Bancassurance becomes crucial growth driver for banks in Vietnam

Bancassurance income is set to have much potential to grow both at sector-wide and individual bank level, according to a brokerage.

Among many activities that became popular service income sources for banks, bancassurance has become a crucial growth driver, especially bancassurance life-premium, according to Viet Dragon Securities Company (VDSC).

Bancassurance (an arrangement between a bank and an insurance company allowing the insurance company to sell its products to the bank's client base) income is set to have much potential to grow both at sector-wide and individual bank level, stated VDSC in its latest report, adding in the context of closer control on credit growth and more limited room to expand net income marginal (NIM), banks are trying to boost service income from cross-selling activities.

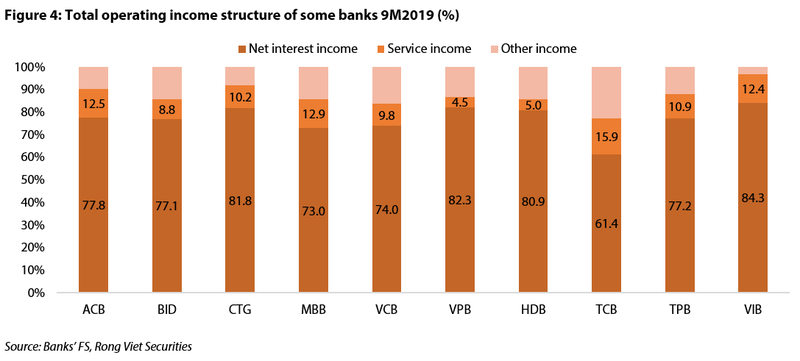

During the first nine months of 2019, the portion of service income on total operational income (TOI) for ten banks under VDSC’s watch list have moved up to 10.5% from 9.6% in 2018, reflecting a more sustainable income structure.

Growth of bancassurance owing to insurance industry potential

The OECD forecasts that Vietnam's GDP can maintain an average growth rate of 6.0 - 6.2% per year until 2025. In addition, more than 50% of Vietnam's population will enter the global middle class by 2035 compared to 11% in 2015. Accordingly, a favorable economic condition combined with a young population with rapidly growing income creates great potential for the insurance industry. The demand for saving, investing and owning cars will boost demand for personal insurance including life insurance, health care insurance and motor vehicle insurance.

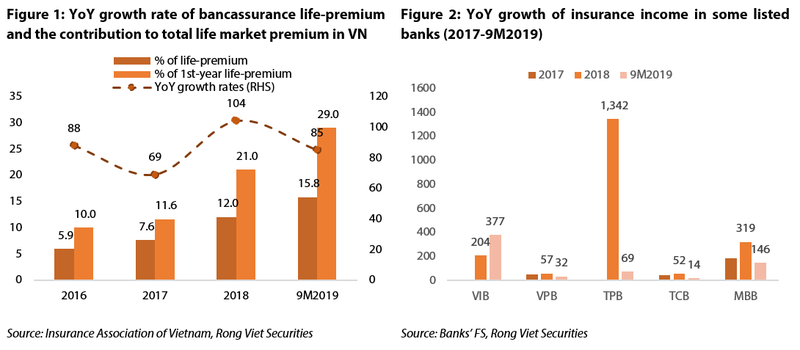

Insurers has tried to serve these demands by approaching customers through the expansion of bancassurance channel. From 2016 to September 2019, life-bancassurance premium has expanded significantly with a CAGR of 84%. The contribution to total life market premium has constantly expanded from 5.9% in 2016 to 12% in 2018 and 15.8% in January – September in 2019. Additionally, life premium generated via bancassurance accounted for 29% of total first year life premium during the period, increasing from 21% in 2018, and 10% in 2016.

Considering Vietnam’s current low penetration of insurance at 2.4% in 2018, it is expected that insurance in general (and life-insurance in particular) would still have opportunities to expand strongly. Coupled with the increasing trend of bancassurance channel contribution, this will support the high growth of banks’ insurance income.

Outlook of bancassurance income at some listed banks

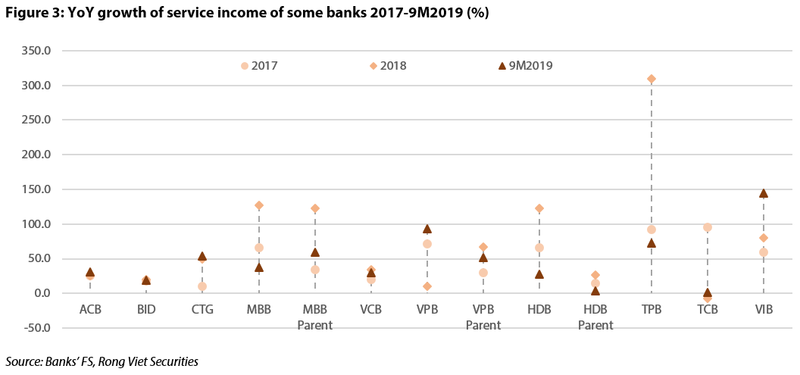

Bancassurance has become a strategic focus of many banks especially those under retail banking strategy. This is not only to serve individual customers’ comprehensive financial needs but also to diversify banks’ service income sources. In the first nine months of 2019, service income expanded most strongly at Vietnam International Bank (VIB) and Vietnam Prosperity Bank (VPBank), also two banks with over 100% increase in life bancassurance, followed by TienPhong Bank (TPBank), Vietinbank and Military Bank.

Apart from these banks, Vietcombank and Asia Commercial Bank (ACB) should be the next to see significant annual growth in insurance income, upon their newly signed bancassurance agreements, (Vietcombank with FWD Insurance in November 2019; ACB with Manulife in September and FWD Insurance in December 2019).

Towards the lower end of bancassurance growth, BIDV and Ho Chi Minh Development Bank (HDBank) are having few growth drivers in insurance activities. BIDV is seeking exclusive life-insurance partners, and therefore, are eligible for potential high up-front fees though the deal are unlikely to be finalized in near term. HDBank also has the plan to boost bancassurance income and card fee since 2020, in order to build a more sustainable income structure.