Vietnam apparels to win market share in US

Among US’ leading suppliers of textile and apparel, China continues to lose its market share (33% in 2019 to 28% in 2020) while Vietnam is the largest gainer (13% to 15%).

The Covid-19 pandemic and the US-China trade tension have created a turbulent business environment for the US fashion companies, resulting in changes in their sourcing strategies. In this regard, Vietnam has emerged as the first choice of the US sides to replace part of their Chinese sources, according to Viet Dragon Securities Company (VDSC).

Among US’ leading suppliers of textile and apparel (China, Vietnam, Bangladesh, Indonesia, India), China continued to lose its market share (33% in 2019 to 28% in 2020) while Vietnam was the largest gainer (13% to 15%), noted the VDSC in its report.

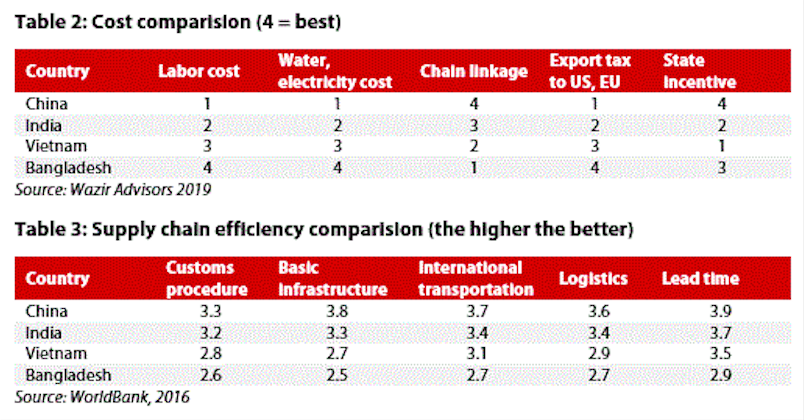

According to the VDSC, Vietnam apparel exports to the US suffered the lowest decline among all sources in 2020 because of its competitive advantages, such as lower production costs than China, India and higher efficiency than Bangladesh.

“Although Vietnam has strengths to attract orders, China remains the top supplier in the short-term,” stated the VDSC.

Indeed, large-scale production allows China to offer material for apparel making at low prices with diversified types and designs. Under this context, US brands can place orders for various products at different scales and quantities.

Moreover, China is the sole country that has fullyintegrated production chain from yarn to garment, in turn minimizing the risk of supply disruptions during hard times such as the Covid-19 pandemic or Suez Canal blockage.

| Production at a garment firm in Hanoi. Photo: Pham Hung |

It was not a coincidence that Asian garment producers have experienced a textile shortage for apparel making in the first quarter of last year when China, which supplies 40-50% of materials for Asian apparel producing countries, applied lockdown measure to contain the pandemic.

Nevertheless, there is other non-economic factors that has significantly and negatively affected the prospect of China as a source of apparel from 2020.

In 2020, the US cotton textile and apparel import from China were reduced by nearly 40% while the total US import of Chinese textile and apparel fell 30.7% in 2020. As Vietnam mainly sources cotton for its cotton yarn production form the US and Brazil, such situation is potential for Vietnam cotton yarn and fabric production and export, stated the VDSC.