Businesses expect production to start rising in final quarter

Business sentiment picked up from the 15-month low seen in August as firms generally expect output to recover over the coming year.

Given signs that the latest wave of the pandemic in Vietnam has peaked and vaccination programs are making good progress, restrictions are set to gradually ease and firms should be able to see growth resume over the final quarter of the year.

Economics Director at IHS Markit Andrew Harker made the comment on Vietnam’s manufacturing sector in the agency’s latest survey.

| PMI signals deterioration in business conditions across the sector. |

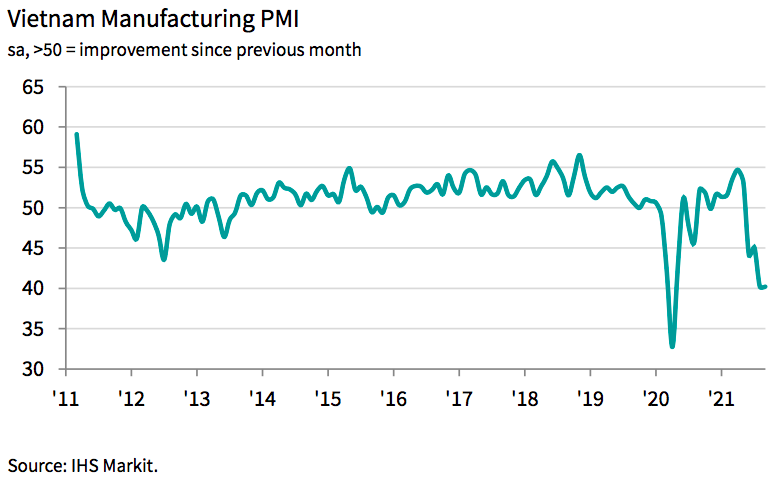

Meanwhile, in September, the Vietnam Manufacturing Purchasing Managers' Index (PMI) remained at 40.2, signaling a further marked deterioration in business conditions across the sector.

A reading below the 50 neutral marks indicates no change from the previous month, while a reading below 50 indicates contractions and above 50 points to an expansion.

Temporary business closures, transportation difficulties, and staff shortages all contributed to a fourth successive reduction in manufacturing output in Vietnam, and one that remained considerable.

New orders also fell sharply, and to the greatest extent since April 2020. Alongside a sharp reduction in domestic new business, firms pointed to a much sharper reduction in new export orders than that seen during August.

Employment levels decreased at the sharpest pace since the survey began in March 2011. Some panelists reported that employees had resigned due to a lack of work, while others scaled back staffing levels amid pauses in production.

The sustained period of restrictions on output and sharply falling staffing levels led to a surge in backlogs of work. Outstanding business rose for the first time in four months, and at a pace, that was by far the strongest in the survey's history.

| Production at Garment 10 Company. Photo: Khac Kien |

As well as lowering staffing levels, manufacturers also reduced their purchasing activity in response to lower production requirements. Meanwhile, supply-chain delays intensified, with lead times lengthening at a new record pace for the third consecutive month.

Issues with the supply of raw materials contributed to further upward pressure on purchase prices, while there were widespread reports of higher transportation costs. As a result, input prices continued to rise sharply, with the rate of inflation slightly faster than in August. On the other hand, selling prices rose only slightly, and at the weakest pace since June. Firms indicated that weak demand meant they offered discounts in order to try to secure sales.

Restricted production volumes impacted inventory holdings. Inventories of purchases rose as inputs were kept in stock rather than being used in production. In turn, falling output meant that stocks of finished goods continued to decrease.

Despite all difficulties, business sentiment picked up from the 15-month low seen in August as

firms generally expect output to recover over the coming year, with production set to start rising during the final quarter of 2021 should the pandemic be brought under control and restrictions lifted.