US$24 billion cash trapped in net working capital in Vietnam: PwC

PwC’s analysis showed that opportunities for cash release from working capital in the fiscal year 2018 would be more than US$11 billion.

A total of US$24.1 billion in cash was trapped in net working capital in Vietnam in the fiscal year 2018, accounting for 50% of total net working capital and 7% of total annual sales of the companies analyzed, according to a report by PwC.

| Vietnam’s working capital performance continues to lag behind that of most Asian countries. |

PwC’s analysis showed that opportunities for cash release from working capital in the fiscal year 2018 would be more than US$11 billion. Remarkably, one third of this amount can be realized for Engineering & Constructions and Consumer Products industries alone. In terms of working capital elements, Inventory days (DIO) was the most important element for the companies to focus on for cash release, followed by Receivable days (DSO).

This is one of the latest findings that is highlighted in PwC Vietnam’s second edition of the annual working capital study – “Cash for growth or growth for cash?”. The study analyses the working capital performance of the 500 largest listed companies by revenue across 15 sectors over the past four years. The companies analyzed have been listed on both the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) for at least the past four years.

As a booming economy, the business environment in Vietnam is becoming increasingly competitive, especially in this time of emerging opportunities and potential trade shift from China owing to the US-China trade war. As a result, in addition to growing the top line of its business, working capital management is essential for every company as it enables a faster cash conversion and reduced dependency on external financing sources

On the current status of working capital performance in Vietnam, Mohammad Mudasser, Practice Lead, Working Capital Management of PwC Vietnam said: “We continue to see cash flows being sacrificed to attain top-line targets in Vietnam which is not sustainable for businesses in the long run. Managing operating working capital is a cross-functional responsibility, hence the role of CFOs must graduate from a pure accounting and controlling to a more active business partner in achieving the company's strategic objectives.”

An effective working capital management would additionally support companies’ liquidity needs which is considered the lifeblood of any business. In recent years, while corporate debts have been constantly on the rise, the amount of trapped cash has also adopted on an upward trend. It is important for businesses to remain cognizant of internal cash release opportunities as it is the cheapest source of liquidity and, in many cases, may be the only source of cash in a harsh credit climate.

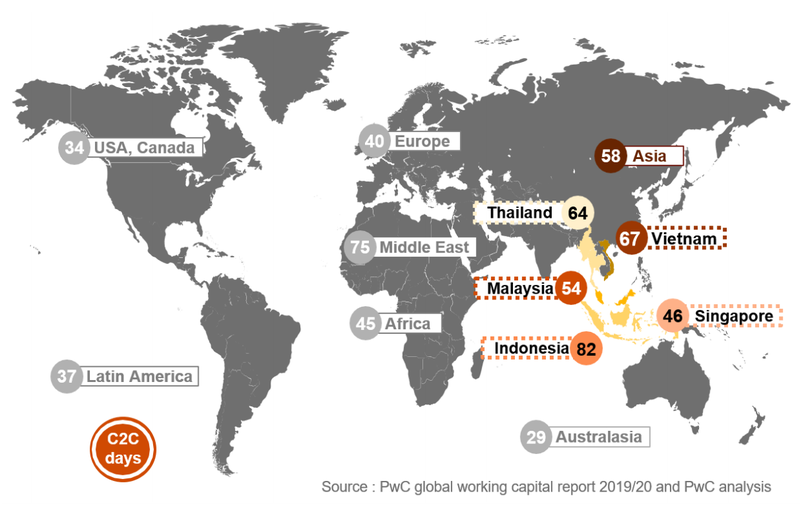

According to PwC Vietnam’s assessment, the working capital performance of Vietnamese businesses deteriorated last year while continuing to trail behind Asian and global peers.

Working capital performance deteriorated in fiscal year 2017 - 2018 by two days reaching 67 days, mainly due to the shortening payable cycles . The findings also reveal that working capital needs were mostly financed through short term borrowings rather than companies looking at opportunities for internal cash release.

Unlocking business potential

Effective working capital management has an important role to play in gaining control over and releasing business’s trapped capital, a valuable resource that is often overlooked. This especially applies for fast growing companies in Vietnam whose dependency on short-term debts is increasing year-on-year.

Beside a significant amount of trapped cash, the stark gap between revenue growth (15%) and increase in operating profits (3%) further signifies the growing burden of expenses and also implies significant opportunities for working capital improvement in Vietnam. To stay ahead, businesses in Vietnam need to actively manage and maintain their working capital elements to optimize business efficiency and ultimately increase cost savings.