Vietnam crude oil and natural gas production face downside risks on Covid-19

Overall crude oil and natural gas production in Vietnam may suffer year-on-year declines of 5% and 1%, respectively, in 2020.

Vietnam’s crude oil and natural gas production face downside risks, in light of a double-whammy of global oil price collapse and sluggish demand due to continued spread of the Covid-19 pandemic, according to Fitch Solutions.

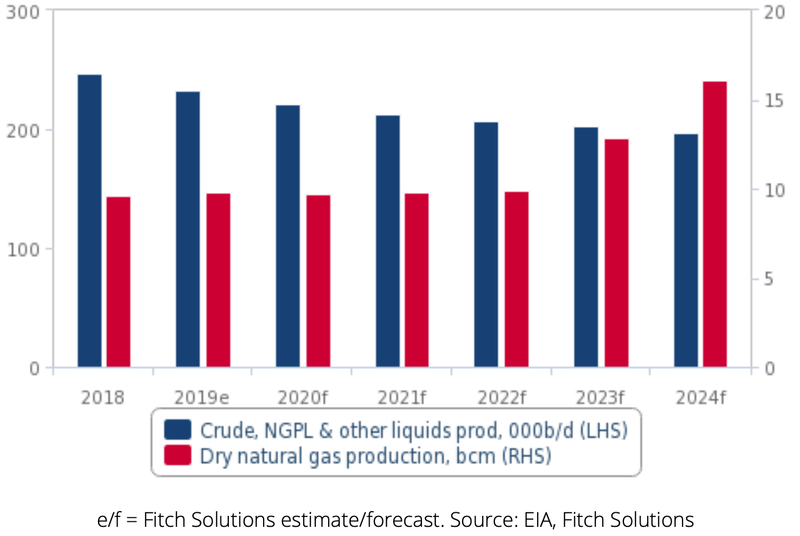

| Vietnam - Crude Oil & Natural Gas Production. |

As of March 31, benchmark Brent had lost almost 60% of its value since the start of 2020. This has occurred next to an apparent price war between Saudi Arabia and Russia, in the aftermath of failed OPEC+ talks in March, and global demand fears created by the Covid-19 pandemic.

This has triggered widespread reactions from across the globe as oil and gas firms announced significant capex cuts, reduced output targets and other cost cutting measures, in order to ride out the downturn. By comparison, responses from Asia’s national oil companies (NOCs) have been more measured, although many have indicated that they are closely monitoring the situation.

Vietnam’s state-owned oil producer PetroVietnam (PVN) has yet to commit to any spending cuts. However, the state-owned enterprise (SOE) did concede through an official statement, that its 2020 revenues are likely to be halved, due to the drop-off in crude and losses incurred from some ongoing projects as a result. The SOE is also believed to have ordered its subsidiaries to prepare business scenarios for different oil price levels, as it contemplates the likelihood of a protracted downturn in prices. Such a scenario would be highly negative for PVN’s upstream portfolio, which mostly comprises of joint-ventures (JVs) with foreign entities in offshore and mature producing areas.

According to industry sources, PVN’s breakeven cost per barrel is believed to be in the region of US$51/bbl, far above the US$36.3/bbl averaged in March and also above the US$43/bbl that Brent is expected to average in 2020, according to Fitch’s forecast. This risks most of the SOE’s existing output, while Fitch predicted overall crude oil and natural gas production in Vietnam may suffer year-on-year declines of 5% and 1%, respectively, in 2020.

Capital spending cuts and FID delays inevitable

Capital spending cuts and foreign indirect investment (FID) delays appear inevitable, as upstream operators come to grips with a lower oil price environment and sluggish demand.

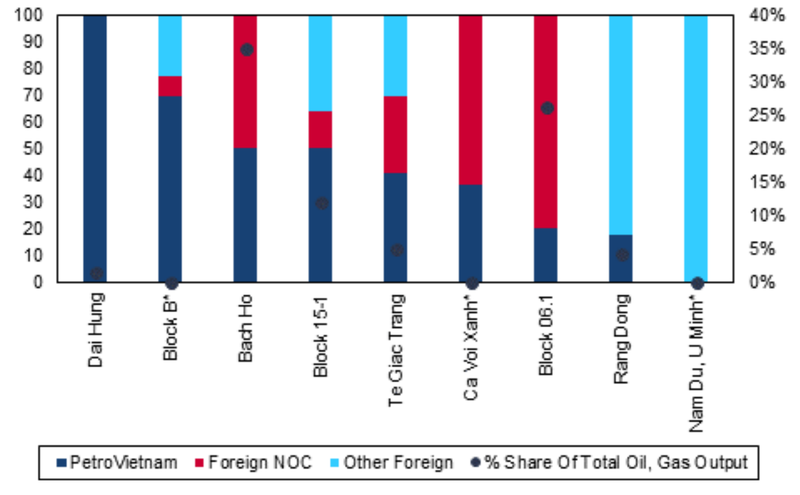

| % Stake In Selected Upstream Projects (LHS) & % Share Of Total Oil, Gas Production (RHS). |

Many of Vietnam’s largest oil and gas fields boast large foreign ownership. For many of these firms, upstream plays in higher-risk emerging markets such as Vietnam, are outside of their core portfolio, and as such, budgeted spend in Vietnam have potential to be among the first to go, in the event of any capex cuts.

