Vietnam’s packaged food enjoys double-digit growth in post Covid-19: Kantar

Vietnam’s fast-moving consumer goods (FCMG) market growth returns to its pre-Covid-19 level in the short term.

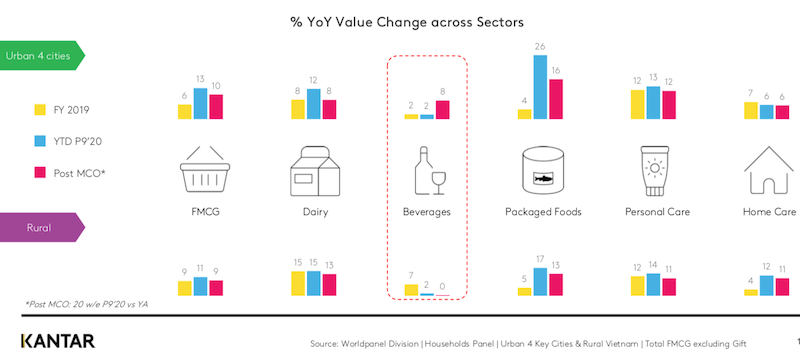

Amid the Covid-19 pandemic, the packaged food sector is leading FMCG market growth, expanding 26% in the past three quarters, and is expected to grow 16% in post-Covid-19, promising great opportunities by capturing new in-home occasions, according to the latest report by Kantar Worldpanel Division.

| Source: Worldpanel Division, October 2020. Screenshot: NM |

Based on Worldpanel data, within packaged food sector, snacking products still remains double-digital growth in terms of value and volume in the first nine months of 2020 in both Vietnam’s urban and rural areas.

Among hot categories, personal care recorded 13% growth in the period. Beverage market has recovered with 8% growth in post-Covid-19 in four cities (including Hanoi, Danang, Can Tho and Ho Chi Minh City), while still struggled to bounce back in rural areas in post lockdown periods.

| Source: Worldpanel Division, October 2020. Screenshot: NM |

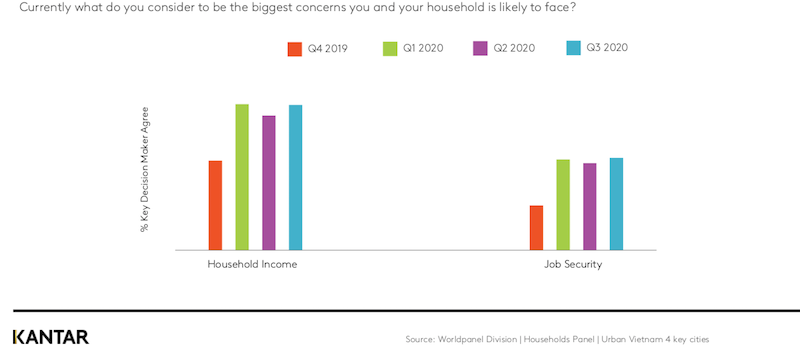

In the short term, not much impact has been seen from the second wave of Covid-19 starting in central Vietnam areas at the end of July. The market growth is getting back to its pre-Covid level, the report noted, and there could be a continued slowdown in the last quarter of 2020 as consumers might delay purchases, especially in central rural areas where consumer spending would be further affected by the flood and typhoons.

| Source: Worldpanel Division, October 2020. Screenshot: NM |

Notably, Kantar showed retail growth is cooling across all channels. With its value growth of 65%, online channel continues to gain share and is the fastest growing format post the social-distancing period. Following are drug stores (53%), pharmacy (33%), minimarket (22%), hyper & super (15%), cash & carry (14%) and wet market (14%).

| Source: Worldpanel Division, October 2020. Screenshot: NM |

The report also highlighted that due to the global pandemic, the desire to live more sustainably might affect Vietnamese purchase behaviors post Covid-19. About 57% Vietnamese surveyed shoppers said that they stopped buying some products/ services because of their impact on the environment or society. Meanwhile, the world figure is 41%.