Vietnam banks' capital to remain weak after Basel II delay: Fitch Ratings

Fitch analysts were upbeat about continued strong economic growth in Vietnam, which makes near-term stress unlikely and underpins their stable outlook for the banking sector.

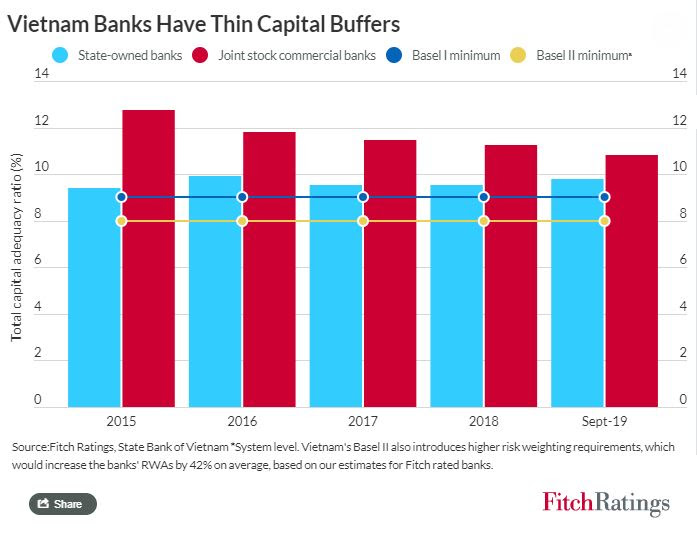

The State Bank of Vietnam's decision to offer some banks forbearance on Basel II implementation highlights weak capitalization in the sector, with many banks in no position to meet the requirements by January 2020, Fitch Ratings has said in a note.

| The headquarters of the State Bank of Vietnam in Hanoi. Photo: Minh Tuan |

Rapid credit growth and limited options for raising external capital are likely to continue to hold back significant improvements in capital ratios ahead of the new deadline of 2023 for qualifying banks, and Fitch Ratings expects the sector to remain vulnerable to shocks given its weak buffers.

Fitch analysts said they had already expected flexibility on the implementation deadline given the number of banks that were struggling to meet the requirements. The minimum total capital adequacy ratio of 8% that will apply under local Basel II is lower than the current 9%, but the risk weightings will be much stricter. Local media reports in mid-December suggested that only 16 of the 38 local banks were able to meet the new standards.

“Eventual adoption of Basel II may still encourage more active capital-raising efforts, which could reduce risks to financial stability and support improvements in banks' credit profiles,” said the analysts.

However, the impact on ratings will hinge on the extent and sustainability of the improvement in capitalization, as well as any changes in risk profiles.

VietinBank is the only Fitch-rated bank that is reportedly yet to comply with the new standards. Vietcombank, Military Bank and Asia Commercial Bank (ACB) are reported to be in compliance already, but the analysts expect their capital ratios to remain low relative to global standards in the foreseeable future.

Foreign ownership limit

Banks will continue to face challenges in raising external capital. Banks in Vietnam have a 30% foreign ownership limit, which constrains their efforts to raise equity from overseas investors and makes them reliant on capital issuance in the shallow local market. VietinBank is among those that are already at the foreign-ownership limit. Meanwhile, Fitch does not expect many smaller banks to attract foreign interest, given their short operating histories and fledgling franchises.

“We expect sector consolidation over the next few years, as smaller players struggle to meet Basel II requirements and become takeover targets. That said, regulatory intervention may be required to incentivize the better-capitalized banks to undertake a merger.”

Stronger profitability and internal capital generation, amid a benign economic environment, have helped some banks to raise their capital ratios recently. However, internally generated capital tends to be depleted by rapid credit growth, and many banks have resorted to issuing local Tier-2 instruments to bridge the gap.

Moreover, rapid consumer lending growth, which has been a key driver of bank profitability, could become an area of potential stress if the economic environment were to deteriorate.

Nevertheless, the analysts were upbeat about continued strong economic growth in Vietnam, which makes near-term stress unlikely and underpins their stable outlook for the sector.