward revisions, Vietnam’s power sector as a whole is still poised for robust growth over the coming decade, Fitch Solutions has said in its latest report.

According to Fitch Solutions, positive economic growth fundamentals in Vietnam will stimulate an ongoing surge in power demand and consumption over the coming decade. While manufacturing is weighed by the outbreak in the near-term, it is expected that growth will rebound relatively quickly, in line with fiscal and monetary support from the government, and possible backlog of orders upon normalization.

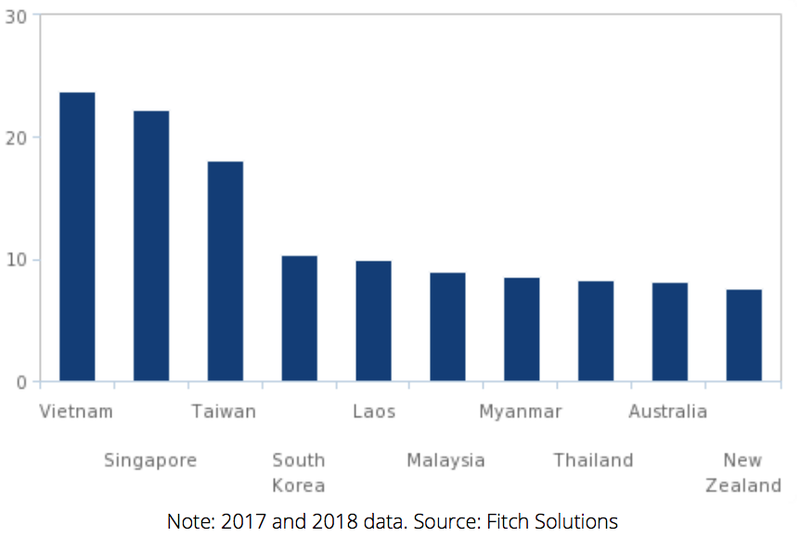

Selected markets' exports to China (% of GDP). |

Liberal trade policies, including the upcoming ratification of the EU-Vietnam Free Trade Agreement, positive demographics, upscaling of its labor force and rapid urbanization will also support the country’s strong economic growth and further drive power consumption growth rates.

Fitch Solutions predicted power consumption in Vietnam to grow by an annual average of 6.5% between 2020 and 2029, which still remains one of the fastest growth rates in Asia.

Meanwhile, Vietnam’s power consumption growth for 2020 has been revised down to 6.2%, in light of growth pressures stemming from the Covid-19 epidemic. Vietnam’s large manufacturing sector, accounting for 16% of the GDP, is set to come under heavy pressure in the first half of 2020, from supply chain disruptions as a result of the outbreak in China.

Fitch noted that China’s aggressive measures to prevent the spread of the virus have inevitably weighed on domestic manufacturing and production, as well as logistical mobility, which will lead to spillover effects into Vietnam, particularly as China is a key source of raw materials and a major export market for Vietnam.

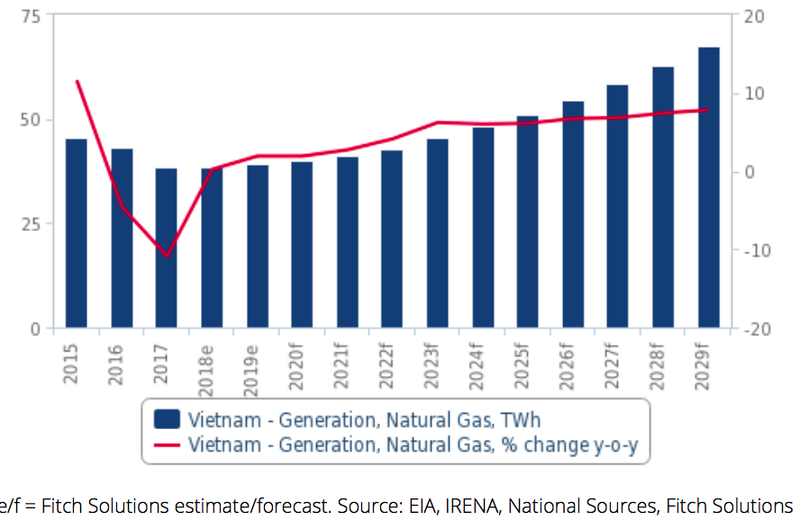

| Vietnam's natural gas power generation. |

Additionally, gas-fired generation is forecast to pick up after 2023, given an increasingly favorable investment environment towards liquified natural gas (LNG), with further upside risk.

The anticipated commissioning of PV Gas’ Thi Vai LNG terminal in the Ba Ria-Vung Tau province in end-2022 will allow Vietnam to begin importing LNG for the first time, which could offer some relief for gas-fired generation thereafter.

The government has recently highlighted the use of LNG as a source for power generation, and will look to create more favorable conditions for foreign investors to develop such projects, said Fitch.

| Vietnam's total power generation and consumption. |

This has already translated into strong investor interests in LNG projects over the past six months, and a robust LNG-to-power project pipeline. Fitch Solutions said that there are now approximately 26GW worth of gas-fired power projects in the pre-final investment decision (FID) phase in Vietnam, which are slated to come online between 2022 and 2029. As such, there should be a rebound in gas generation to occur only after 2023, assuming that some of these projects will come online as planned.

That said, the lack of FIDs to date means that some of these projects are inherently exposed to a certain level of risk, including delays at the bureaucratic level, and Fitch, thus, did not incorporate all of this capacity into its forecasts.