Declining oil prices set to boost Vietnam’s external balance by US$1.5 billion

Vietnam posted net spending on offshore crude oil of nearly US$1.8 billion in 2019.

Vietnam’s external balance is set to improve by over US$1.5 billion in 2020 as a result of a sharp decline in global oil prices, according to Viet Dragon Securities Company (VDSC).

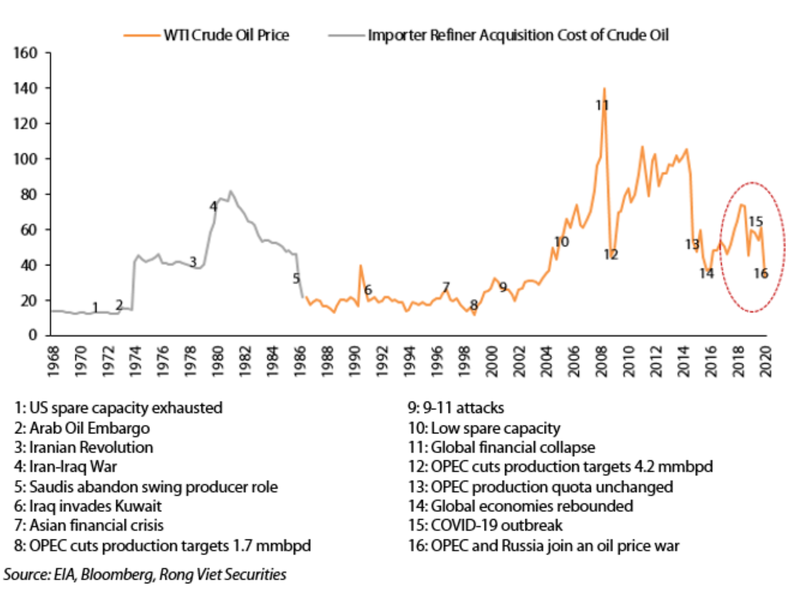

| Crude oil price (USD per barrel). |

Crude oil prices crashed by over 30% last Friday because of disagreements between the OPEC and Russia on cuts in production. Meanwhile, Vietnam is a net crude imporer and its net spending on offshore crude oil in 2019 reached nearly US$1.8 billion.

Regarding fiscal policy, VDSC expected no unanticipated changes caused by strained public finances in 2020 because of the weakening of oil revenues and taxes from export/import goods, said the VDSC in its latest report.

In the context of the oil crash accompanied by a global economic slowdown, it is predicted real income gains for consumers will be limited in Vietnam, due to the people’s current preference for saving rather than spending. The clearest impact is the pass-through into slowing inflation which may ease pressure on the State Bank of Vietnam, the country’s central bank, and present a window of opportunity to implement policy accommodation.

As a result, the circumstance may lead to the SBV’s decision to lower interest rates in the second half of the second quarter.

In the past, the plunge in crude oil prices has led to significant real income shifts from exporting to importing countries. Although that is a zero-sum game between oil exporting and importing countries, the economic models of the World Bank showed that declines in crude oil prices likely result in a net positive effect for global activity over the medium term.

The losses of oil-exporting countries are entirely offset by stronger growth in oil-importing ones via rising consumption, lower inflation and widening policy room that would lower macroeconomic vulnerabilities.

However, in reality, the impact varies among oil-importing countries in different periods and the economic effects are dependent on at least three critical aspects of the oil price decline, including 1) Underlying drivers of the oil price decline, 2) Persistence of the oil price decline and 3) The extent of price pass-through.

The explanation for the present plunge in crude oil prices hints that both supply- and demand-side effects are dominant.

Energy prices dropped by 10% since the beginning of the year as the Covid-19 outbreak has darkened the outlook of global demand. Besides Italy, France and Japan, more and more countries are expected to suffer technical recessions in the first half of 2020. Crude oil producers are hurt further due to a significant shift of OPEC policies that have been unable to curb supply.

The last three plunges in crude oil prices were due to the unwinding of geopolitical risks in Middle East in 1980s, global finance collapse in 2008 and technology-driven surprises in the production of unconventional oil in 2014. The current drop in crude oil prices is highly sensitive to the effort of containing the epidemic and the deals of big oil exporters. Whether the drop is temporary or not is important to assess its impact on saving real income gains or translating into higher spending to lift economic activity.

The third factor is related to the price pass-through that determines how much of the decline in oil prices translates into a drop in gasoline and petroleum prices at the retail level. The benefits depend on the specifics of the subsidy and pricing regimes.

In Vietnam, there are administrative controls on energy prices in which taxes and fees account for nearly half of retail prices. This somehow limits the positive impacts from lower energy prices on customers’ income and consumption. In 2014-2016, for example, gasoline prices in Vietnam decreased by approximately 40% while global crude oil prices declined by 70%.