Vietnam manufacturing outputs expand for fourth successive month

Business confidence strengthened to a six-month high in August on expectations for an improvement of demand.

THE HANOI TIMES — Manufacturing production in Vietnam continued to rise in August, marking the fourth consecutive month of growth in the sector, according to S&P Global Vietnam.

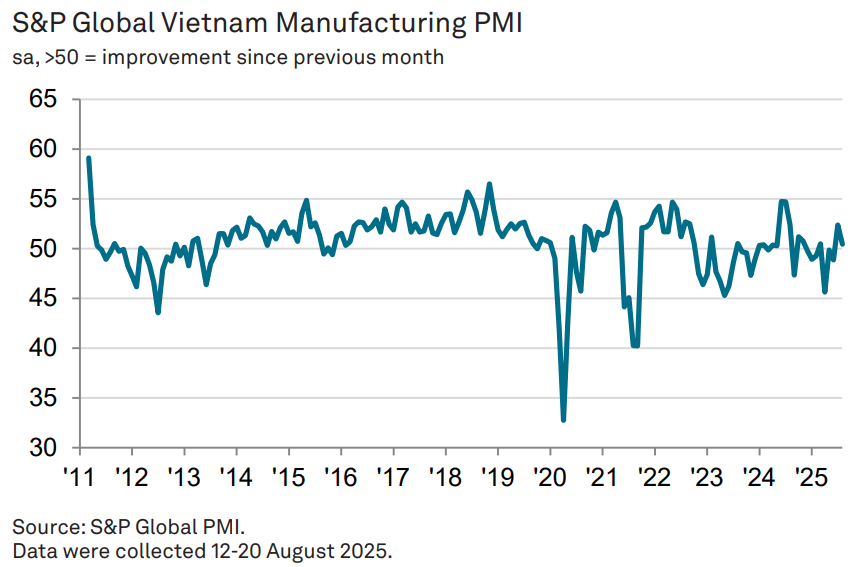

S&P Global Vietnam's chart shows PMI developments.

In particular, the S&P Global Vietnam Manufacturing Purchasing Managers’ Index (PMI) remained above the 50.0 no-change mark in August.

Vietnam's PMI ended August at 50.4, down from 52.4 in July and registered only a marginal strengthening in business conditions.

A reading below the 50 neutral mark indicates no change from the previous month or even contractions; above 50 points means an expansion.

"While it was positive to see output expand again during August, a renewed fall in new orders calls into question how long firms will be able to keep increasing production," said Andrew Harker, Economics Director at S&P Global Market Intelligence.

"The drop in new sales was led by exports, which decreased solidly again as issues around tariffs continued to impact the sector," he said in a note.

"Firms were at least more confident in the year-ahead outlook, in part based on hopes of a pick-up in demand, which encouraged a rise in purchasing activity. Manufacturers were hampered to some extent by material shortages, however,” he added.

“With the path ahead for tariffs seeming more stable now, the predicted improvements in demand will hopefully materialise in the months ahead, helping to maintain production growth in the sector."

The main positive from the latest survey was a sustained expansion of manufacturing production, with growth recorded for the fourth month running.

The increase in August was solid, albeit slower than that seen in July, stated S&P Global Vietnam.

Those firms that raised output did so in response to positive new order inflows at their units, while the slowdown in the upturn reflected reports of a subdued demand environment.

New orders decreased in August, after having risen for the first time in four months during July.

Electronics production at Quang Minh Industrial Park, Hanoi. Photo: Pham Hung/The Hanoi Times

According to the report, demand conditions were subdued due to multiple reasons, with the US tariffs cited as a primary cause.

Issues around tariffs meant that new export orders continued to fall for the 10th consecutive month. The solid reduction seen in August was sharper than that seen for total new business.

With new orders down, manufacturers again scaled back their workforce numbers midway through the third quarter of the year.

Employment decreased for the 11th successive month at a modest pace. The drop in new orders, however, meant that spare capacity remained evident in the sector.

While manufacturers reduced their staffing levels and stocks of finished goods, an increase in purchasing activity was recorded for the second month running.

The growth was referred to higher output requirements and efforts to build stocks ahead of an expected improvement in demand. However, stocks of purchases fell amid reports of a reduction in imports.

Material scarcity also impacted efforts to secure inputs. The scarcity caused suppliers' delivery times lengthening significantly.

Material shortages, tariffs and increased transportation costs meant that input prices increased again in August.

The rate of inflation ticked higher and was the fastest in 2025 so far, albeit remaining weaker than the series average.

Output prices rose for the third month in a row due to higher taxes and the pass-through of increased input costs to customers. Charges were up modestly and at a broadly similar pace to that seen in July.

Business confidence strengthened to a six-month high in August, but remained below the series average.

A number of respondents predicted an improvement in new orders next year, supporting optimism around output.