Vietnam economic recovery stays positive despite worst Covid-19 wave yet

Once Vietnam is able to contain Covid-19, the country would regain its growth momentum quickly, stated the HSBC.

Vietnam’s economic recovery remains bright despite the worst Covid-19 wave since the start of the pandemic, given numerous tailwinds, such as growing FDI inflows and an extended global tech upswing, remain in place, according to HSBC’s latest report.

“Even as Vietnam lags behind its peers in terms of vaccinations, it has made progress to accelerate vaccine procurement,” it noted, saying that the country will likely receive 62 million doses, enough to inoculate around 30% of its population by end-2021.

HSBC, however, trimmed its 2021 growth forecast for Vietnam from 6.6% to 6.1% to reflect the impact of the recent outbreak.

The services sector was no doubt the hardest hit. Its contribution to growth shrank from 45% before the pandemic to only around 20% in the second quarter. Tourism-related sectors, particularly transportation and accommodation, continued to remain in the doldrums. As border restrictions have been swiftly tightened since the beginning of the recent outbreak, air traffic has seen a notable impact, with flights in Hanoi airport down 50% from the first quarter.

Meanwhile, Vietnam’s domestic demand has become even bumpier. Since the start of the fourth Covid-19 wave, May and June's data saw two consecutive declines in year-on-year terms.

“This reflects a much larger magnitude of this outbreak than during the previous two waves. After all, Vietnam’s mobility fell as much as 30% below the pre-pandemic level, the second-largest decline in ASEAN,” stated the HSBC.

In addition, the recent outbreak exacerbates the weakness in the labor market. Overall, the unemployment rate ticked up from 2.4% in the first quarter to 2.6% in the second, with the total number of jobs shrinking 65,000 quarter-on-quarter or 9% below the pre-pandemic level.

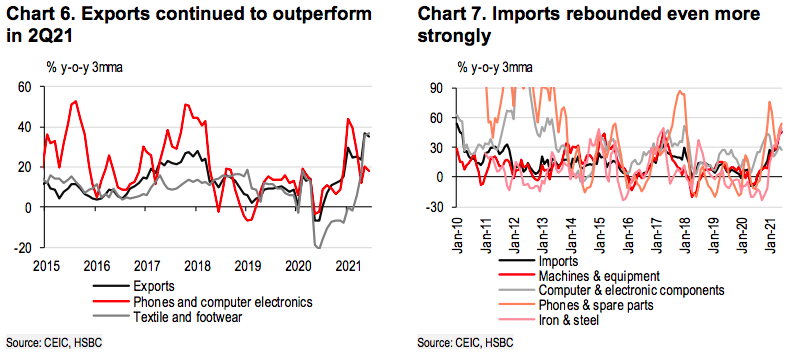

Contrary to an evident hit to domestic demand, external sectors remained surprisingly resilient in 2Q21. Exports rose 33% year-on-year in the April-June period, partly due to favorable base effects.

| Production at Garment 10 Company. Photo: Pham Hung |

“Vietnam still reaps the benefits of elevated demand for pandemic-related products, including electronics and machinery,” it added. In addition, traditional manufacturing has been leading firm export growth, thanks to improving global demand and hefty cash transfers to Western consumers.

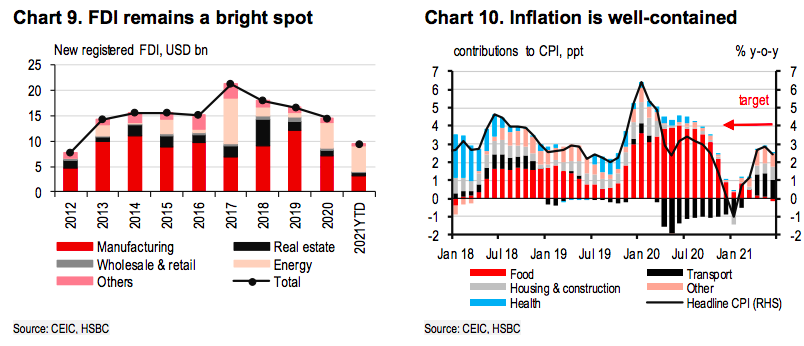

Foreign direct investment (FDI), which reflects investors’ long-term confidence, defied recent Covid-19 challenges. New FDI rose 13% year-on-year in the first half of 2021, while FDI disbursement grew almost 7%.

On inflation, HSBC expects the rate to average 2.8% in 2021, providing flexibility for the central bank to remain on hold in 2021.

“That said, once Vietnam is able to contain Covid-19, it should regain its momentum quickly,” it noted.

Fitch Solutions, a subsidiary of Fitch Group, made a more cautious forecast for the country’s GDP growth at 5.8% in 2021, noting manufacturing activity to be the main growth driver over the remainder of the year, while construction and services will continue to post positive but relatively weak growth. “Growth in this component will continue to benefit from improved market access from the EU-Vietnam and EU-UK free trade agreements, as well as the ongoing global inventory, restocking cycle. Looser Covid-19 containment measures in Europe, the US, and China encouraged by rapid vaccination progress, all point to better business optimism around the outlook for consumer spending, and this is likely to feed into stronger order books for Vietnamese exporters.” |