Indeed, a breakdown of ownership across nine select upstream developments (including those in the pre-FID phase) shows that apart from the Dai Hung field – output contribution from which is small – and Block B project, the remaining seven projects boast at least 50% foreign ownership. A large number of foreign firms operating in Vietnam are NOCs, and while this could see activities within the sector prove more resilient in the face of elevated headwinds, anecdotal evidences point to a gradual, cautious turn in sentiment.

For instance, in March 2020, Zarubezhneft participated in discussions with other Russian oil companies and Energy Minister Alexander Novak, which reportedly ruled out output increase in the near-term due to weak demand in light of the Covid-19 pandemic. Thailand’s PTT has not revised its capex plans for 2020 and subsequent years, although has urged the government to release barrels in strategic storage, so as to stave off first quarter losses due to a drop in prices.

Delays of FIDs that were initially slated for 2020 also appear increasingly inevitable, and pose risks to our medium-term output growth projections for Vietnam, as drilling activities and major contract awards are postponed. In March 2020, Jadestone Energy put developments of the Nam Du and U Minh gas fields on hold, in order to maintain its balance sheet.

Other projects at risk of facing delays include Block B and Ca Voi Xanh. The two projects are expected to require combined capital input of about US$15 billion. Output from both could climb to a peak of about 15 billion cubic meters, equivalent to 1.5 times Vietnam’s total gas production in 2019.

Contraction in refined fuels consumption

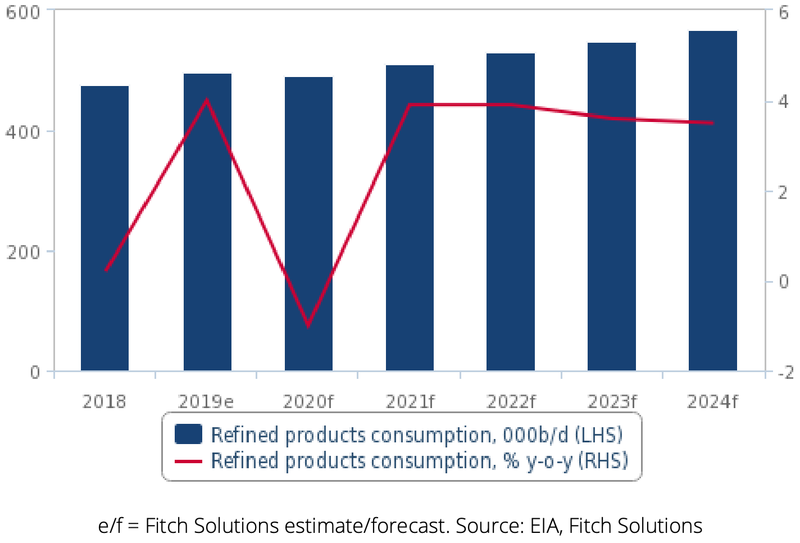

Additionally, Fitch also revised down its demand growth projections for Vietnam, to reflect reduced demand in light of Covid-19. As a result, refined fuels consumption is expected to contract by 1% in 2020, down from previous forecast for 3% expansion. The severity of reported Covid-19 spread in Vietnam has been moderate relative to larger regional peers, although this has proven insufficient to prevent a precipitation in domestic demand. Indeed, PVN’s domestic refined fuel sales registered a year-on-year decline of some 30% over the first two months of the year, mainly due to the implementation of early containment measures– since December 2019 – and subsequent collapse in travelling demand.

| Vietnam - Refined Fuels Consumption & % chg y-o-y. |

Given the concentration of containment measures in limiting aviation traffic flows, the most pronounced impact will continue to be felt in jet fuel, particularly as Vietnam is expected to deepen travel restrictions in order to curb the growing number of imported cases. Extension of visa restrictions onto arrivals from Europe and North America, on top of measures already in place for Asia-Pacific countries, for instance, would weigh heavily on jet fuel demand in the second quarter.

Outside of jet fuel, diesel demand is also expected to endure heavy hits over the first half of 2020, mirroring the slowdowns in industries, notably manufacturing, due to the sector’s large exposure to raw materials from China and a drop-off in regional export demand. Indeed, according to official statistics, growth in manufacturing output is shown to have slowed to 7.4% year-on-year over the January-February period, compared with growth of 11.4% year-on-year in the same period in the previous year.