New bank frauds emerged as Tet nears

Customers are urged to stay cautious against rampant scam and fraud activities ahead of Tet holidays.

Over the past few days, many banks in Vietnam have warned customers of messages appeared to be sent from them that include website links. Once customers click those links and fill out bank data, money in their bank accounts would instantly be “evaporated”.

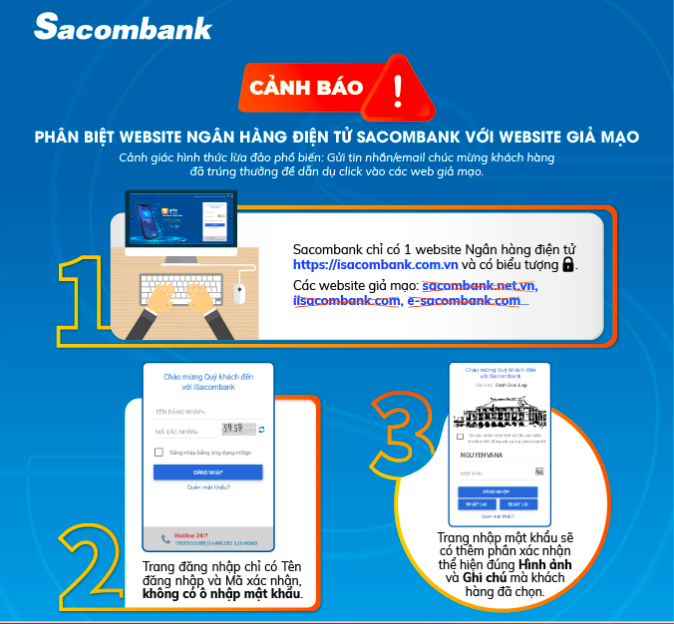

| A warning from Sacombank against suspicious link. |

“Please do not click on any links that are included in mobile message, email, social network, of even from sender named Sacombank,” stressed the bank in a message to their customers.

The move came after many customers said they receive a message that informed them of irregularities related to their bank accounts and urged them to log in the website address of http://i-sacombank.com to verify information and change bank password.

The message was sent from a Sacombank SMS brandname created almost no suspicion, and many have clicked on the link and fill in all the fields required in the link. However, right after completing the final step of entering the OTP verification code, all money in the bank account would be gone in a matter of seconds.

Another type of message from the same Sacombank sender that saying the lender would give a voucher worth VND50,000 (US$2.17) ahead of Tet for customers and asked them to verify their bank information. And once all the personal details have been provided, their bank accounts would be empty.

A representative of Sacombank said all those messages are a scam, saying the process of sending SMS brandname message is conducted via its service provider IRIS Media.

“The bank is reviewing its system and working with local authorities to address the issue,” he noted.

Meanwhile, Sacombank’s customers are not the only one targeted by scammers, as similar messages have been sent to those of OCB.

OCB bank has also asked its customers to be cautious against fake lending contract. According to the bank, swindlers would look for their victims among those seeking loans in social networks, and then approach them as employees of OCB to ask them to apply for loans at the bank.

Customers would then be asked to pay up to VND2.5 million (US$108) upon receiving these contracts via shippers.

To prevent more customers from being misled, Sacombank urged customers not to click on any link except the bank's two official website addresses, including https://www.sacombank.com.vn and http://isacombank.com.vn.

The bank also instructed customers to directly type the link onto the web browsers, instead of using those sent from messages or email.

In a similar move, Vietcombank and Agribank also asked customers not to enter their passwords or OTP code into links sent via SMS, zalo, or social networks.

Given rampant fraud and scam activities ahead of Tet holidays, customers are advised to stay cautious and update information from official sources to ensure safety in transactions.