Vietnam shares suffer deepest fall in 19 years on epidemic fears

The decline was stronger than a 5.89% tumble in May 2014 when China started a territorial spat with Vietnam.

Vietnamese shares on Monday plummeted the most since 2001 as traders strived to exit the markets on panic over the Covid-19 epidemic and a global crude price war.

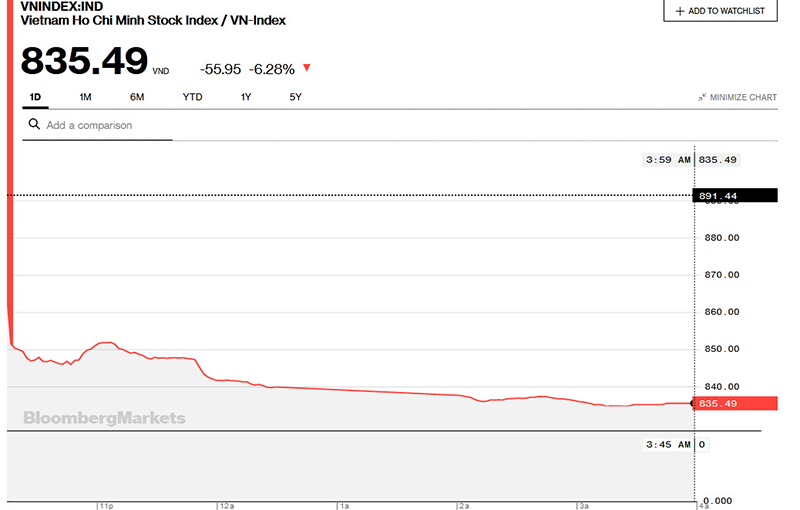

The benchmark VN-Index of the Hochiminh Stock Exchange (HoSE) ended down 6.28% to 835.49 – the lowest since November 2017, causing a decline of nearly US$13 billion in market cap.

| Source: Bloomberg |

The loss was stronger than a 5.89% tumble in May 2014 when China sent a gigantic oil rig within Vietnam’s exclusive economic zone, initiating a territorial spat between the two countries.

In its history, the index dropped 6.89% on September 10, 2001, 6.45% on October 3, 2001, and 6.3% on October 1, 2001, VnExpress quoted exchange data as saying. But today’s fall is seen as more painful as the Vietnamese stock market in 2001 had just five tickers and the VN-Index hovered around 200 points.

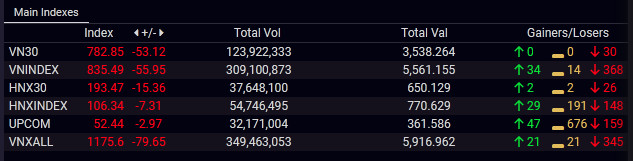

On the HoSE, as many as 368 tickers closed in negative territory, 14 stood still and only 34 others managed to go north. The VN30 Index, formed by the 30 largest and most liquid stocks, dropped 6.35% to 782.85, with all the constituents ending in red and 23 hitting the lower limits.

Trading was strong with 309.1 million shares worth VND5.56 trillion (US$238.7 million) changed hands.

On the Hanoi Stock Exchange, the HN-Index dived 6.44% while the UPCOM-Index lost 5.32%.

| Main stock indexes at the close on March 9. Source: SSI |

Investor sentiment, already fragile, became sourer after the announcement of the first cases of coronavirus infection in Hanoi and other localities, according to VNDirect Securities.

In addition, an oil crash caused by disagreement between the world’s major producers dampened further sentiment. Oil prices plunged 30%, crude’s biggest one-day fall since the early 1990s Gulf war.

“Unlike previous falls which were driven by global losses, investor sentiment is heavily impacted by complications of the Covid-19 epidemic domestically. Declines were broad-based,” said Nguyen The Minh, head analyst at Yuanta Securities.

It’s unpredictable when the downside momentum ends, VNDirect analysts said.