Vietnam shares narrow losses, close at 1-year low

If the psychological thresholds of 890-900 of the VN-Index are not breached, the market may recover in the short term.

Vietnamese shares extended losses on Monday for a third day after the one-week Lunar New Year break but the fall was narrowed as investors stepped in to pick battered stocks.

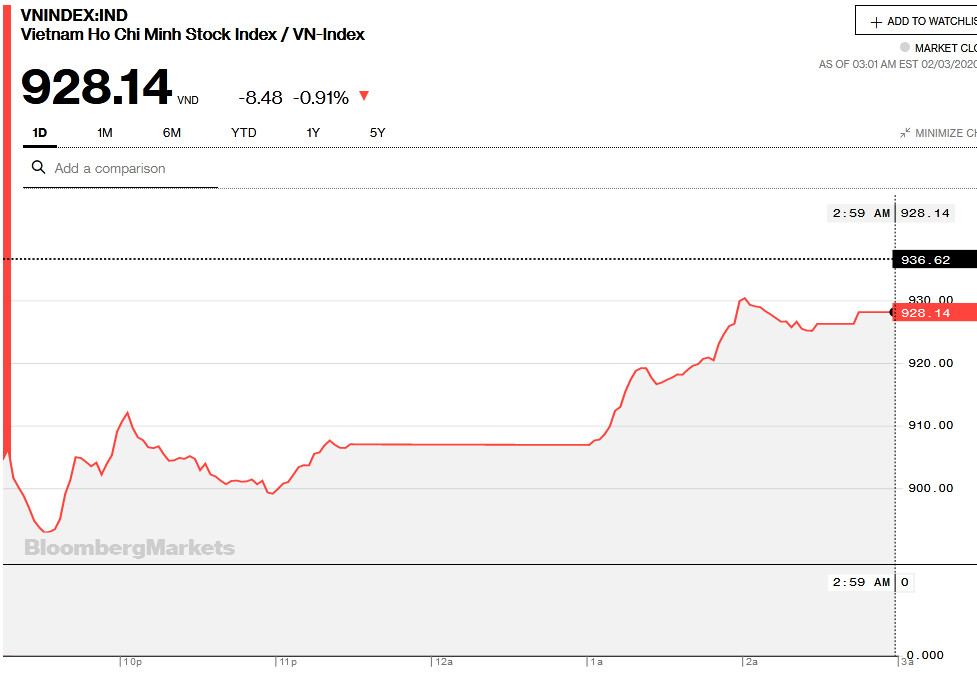

The benchmark VN-Index ended down 0.91% at 928.14 – the lowest from the close on February 11, 2019. The index managed to bottom out from an intraday low of 892.84 – the lowest from November 2017.

| The development of the VN-Index on Feb. 3, 2020. Chart: Bloomberg |

The recovery was led by heavyweights, especially lenders BIDV (BID), VietinBank (CTG), Sacombank (STB) and VPBank (VPB), and steel maker HPG.

Trading volume was heavy with 275.52 million shares worth VND5.05 trillion (US$216.8 million) traded, compared to 254 million shares, valued at VND4.88 trillion (US$209.7 million) on Friday.

Sentiment became less sour towards to close as investors bought on the dip after the VN-Index lost 5.53% in the first two days after the markets reopened.

The rising selling pressure was understandable as investors are worried about the uncertain evolution of the new coronavirus epidemic, and the historical losses in the previous global epidemic like the SARS in 2003, said Nguyen Thanh Tuan, head securities analyst at VNDirect Securities.

However, that the VN-Index loss of 7% in the past three days was an overreaction of investors, Tuan said.

If the psychological thresholds of 890-900 of the gauge are not breached, the market may recover in the short term and the recovery will be gradual on the course of positive news in dealing with the coronavirus epidemic from the Vietnamese and global health authorities, the analyst commented.